Popular Tax Strategies for Cryptocurrency in 2022

- Introduction:

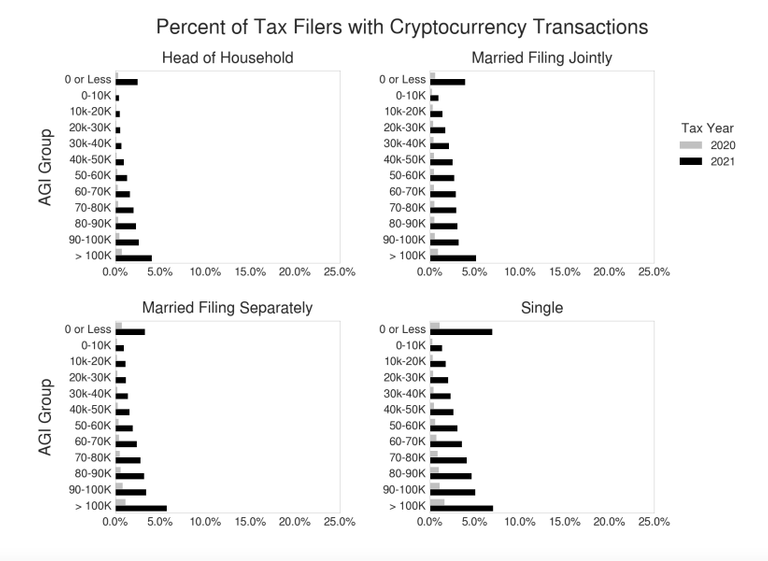

Cryptocurrency has become a popular investment option in recent years. And each year, the percentage of taxpayers who have filed their taxes disclosing cryptocurrency transactions is on the rise:

But with its volatility comes the risk of losses. Fortunately, there are various tax strategies available to help offset these losses and/or reduce the impact on an individual's overall tax liability. Here are some of the most popular tax strategies for offsetting cryptocurrency losses in 2022:

- Tax Loss Harvesting:

Tax loss harvesting is a tax strategy that involves selling losing positions in investment assets, such as cryptocurrency, to offset gains in other investments. The goal of tax loss harvesting is to reduce the overall tax liability by using capital losses to offset capital gains. Here is a more in-depth explanation of how tax loss harvesting works:

Identifying Losses: The first step in tax loss harvesting is to identify investment positions that have experienced losses. These can be cryptocurrency investments or other investment assets such as stocks or bonds.

Selling the Loss Position: Once you have identified the losing position, you will sell it to generate a capital loss. This capital loss can be used to offset capital gains from other investments, reducing your overall tax bill.

Offsetting Capital Gains: The capital loss generated from the sale of the losing position can be used to offset capital gains from other investments. For example, if you have a $10,000 capital gain from stocks and a $10,000 capital loss from cryptocurrency, you can use the loss from the cryptocurrency to offset the gain from the stocks, effectively reducing your taxable income by $10,000.

Wash Sale Rule: It is important to keep in mind the "wash sale" rule when implementing tax loss harvesting. This rule states that if you sell a security at a loss and purchase the same or a substantially similar security within 30 days before or after the sale, the loss is not deductible for tax purposes. To avoid the wash sale rule, you should wait at least 31 days after selling the losing position before buying back into the same or a similar investment.

Repurchasing the Loss Position: After the wash sale period has passed, you can choose to repurchase the same or a similar investment, effectively resetting the cost basis and allowing you to potentially benefit from future price appreciation.

- 1031 Exchange:

A 1031 exchange, also known as a like-kind exchange, is a tax strategy that allows taxpayers to defer the recognition of taxable gains on the sale of investment property by exchanging it for another similar property. This strategy is typically used for real estate investments, but it can also be applied to some types of personal property, including cryptocurrency. Here is a more in-depth explanation of how 1031 exchanges work:

Identifying Eligible Property: To participate in a 1031 exchange, the property being sold must be investment property and must be exchanged for another investment property of a "like-kind." For cryptocurrency, this typically means exchanging one type of cryptocurrency for another type of cryptocurrency.

Working with a Qualified Intermediary: To participate in a 1031 exchange, you must work with a qualified intermediary, also known as an exchange facilitator. The qualified intermediary acts as an escrow agent and holds the proceeds from the sale of the first property until the new property is purchased.

Timing Requirements: There are strict timing requirements for 1031 exchanges. The new property must be identified within 45 days of the sale of the first property and purchased within 180 days. Additionally, the proceeds from the sale of the first property must be held by the qualified intermediary during this time period.

Deferring Taxable Gains: The benefit of a 1031 exchange is that it allows individuals to defer the recognition of taxable gains on the sale of investment property. Instead of paying taxes on the gain from the sale of the first property, the gain is deferred until the new property is sold.

Limitations and Considerations: It is important to keep in mind that there are limitations and considerations when participating in a 1031 exchange. For example, you cannot use the proceeds from the sale of the first property for personal expenses during the exchange period. Additionally, the new property must be of equal or greater value than the first property, and any cash received from the sale of the first property must be reinvested in the new property.

- Charitable Contributions:

Charitable contributions can be used as a tax strategy to offset losses from cryptocurrency investments. By making a charitable contribution, individuals can deduct the donation from their taxable income, potentially reducing their overall tax liability. Here is a more in-depth explanation of how using charitable contributions to offset cryptocurrency losses works:

Making Charitable Contributions: To use charitable contributions to offset losses from cryptocurrency investments, individuals must make a donation to a qualified charitable organization. This can be done by making a cash donation or by donating cryptocurrency directly to the charity.

Determining Deductible Amount: The amount of the charitable contribution that is deductible for tax purposes is limited by various rules and regulations. For example, the maximum deduction for charitable contributions is generally limited to 60% of an individual's adjusted gross income (AGI) for cash contributions and 30% of AGI for contributions of long-term capital gain property, including cryptocurrency.

Reducing Taxable Income: By making a charitable contribution, individuals can deduct the donation from their taxable income, potentially reducing their overall tax liability. For example, if an individual has a $10,000 loss from cryptocurrency investments and a $10,000 charitable contribution, they can use the charitable contribution to offset the loss from the cryptocurrency investments, effectively reducing their taxable income by $10,000.

Choosing the Right Charity: It is important to choose a qualified charitable organization when using charitable contributions to offset cryptocurrency losses. This includes organizations that are recognized as tax-exempt by the Internal Revenue Service (IRS) and are eligible to receive tax-deductible contributions.

- Investment in Opportunity Zones:

Investing in Opportunity Zones is a tax strategy that allows individuals to defer capital gains taxes by investing in designated economically distressed communities. The Opportunity Zone program was created as part of the Tax Cuts and Jobs Act of 2017 and is designed to encourage long-term investment in low-income communities. Here is a more in-depth explanation of how using investments in Opportunity Zones works:

Identifying Opportunity Zones: To participate in the Opportunity Zone program, individuals must invest in a designated Opportunity Zone. Opportunity Zones are selected by the state and certified by the U.S. Treasury. There are over 8,700 Opportunity Zones across the United States.

Investing in Qualified Opportunity Funds: To take advantage of the tax benefits of the Opportunity Zone program, individuals must invest in a Qualified Opportunity Fund (QOF). A QOF is an investment vehicle that invests in property or businesses located in Opportunity Zones.

Deferring Capital Gains Taxes: The primary benefit of investing in a QOF is the ability to defer capital gains taxes. When an individual sells a property or investment that has appreciated in value, they must pay capital gains taxes on the profit. However, if the individual invests the proceeds from the sale into a QOF within 180 days, they can defer paying the capital gains taxes until December 31, 2026, or until the earlier of the sale of the QOF investment or December 31, 2047.

Reducing Capital Gains Taxes: In addition to deferring capital gains taxes, individuals can also potentially reduce their capital gains taxes by investing in a QOF. If the individual holds the QOF investment for at least five years, they can receive a 10% reduction in their capital gains taxes. If they hold the investment for at least seven years, they can receive a 15% reduction.

Exiting the Investment: When the individual exits the QOF investment, either by selling their interest or through a liquidation event, they will recognize the deferred capital gains and pay taxes on them. However, if they hold the investment for at least ten years, they can receive a permanent exclusion from capital gains taxes on the appreciation of the QOF investment.

- Cost Basis Reduction:

Cost basis reduction is a tax strategy used to lower capital gains tax liability by reducing the cost basis of an asset. The cost basis of an asset is the original price paid for it, and it is used to determine the amount of capital gain (or loss) when the asset is sold. The higher the cost basis, the lower the capital gain and thus the lower the capital gains tax liability. To reduce the cost basis, an individual can make adjustments to the original price paid for the asset. This can be done through various methods such as:

Capital Improvements: Making improvements to the asset, such as renovating a rental property, increases the cost basis and reduces the capital gains tax liability when the property is sold.

Depreciation: Assets such as rental properties and equipment can be depreciated over time, which reduces the cost basis and the capital gains tax liability.

Gifts: If an individual receives an asset as a gift, the cost basis is typically the fair market value of the asset at the time it was gifted. This can result in a lower cost basis and lower capital gains tax liability when the asset is sold.

Tax-Loss Harvesting: This strategy involves selling losing investments to offset gains from winning investments, which can reduce the cost basis of the winning investments and lower the capital gains tax liability.

- Conclusion:

It is important to note that tax laws are not only complex but are subject to change. Accordingly, individuals should consult with a tax professional before making any decisions regarding their cryptocurrency investments.

Posted Using LeoFinance Beta

-p-800.png)