Is CityCoin a Boon for Investors or Just Another Wolf in Sheep's Clothing?

Introduction: So What is CityCoin Anyway?

"Launched in October 2018, City Chain is a Proof-of-Stake coin. It aims to become the foundation for a Smart City Platform, which leverages blockchain technology to improve and modernize how a city can organize and deliver services to its citizens" [CoinMarketCap. City Coin. (Accessed May 29, 2022)]. "First, it was endorsed by New York City, then Miami, and now there are rumors that Austin, Texas is next on the list" [MintDice.com. CityCoin: Helpful cryptocurrency or the Latest Scam?. (Accessed May 29, 2022)].

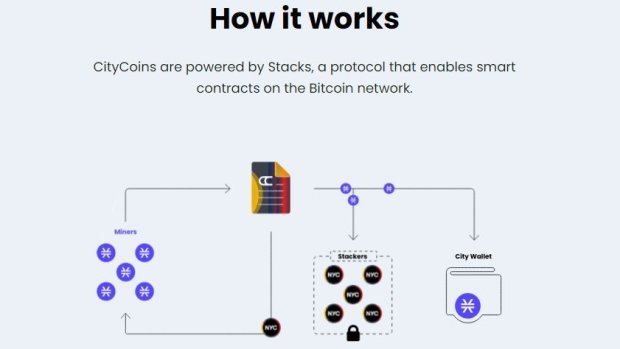

CityCoin is powered by 'Stacks' which is a protocol enabling smart contracts on the Bitcoin blockchain. As set forth in the official CityCoins website, there are three steps to this 'Stacks' process, to wit:

- STEP ONE: "The community mines to create CityCoins. Mining CityCoins is performed by forwarding STX tokens into the smart contract in a given Stacks block, and is a one-way process. Miners are rewarded with new CityCoins tokens" [CityCoins. Introducing CityCoins. (Accessed May 29, 2022)].

- STEP TWO: "Stackers receive the STX spent to mine the CityCoins. 70% of mining rewards are distributed to people who chose to stack their CityCoins (Stackers)" [Id].

- STEP THREE: "The city's reserved wallet grows. 30% of mining rewards are sent (in STX) to a city's custodied reserve wallet. The city can claim this and convert their STX to USD whenever they want" [Id].

[For further information into the mechanics of CityCoin see Sergeenkov, A. What Is CityCoins and How Does It Work?. (Accessed May 29, 2022)].

Several items are additionally worthy of note:

- An investor becomes a 'stacker' by the staking of the STX token in a pool located on the CityCoin App.

- The tokens must be locked for a specified period of time before any reward is received by the 'stacker'.

- To participate a 'Stacks Wallet' is necessary and said wallet is solely available for purchase by way of the OKCoin Exchange.

- The CityCoin project is supposedly non-profit and is not funded nor founded by any governmental entity.

Is CityCoin a Boon or a Bust (Scam)?

Well...just stop and think a moment. With CityCoin, an investor must send an asset to receive an asset in return as yield (or stake an asset to receive an asset in return as yield) where the asset received in return came from other investor's adding to the fund. Sound like something you heard before? Maybe a 'pyramid scheme'?

If you have identified CityCoin as a potential scam, you are not alone. In fact, many cryptocurrency enthusiasts are labelling the project a scam [See, e.g. Adejumo, O. MiamiCoin raises regulatory concerns after value nosedives more than 90%. (Accessed May 29, 2022)].

Looking Beyond Whether or Not It's a Scam, Is CityCoin Legal?

To date, no approval of CityCoin has been rendered by the U.S. Securities and Exchange Commission. To test whether or not CityCoin is legal, resort must be had to the seminal standards set forth in SEC v WJ Howey Co., 328 U.S. 293 (1946).

In Howey, the Supreme Court enunciated the factors to be considered in determining what constitutes an investment contract and therefore subject to U.S. Security Laws (and more importantly, security registration). Specifically, the Howey test as set forth by the Court is:

an investment contract, for purposes of the Securities Act, means a contract, transaction or scheme whereby a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party, it being immaterial whether the shares in the enterprise are evidenced by formal certificates or by nominal interests in the physical assets employed in the enterprise.

[SEC v WJ Howey Co., 328 U.S. 293, 298-9 (1946). See also, Justia. SEC v. W.J. Howey Co., 328 U.S. 293 (1946). (Accessed May 29, 2022)].

It appears that CityCoins fails the Howey test by meeting three of the four factors present to be determined to be an investment contract, to wit:

- 'INVESTS HIS MONEY IN A COMMON ENTERPRISE':

CityCoins mines MiamiCoin and NYCCoin in exchange for Stacks forwarded by persons who will become the holders of the coins. CityCoins may have an argument that this transaction merely provides mining services, rather than receiving investments of money, but the SEC may consider the distinction not to be substantial. Moreover, investment of cryptocurrency in a common enterprise appears to occur in the coins’ other function, Stacking, when holders of MiamiCoins or NYCCoins lock them for a reward cycle to earn Stacks rewards.

[Kim, R. ANALYSIS: City Crypto Coins Are Becoming the Mayor’s New Clothes. (Accessed May 29, 2022)].

- 'EXPECTATION OF PROFIT':

CityCoins promises that holders of MiamiCoin or NYCCoin will receive “rewards” for stacking their coins (70% of the Stacks forwarded for CityCoins mining), and Bitcoin rewards for stacking their rewarded Stacks on Stacks. These expectations of receiving rewards of Stacks and Bitcoin look a lot like a reasonable expectation of profits.

[Id].

- 'FROM THE EFFORTS OF OTHERS':

Exactly who handles the MiamiCoin and NYCCoin tokens that holders choose to “stack” in return for rewards is left unstated. The handler may be a blockchain-based software protocol rather than a person. Whoever does it, management of the Stacks rewards program has to occur, and the holders of MiamiCoins and NYCCoins are not doing it themselves.

[Id].

A careful review of the CityCoins website provides no evidence that either CityCoins conducted due diligence with regard to the Security Laws and in fact either: 1). registered the coins as securities; 2). offered the coins under an identified exemption to the registration requirements; or, 3). concluded following analysis that CityCoins would not be considered a security under Howey. For the reasons set forth above, this absence of due diligence is troubling and is a huge area of concern regarding the legality of CityCoins.

One More Red Flag for CityCoins

If a citizen truly believed in his/her city government or governmental officials, why go through the hassle of CityCoins and rather just make a direct donation to the City? This answer to this is crystal clear - people are donating by way of CityCoins as a vehicle for investment earning a personal financial reward. Their motivation is not founded in helping the city, but rather, in reaping the 70% yield from future monies invested by others.

This situation brings rise to the potential for political corruption of a high magnitude using cryptocurrency. High ranking city officials may now under this scenario donate large sums of money to their city without filing the required political donation documents, all while getting a portion back by yield for themselves.

Final Thoughts

"MiamiCoin launched last Aug and NYCCoin launched in Nov. Fifteen more cities are slated to receive CityCoins, including three in the U.S. and twelve others in Mexico City, Rio de Janeiro, Amsterdam, Lisbon, Berlin, Lagos, Cairo, Dubai, Singapore, Seoul, Tokyo, and Sydney" [Thomas, D. Stacks Ventures Adding DeFi Capabilities to CityCoins. (Accessed May 29, 2022)]. And as the CityCoin conceptualization grows beyond the borders of the United States the legality of the project will grow even more murky.

In this author's humble opinion, CityCoin is most likely a scam project. Furthermore, it is only a matter of time before the project is challenged by the SEC under Howey.

So please, be careful before making any investment in this project. It is a given that every individual investor possesses a different present financial circumstance, tolerance for risk, and investment strategy. These must be weighed in light of the factors and information above provided in finalizing any investment decision. Accordingly you as the potential investor must make the final investment decision that is appropriate for your individual circumstances and in your best interests and invest at your own risk. The foregoing is for educational purposes only and should not be considered investment advice. Any potential loss you incur from investing in this project is yours and yours alone and may not be imputed to this author.

Never invest more than you comfortably can afford to lose.

Posted Using LeoFinance Beta