More Terra Fallout as Magic Internet Money Depegs

Well folks, the fallout from the Terra/UST debacle continues its domino effect through the stablecoin markets. "Magic Internet Money (MIM), a US dollar-pegged stablecoin of the Abracadabra ecosystem, joins the growing list of tokens losing their $1 value amid an untimely crypto winter. The sudden de-pegging of the MIM token commenced roughly on June 17, 7:40 pm ET, which saw the token’s price drop to $0.926 in just three hours" [Sarkar, A. Magic Internet Money token depegs as Terra (LUNA) domino effect persists. (Accessed June 18, 2022)].

Liquidity is a sensitive issue in the current market, making many depeg tokens. Stablecoin MIM the newest name to join the depeg list this time around. The reason why project Abracadabra (SPELL) lost its peg was due to rumors of bad debt.

[CoinCu News. Stablecoin MIM Depeg After Rumors Of “Bad Debt”. (Accessed June 18, 2022)].

The specifics concerning the MIM depeg are as follows:

Since crypto markets began to unravel, Magic Internet Money (MIM), the stablecoin native to the DeFi network, has lost its peg. MIM has fallen 7% in the last 24 hours and is now trading at $0.9456. MIM’s value has been threatened by a rapid decrease in the crypto markets, which led to the move to de-peg the token. The MIM pool on DeFi platform Curve has a significant imbalance, with 96% of the pool consisting of MIM, which has only worsened the situation. It’s a sign that traders are unloading the token, most likely.

[Nayazunissa. Another Stablecoin Magic Internet Money (MIM) Loses $1 Parity. (Accessed June 18, 2022)].

The impetus for the depeg is a tweet from @AutismCapital claiming "that MIM and Abracadabra are “nearly insolvent” because of $12 million of bad debt from the Terra catastrophe" [Id], based upon alleged insider information:

Autism Capital continues on Twitter stating:

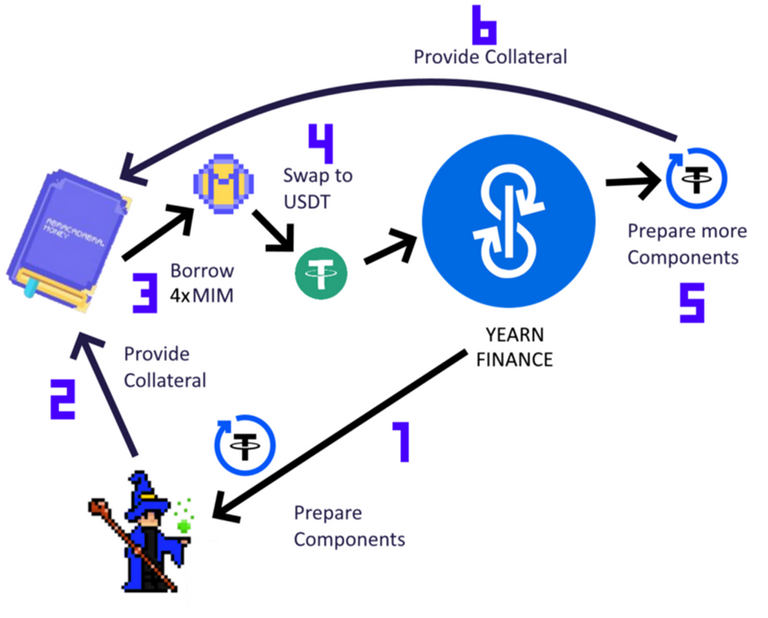

Understanding the mechanics behind MIM is essential to understanding this depeg. "MIM is developed in the form of collateral to be able to mint this stablecoin. For ease of comparison, this is the same model as MakerDAO’s DAI" [CoinCu News, supra].

However, to ensure that the number of stablecoins on the market is always secured, the mechanism will have a level of liquidation. In a nutshell, when the asset value falls below this mark, the liquidation bots will take the user’s loan, return the MIM, and take back the position’s collateral. Attached to that, these liquidation bots will also receive an additional bonus. In SPELL’s case, because UST fell so quickly, the liquidation bot didn’t work effectively to keep up with the plunge, resulting in a large amount of MIM out of the market with no collateral to secure.

[Id].

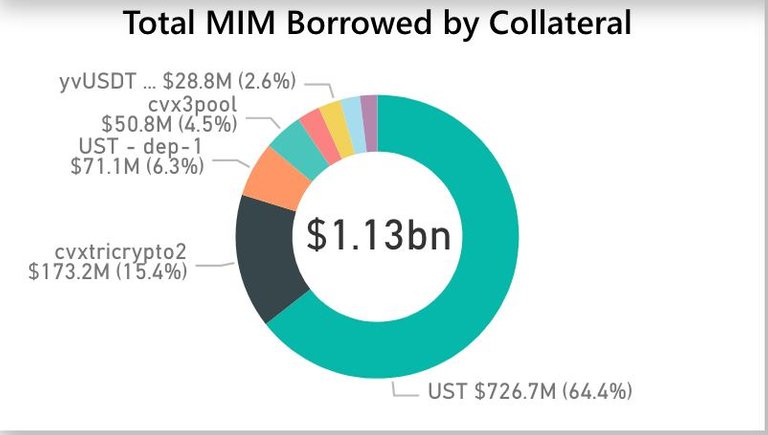

In an image of its mortgaged assets dashboard, as of March 25, 2022, ~64% of MIM’s collateral was held in UST:

But it should be noted that this pie chart has been taken down by the 'SPELL' team as being incorrect and 'under maintenance'. Conveniently, the team claims this is a 'coincidence' timed with the release of the 'insider information'.

"Specifically, if the bad debt described above occurs, there will be an unsecured amount of MIM stablecoins on the market" [Id].

Nonetheless, according to Abracadabra creator Daniele Sestagalli, there are more assets than liabilities in their Treasury:

"Traders are selling their stablecoins in favor of dollars due to the market’s tremendous panic, as seen by the depegging. As a result, stablecoin suppliers are under increased pressure to maintain the peg and respect redemptions" [Nayazunissa, supra].

Posted Using LeoFinance Beta

.png)

.png)

.png)

A lot of development and proposal came out from Terra team. But I dont know I could trust it. They already give a benefit of the doubt.