Bitcoin Liquidity is Decreasing as FED Tries to Kill Crypto Rails

When it comes to markets, liquidity is an incredibly important variable. There are a plethora of ways in which liquidity matters to any market - whether TradFi or Crypto.

The FED & Biden Administration has made a coordinated effort to attack crypto rails. It's becoming readily apparent that this is happening. Some Crypto Twitter power users are calling this "Chokepoint 2.0" (1.0 being a phenomenon that happened in the 2008 crisis during the Obama administration).

Without getting too political, I'm going to talk about the situation and what I think the long-tail impacts of this negative crypto sentiment are going to be.

Liquidity in Crypto has Been Worsening

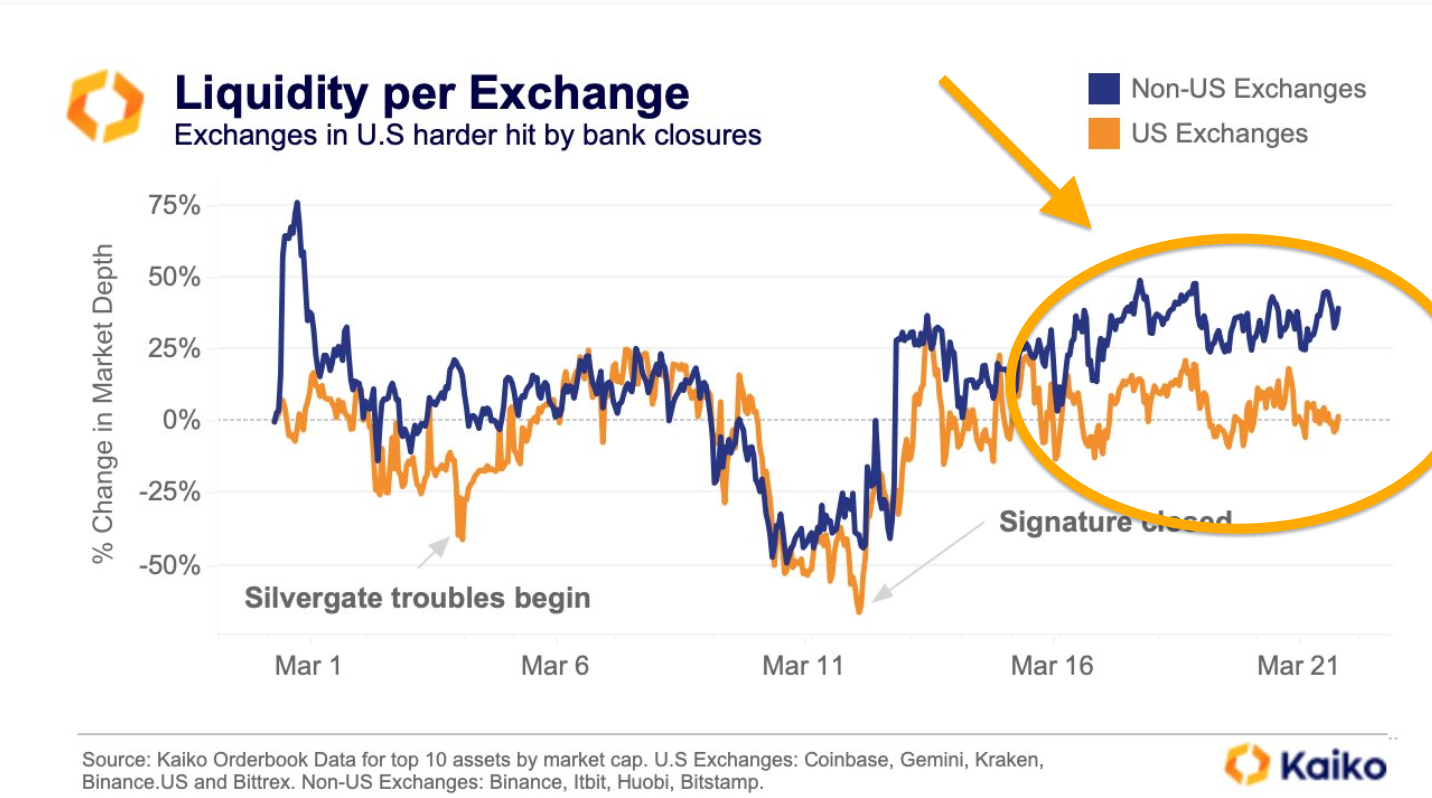

The liquidity in crypto has not been doing well. Here's a chart from Conor who works at KaikoData. He put together a great Tweet Thread and compiled a bunch of charts talking about liquidity across the ecosystem.

The 2% market depth has dropped to 10 month lows. This is directly correlated to U.S. rails being impacted. Market makers are losing access to go from fiat to crypto and vice versa. This is negatively impacting the market making business in a huge way.

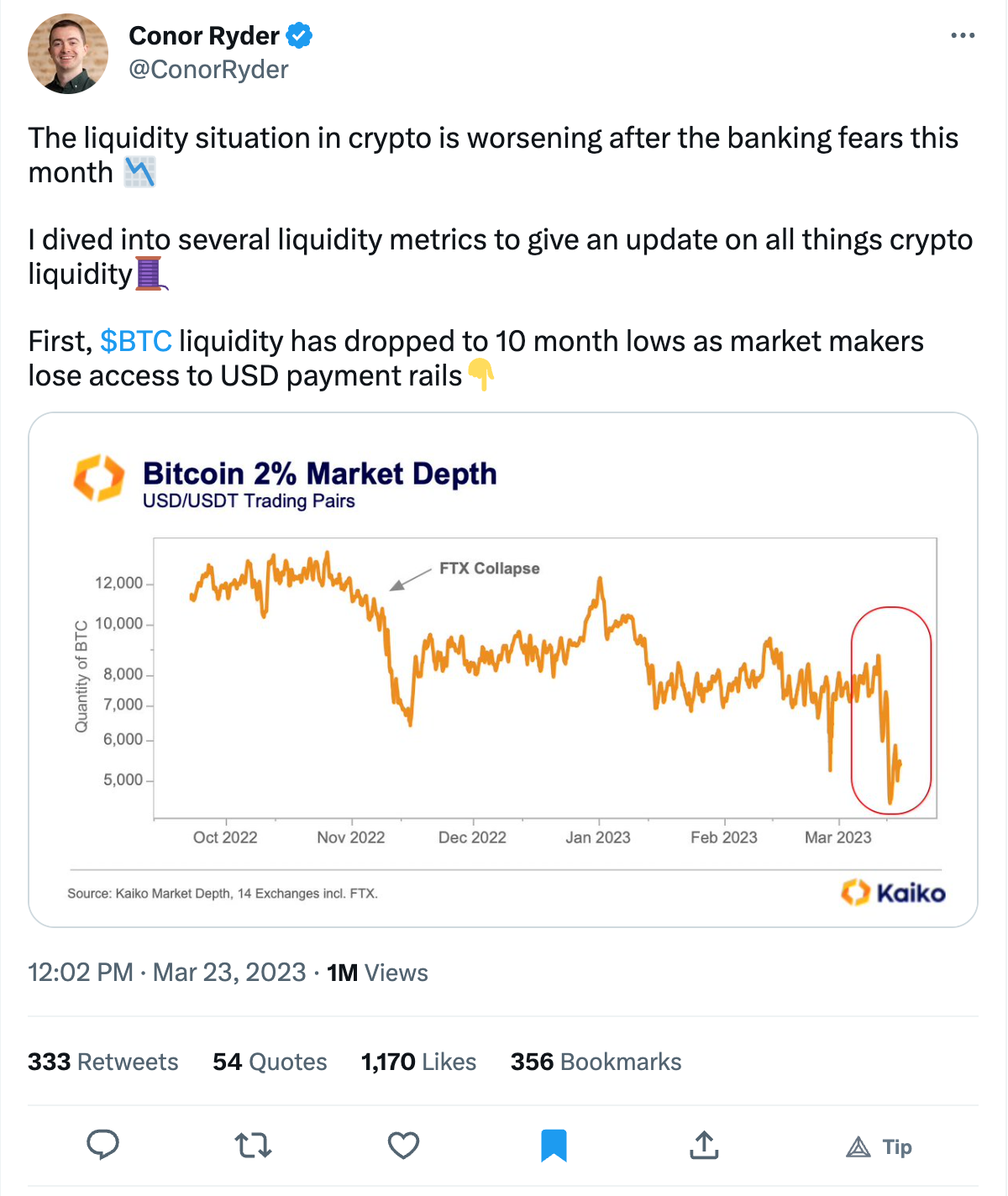

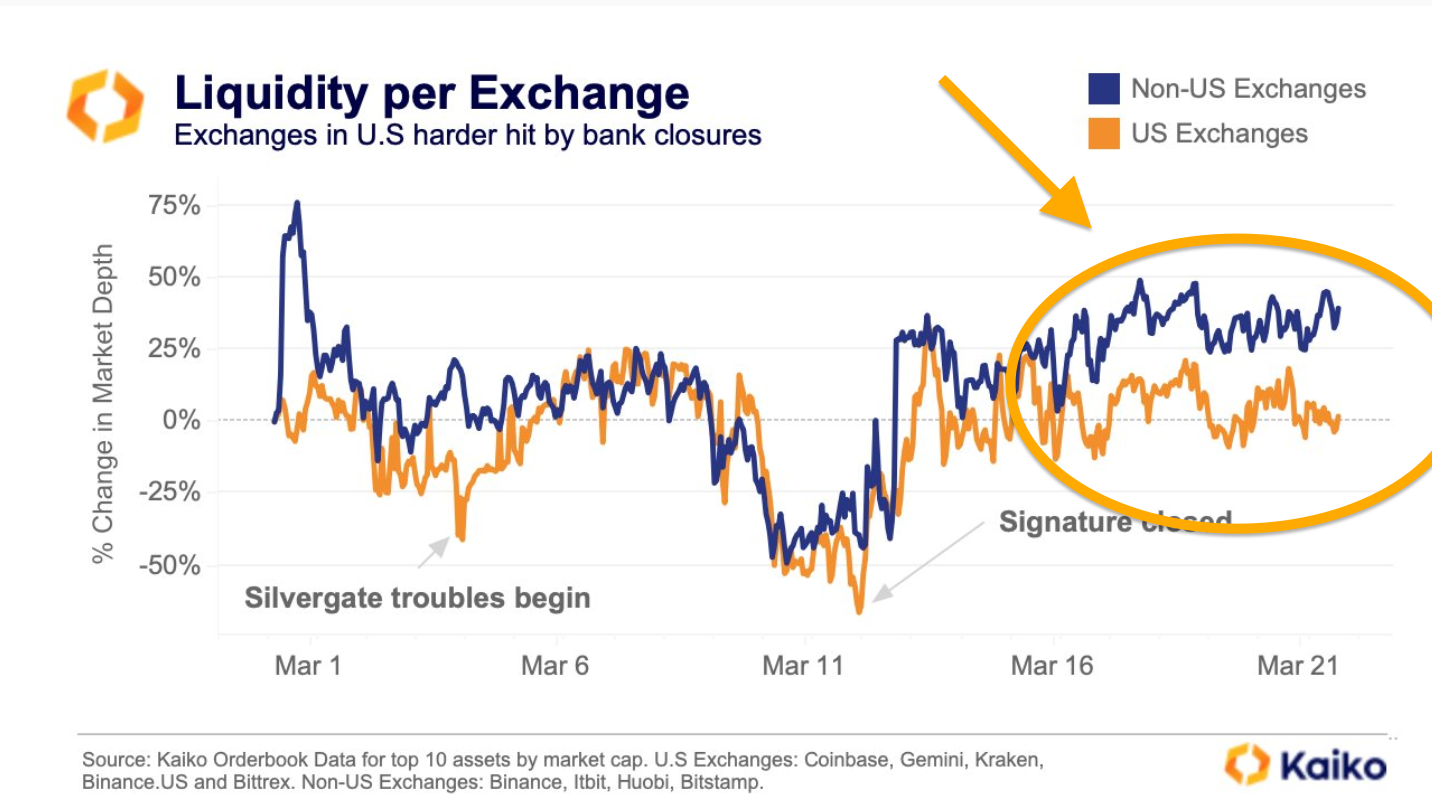

The following chart shows US exchanges getting hit harder than non US exchanges. Look closely and note the divergence in correlation lately:

Binance vs. Coinbase

Coinbase recently announced that they are putting more focus on global operations. They are diversifying their business and literally heading overseas to hedge against increasing U.S. regulation. They also just received a wells notice that the SEC is suing them.

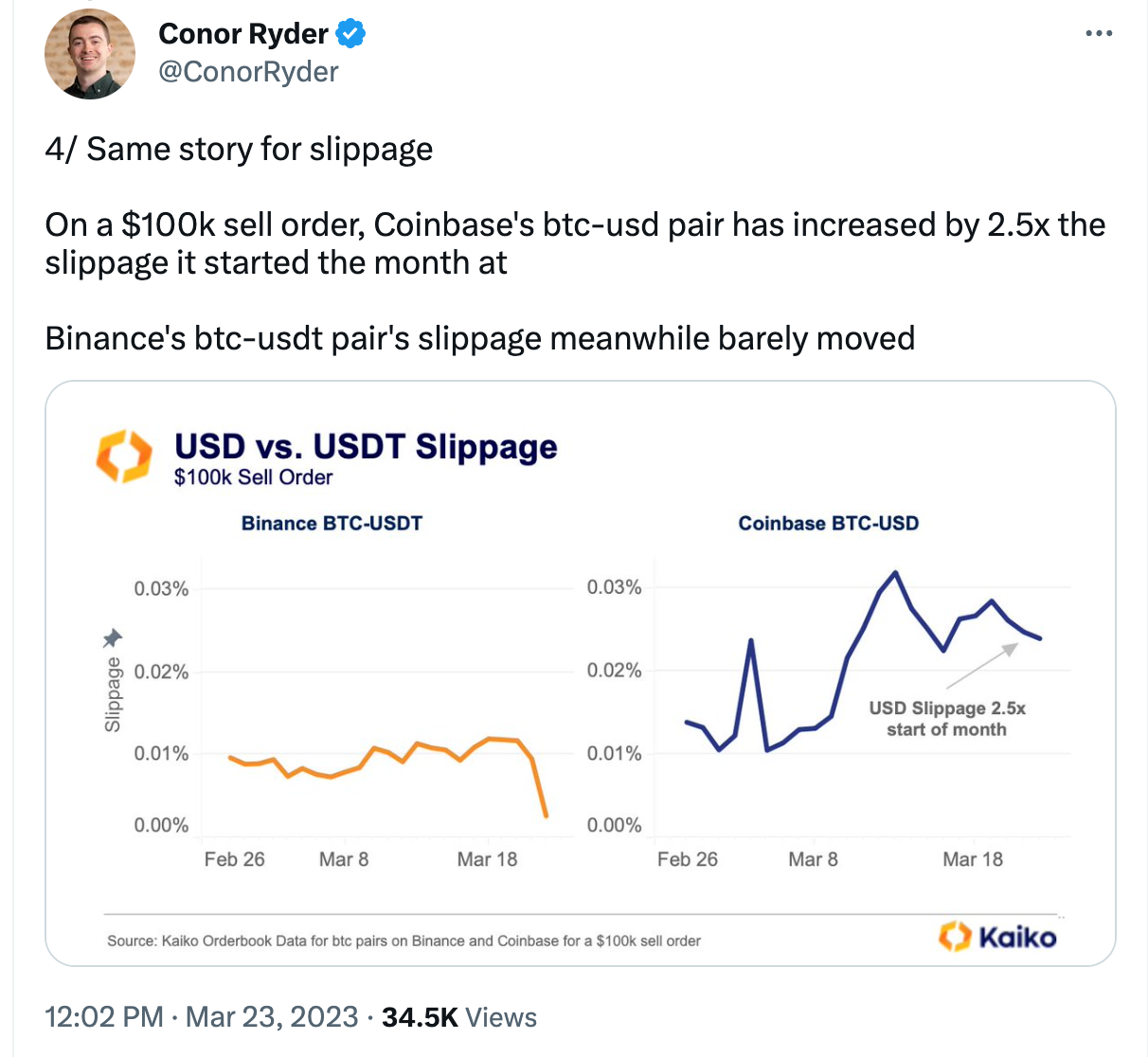

Slippage for trading BTC to USD and vice versa on Coinbase has been severely impacted - increasing by 2.5x since just the start of this month.

Meanwhile, Binance's BTC-USDT pair has remained unchanged. It is a crypto-to-crypto rail afterall - while Coinbase's is a Crypto-Fiat rail.

Having rails to/from crypto and fiat is very important. This coordinated attack is going to have rippling effects in the crypto industry.

Will This Kill Crypto?

No this won't kill crypto. We're simply going to see more and more activity move overseas. We've seen this play out as other government's have tried to ban crypto - could be short-term bearish but won't be long-term.

Long-term, the only impact is that the U.S. is losing market share. They're losing innovation. They're losing potential taxable capital.

The more that they tighten the onramps and offramps from crypto to fiat, the more they shoot themselves in their own foot. This is a national issue - the government has become the incumbent company that can't see their own disruption from the tiny tech startup. The startup continues to grow despite all the efforts of the incumbent and eventually... dominance will flippen.

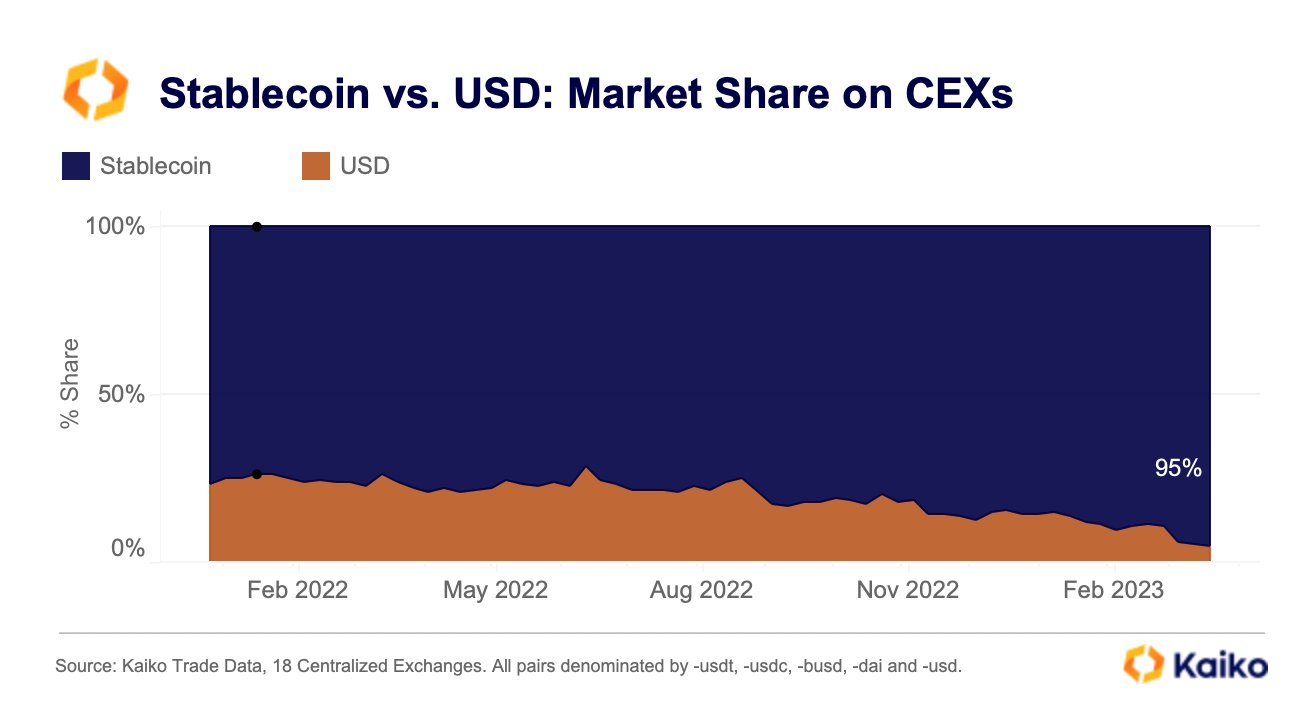

Look at this chart. Wouldn't you want the USD to become a major player in crypto? Wouldn't it be bullish for USD to back all crypto pairs?

I mean, imagine if crypto was embraced and the USD also became the default reserve pairing against all other crypto assets. That would be mega bullish for the USD - especially since we all know that this new technology is going to take the world by storm and disrupt nearly every industry on the planet.

If I were at the helm of the USD, I would be fighting like hell to get all crypto's paired to USD and build massive liquidity.

BUT that's what big corporations and big governments do, right? They reject technology that could disrupt them... That's how they get disrupted.

All those businesses that went out of business because they denied transitioning to an internet-focused business model? Yeah, they're gone for a reason.

Conclusion

Am I worried about crypto's demise?

Not at all. I think even a full-scale ban on crypto in the U.S. wouldn't have that massive of an impact, long-term. All that's going to happen is that the U.S. is going to lose its share of innovation, capital and potentially even reserve currency status.

Innovation always wins in the end.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta

This will he bad if it actually happens .

I don't see anything stopping crypto as at now

Very true and it sounds stupid they dont but I guess their fear is loose the grip, the more pressure they put into restrictive regulation the more ppl move away and it wouldnt be strange that in the future no exchange operate in the US

All this pressure on cryptocurrency regulation is bringing more bad than good things.

It's so sad to see this.

Almost time to open a bank account in south america to move my USD funds into so I can buy crypto. Which country was it that got out of debt thanx to crypto that is where I want to move my money.

I can also buy loot boxes on League of Kingdoms turn the resources into matic. That will get my USD funds into crypto though I think it will cost a bit more would need to look at that.

China is coming out with blockchain games this year or next another on ramp, though I won't use them.

Need to find the website but I can pay for most of my streaming services and amazon purchases using crypto. Oh yea there were many other gift cards. Could buy them for crypto and sell them for fiat locally.

USA govt can do what they want as us citizens watch the economy tank, question is how much of my paycheck I place into crypto???

Posted Using LeoFinance Beta

Well, I believe in the long run if dollar in introduce to crypto world it would be a better place for everyone

well don't look to the EU, it's (getting) worse here than the US. The EU is trying to "kill" crypto by banning self hosted wallets in the coming years

I suppose El Salvador might a better bet, some South American countries and probably Africa.

Posted Using LeoFinance Beta

They're definitely taking steps against self-hosted wallets. The problem is it will be difficult to outright ban them. If it goes that far, it has major implications for European Hive users. Going pseudonymous will be the chosen path for many then.

If the US bans crypto and self hosting wallets, then it’s easy to spread that ban to other places like countries in Africa, I know Nigeria government will jump at it without knowing anything about why.

that is true, but it would also bring enormous advantage to the ones that do not implement it I think

It is quite alarming how government are doing everything possible to hurt cryptocurrency in the society,I just hope thing change with time

Posted Using LeoFinance Beta

It is no surprise that the governments of the world are after the demise of crypto. They've been at it for as long as I can recall, yet to no avail. Eventually, they are going to have to succumb as the masses have decided to adopt and embrace it.

https://twitter.com/863912546/status/1639653645552582656

https://twitter.com/1472693700933345286/status/1639685102035775491

https://twitter.com/1415155663131402240/status/1639996033764831234

The rewards earned on this comment will go directly to the people( @celi130, @kalibudz23, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

The USD is being rapidly abandoned in global trade. Russia, China, India, Saudi Arabia and many others are ceasing to conduct major transactions in USD.

The only area where the US still had a lead is in technology and these actions against crypto just destroy that last advantage.

When the USD is no longer the world's reserve currency then the US will be bankrupt and will have to default on its debt - hello Argentina.

Liquidity in cryptocurrency is the life of the business and its success without high liquidity nothing is really happening.

Talking about the death if crypto currencies, it's like water and sun they don't die and they won't die. They are life. Cryptocurrency won't die no matter the way it struggles.

#LeoFinance

let's wait, bitcoin was already high, it's going down again,

everything related to the news and impacts on cryptocurrencies

I love to see more bullets in their feet until they get paralyzed.

On a side note, I am suspicious that our government's move to re-register again the already registered mobile phones here in the Philippines has the same intent - either to police or cut the flow of capital from fiat to crypto and vice-versa.

Posted Using LeoFinance Beta