A guide on how to use Bitcoin (BTC) on Binance Smart Chain (BSC)

Hello, this is kimm. It appears that you have posted a lot of posts on the Binance Exchange and Binance Smart Chain (BSC). Personally, Binance's CeFi service and the Binance Smart Chain ecosystem are a way to add effective investment vehicles that can do more than just trade . I think there is a lot to know.

Today, I'm going to explain how to use Bitcoin on the Binance Smart Chain . Based on the Binance Chain blog below, this post has been adapted and added to some content, so that even beginners can grasp as much of the overall concept as possible.

Enter

It's been more than two months since the Binance Smart Chain (BSC) was launched. Many use cases are starting to emerge thanks to the fast growing ecosystem of decentralized applications (dApp).

Don't you want to sell your bitcoins? Perhaps, it is time for many people to consider whether Bitcoin should be profitable now. Bitcoin reached the highest point in 1,000 days and showed a tremendous increase in price. However, if you want to invest in bitcoin over the long term, there are ways to take full advantage of the bitcoins you have on theBinance Smart Chain without having to sell bitcoins .

Binance Smart Chain (BSC) supports withdrawals of BTCB, a token pegged 1: 1 to Bitcoin on the Binance Exchange wallet. If you have BTC on a private wallet or domestic exchange other than Binance Exchange, you can use Binance Bridge, which supports cross-chain transfers to the Binance Smart Chain.

For reference, the BTCB official contract address on the Binance Smartchain is 0x7130d2a12b9bcbfae4f2634d864a1ee1ce3ead9c . There may be fraudulent tokens that share the same ticker (symbol), so always check the contract address before sending or trading.

In this article, we will explain 4 ways you can take advantage of Bitcoin on the Binance Smart Chain . Whether you're a Bitcoin Maximalist or anyone curious about the Binance Smart Chain, it's time to actively use Bitcoin rather than leave it on an exchange and start improving your own features.

1. Generate interest income with Bitcoin

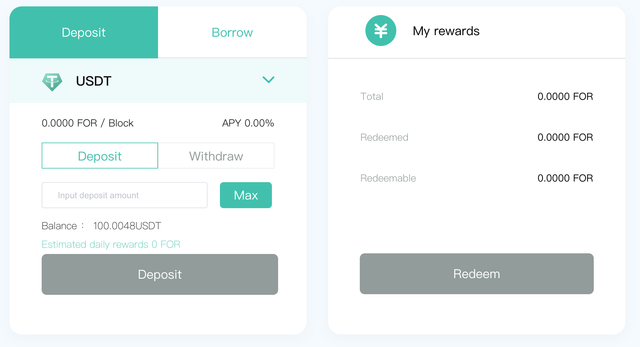

A much better way than just holding Bitcoin is to earn interest income with Bitcoin . Currently, Binance Smart Chain has DeFi platforms like CREAM Finance and ForTube which allow you to deposit BTCB and earn instant interest income.

With CREAM Finance or ForTube, you don't have to worry about complex liquidity mining. You only need to deposit BTCB and you can earn interest right away. No other conditions are considered. See how interest starts accruing as soon as you deposit BTCB in the Binance Smart Chain Wallet

If you enjoy profitable farming (yield farming), you can also participate in soybean farming using platforms like Beefy, Fry world, and COKE. You can earn interest by placing Bitcoin (BTCB) in a vault or doing produce farming through LP supply. If you want a higher return even if you take a higher risk, it is also possible to farm assets like CAKE and BAKE on new DeFi trading platforms like Pancake Swap.

2. Transactions on a decentralized platform

Bitcoin is also used as the main currency in the BTC pairs of centralized exchanges, but it can also be used to trade other tokens that are not listed on the exchange on a decentralized DeFi platform such as Bakerless Swap, Pancake Swap, Burger Swap, etc.

The governance token of the decentralized platform has high price volatility and high risk, but at the same time, because it has the highest mining speed in LP mining, exchange transactions for Bitcoin (BTCB) for the appropriate token according to individual risk preferences and analysis results. You can also join the farming.

3. Get a loan with Bitcoin

If you predict that the Bitcoin price will go up any further than now, there are ways to take full advantage of Bitcoin without throwing it away. Namely, at CREAM Finance or ForTube mentioned above, depositing Bitcoin (BTCB) and then setting it as collateral to borrow another asset.

Currently, the DeFi platform supports stablecoins such as USDT and BUSD, as well as lending functions such as BTC, ETH, ATOM, ADA, etc., and when using loan services, the risk ratio and collateral to prevent bitcoin liquidation are provided as collateral. Must be cared for properly. Managing liquidation risk can feel complicated and riskier than dumping Bitcoin, but establishing a stable guarantee ratio and an established investment strategy can make you more profitable without providing additional liquidity.

4. Issuing stablecoins

The Venus protocol, released recently, provides the ability to issue stablecoins, VAI, as collateral with Swipe (SXP), Binance Coin (BNB), and Venus (XVS). It does not yet provide the function of issuing stablecoins via bitcoin collateral (BTCB), but is expected to provide collateral and stablecoin issuance functions for various assets such as bitcoin soon.

Today, on the Binance Smart Chain, DeFi projects thrive through the advantages of low GAS fees, fast transactions , and user experience via the same tools (metamask) as in the Ethereum ecosystem, and on it, you can use Bitcoin to earn extra income. . There are countless opportunities. If you don't plan to dump Bitcoin in the short term, we advise you to take full advantage of this opportunity to hold Bitcoin and earn additional profits .

!ASH

Command accepted!

Aeneas is a blockchain project under development and a decentralized blogging platform based on Hive spesialized on the #social #politics #economics #indiejournalizm and all the #cryptocurrency related threads

Join Aeneas.Blog to earn more ASH for your unique content!

Dear, @kimmyhime, you have received

ASHtokens!Join our Discord Server for further updates!

@tipu curate 3 :)

Upvoted 👌 (Mana: 0/22) Liquid rewards.