My first leap into DeFi with Splinterlands assets

Hello friends on hive blockchain.

My weekend was a tedious one. I don't know about yours. We've started documentation for my last parade in Bauchi as a Corper. I had lots and lots to attend to. I could only spare some time to create my short pictorial posts - Model Agency and photography. I grateful to God I was able to undertake all of my allotted work.

I didn't run away. Thank you all who have engaged my posts since I made the commitment to get serious on hive. The support and love received has been massive.

My research for the post multiple ways to earn from Splinterlands revealed that there are lots within the Splinterlands ecosystem I am yet to know and engage and even more when we go wider to the Hive blockchain.

Meanwhile, I started creating threads on leofinance and it was fun. The full gist is coming. I did promise that I will venture into the adding liquidity to Splinterlands asset pools as my next target and finally, it's done.

Today, I made my leap into DeFi with Splinterlands assets.

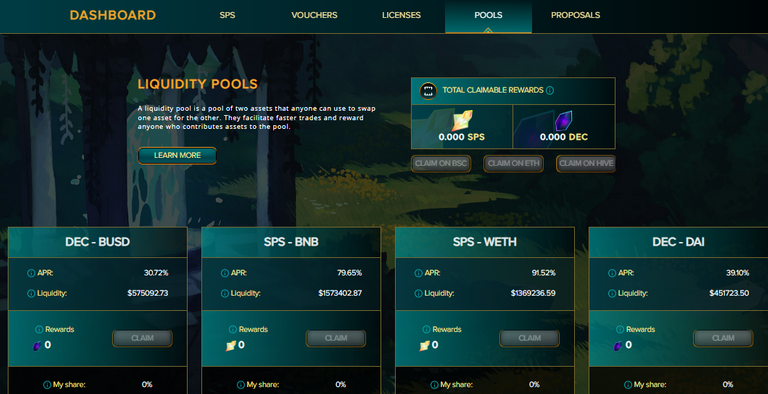

According to Splinterlands, a liquidity pool is a pool of two assets that anyone can use to swap one asset for the other. They facilitate faster trades and reward anyone who contributes assets to the pool. I have used often swapped tokens on tribaldex but I didn't really understand that was DeFi.

In fact, I had provided liquidity for the ONEUP pool some many weeks back. I only followed a procedure I saw but not understanding exactly what I was doing. Glad I took learning here very intentional and I'm lad I did.

There are many DeFi pools with splinterlands assets such as DEC, SPS, SPT, VOUCHER and other tokens. Trust me, I had to search for which of them would give me a higher return.

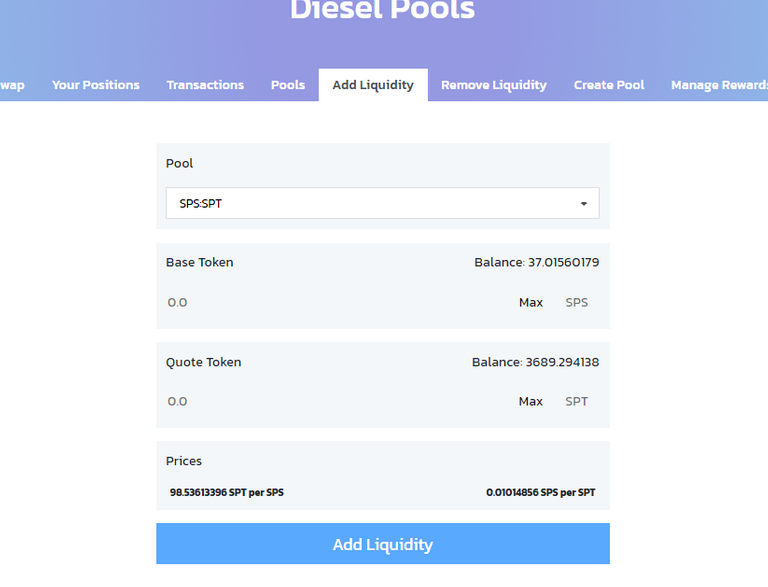

Boom! SPS:SPT was my best bet. I decided to used 10 SWAP.HIVE to start-up my liquidity addition investment. I split the funds into two. I used 5 SWAP.HIEV to buy SPS and 5 SWAP.HIVE to buy SPT token. A click on any pool on splinterlands will take you to tribaldex interface as below. I searched from the options and found the SPS:SPT a better option for me.

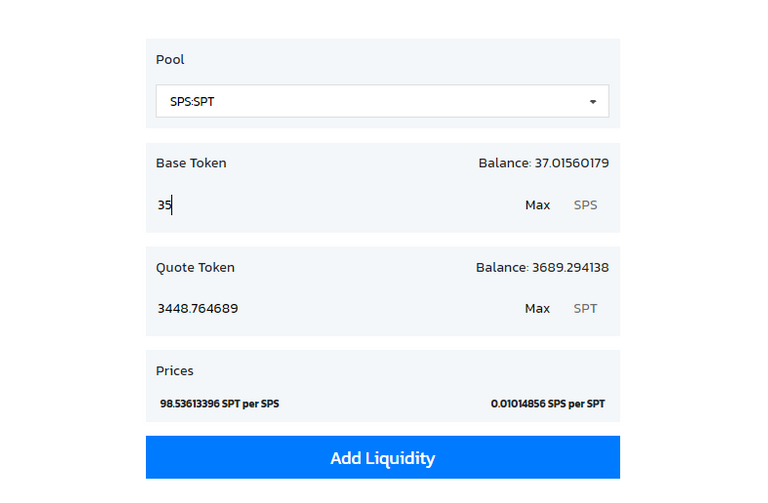

My 10 SWAP.HIVE could afford 37 SPS and 3689 SPT. I chose to start with 35 SPS which required an equivalent3448.79 SPT. I ht the ADD LIQUIDITY tab and confirmed my transaction.

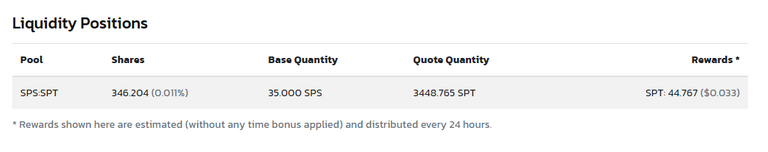

I needed to know how my liquidity fares. On clicking https://tribaldex.com/dieselpools/positions takes you to the age showing your liquidity position as below.

My liquidity added will cause me to earn 44.76 SPT everyday. But I do not really know the future of the SPT token. I will search for more information. But already, that is a huge return. That amount if continued will help me to recover my investment in 200 days or so.

My post may sound simple but it wasn't an easy task for me. below are the transaction IDs:

- Swapping SPS with SWAP.HIVE: https://hiveblocks.com/tx/03a1a1fed48edd0514751f6ce4efb6f123aac5a2

- Buying SPT from the market: https://hiveblocks.com/tx/a3f10e576869c2c40049882dea99a418740dd6df

- Adding pool - 35 SPS and 3448.7 SPT: https://hiveblocks.com/tx/d8de251e059a8b742611df48f3f364594f50147f

I am confident that it is the right step in the right direction. I will share with you when my returns begin to grow.

Please wish me well.

You too can be on your way to earning big on splinterlands by providing liquidity to pools.

Start now. I am happy I did same.

I am @Kingswill, let's meet and greet.

https://twitter.com/kingswill93/status/1573806479903268864

The rewards earned on this comment will go directly to the people sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Thank you very much.

Thanks for sharing! - @rehan12

De-fi world is indeed interesting! While I do suggest for you to dig deeper and understand all the facts regarding to the pool. I mean long term idea, short ideas, what happens if you pull out your asset and how much you will get in return, while also the fact about impermanent loss. As I have seen many people gets confused regarding this matter and end up loosing money of sorts. But I must admit De-fi world is amazing and there are lots of information to get educated from. All the best to you 🙂

Dear @rehan12. I really appreciate your feedback and advice. I would appreciate a few guide links. Thank you for the curation.

Hi there :)

I would suggest you to check Youtube videos. I might as well say it, Youtube is one of the best teacher out there for us. Don't you think?

Few key words to search for

And the list goes on !

I hope it helps :)

Thank you. I will start off the learning.

Please permit me to reach back to you if I have more questions.

Yeah sure :)

But I guess, you will get more than enough from these Youtube videos/tutorials. But yeah am here!