LBI Weekly Holdings and Income report - Year 2, Week 21 - week ending 21 December 2025

Update time for LBI again, where we review all our wallets and activities over the last week, and see how our asset's have performed. This week, HIVE has continued it's decline, but LEO has bounced back a bit, in HIVE term s at least. Overall, our Dollar value has declined a bit, but we push on regardless.

So here are the prices of our tokens at cutoff time this week:

And here is last weeks update post for you to compare this one to:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-year-2-week-20-week-ending-14-december-2025-7xm

Assets.

@lbi-token wallet.

This wallet has drifted about $500 down over the week, with HIVE's slow, steady decline. No real changes of note here except that we bought a small chunk of DUO. We buy a few daily, but a bigger buy also happened this week from the power-down of the PWR wallet.

I keep looking at the HBD and getting a bit twitchy. At what point is it worth pulling some out of savings to buy HIVE? Surely HIVE has not got much further to go down? Or will we see $0.05 HIVE? Lower? I have noticed HBD starting to look like the peg is weakening, at what point does the peg fail and HBD drop in value?

Lot's of questions, not sure of the answers, but I am feeling like HBD might be a concern. The other possibility is the witnesses dropping the interest rate for HBD. all stuff to keep an eye on I guess. I'd love to here everyone's thoughts on this.

@lbi-leo wallet

Not a lot of change for this wallet either. Compounding half of our Leostrategy token income now, and bought a few TTSLA aside from that also. So we add around 10 TTSLA overall for the week, and will continue to buy this as it's our smallest position. Still looking forward to TNVDA income getting added in also. You will see in the Income section below how significant these assets are as they are generating over half our weekly income now (even only using half the yield). Next week should be another good yield week, with these tokens all still trading well below their "pegged value". I think that if the price of LEO moves up, the peg's will get stronger, so our yield would drop.

For now, the main interest is the Leostrategy tokens and how they perform. Yield is good and we compound half of it. Once rewards for sLEO on Arbitrum are restarted, we shall see if it is worth moving more LEO over. But for now, the Leostrategy tokens are the backbone of our funds income, representing 30% of our total asset base, and 60% of our income (roughly).

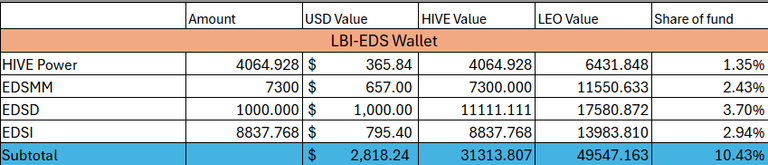

@lbi-eds wallet

Added 500 HP into this wallet this week, from the PWR power-down. We have enough EDSI now that it is worth sacrificing a bit of APR in the interests of helping the EDS project hit the flip point where yield starts to increase. The path to that point is through EDSD and HP delegations, as those are profitable for EDS. Anyway, we grew by 47.693 EDSI across the week - nice and consistent. Last week was higher, but it included a double EDSD payout as it had been missed the week before.

Will add to HP a bit each week, with the goal of moving consistently above 50 EDSI per week growth.

@lbi-dab wallet

Acquired 250 DAB this week, and added to the stake. Goal with this wallet is to move it from 75 - 100 growth in assets per week (combined DAB and DBOND growth). We have been tracking around 50 DAB and 25 DBOND for a bit now, and I worked out the lowest investment to move that to a total of 100 is to have more staked DAB (generating more DBOND). This will take time to show its effects, as we need to add a couple thousand DAB to stake to get there. If we can buy 250 DAB each week for 10 weeks, we can add the 2500 DAB stake we need to achieve this.

Anyway, just under 25 DBOND, and just over 50 DAB in growth for the week. We will grow this total to 100 per week over the next few months.

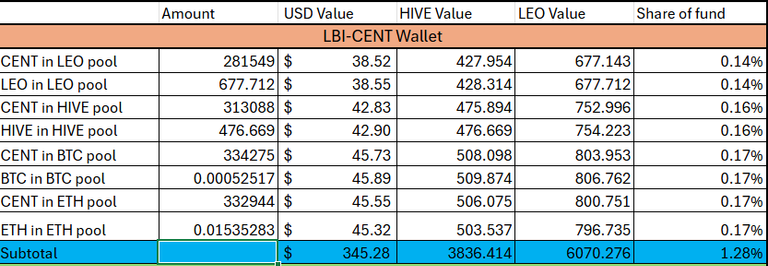

@lbi-cent wallet

Overall value is similar to last week, down slightly but in line with HIVE's drop. Cent token has stopped dropping against HIVE, so everything is pretty stable this week. This wallet is little, but it contributes to the weekly income above it's weight. 1.3$ of our assets, but contributing 3% to the income fund makes the wallet satisfactory. I'm still tempted to add more funds to boost our position or add another pool into the mix.

@lbi-pwr wallet

The first power-down hit this week, and the funds as mentioned above where split across our other wallets. Bought some DUO, DAB, TTSLA and added HP to EDS wallet.

Totals

We end the week at $27,000 fund asset value - down a couple thousand from last week. During the week I discovered that my conversion to SURGE has been incorrect in the spreadsheet, and rectified it.

Income

Here you can see just how important the Leostrategy tokens have become to our weekly income distribution. Over half of the LEO we generated this week comes from those positions. I need to focus on building our other income flows now, as we have positioned nicely in these projects but need to get some balance back with income growth in other areas. Could buy more BEE, or EDS, Buy DUO faster or add to the CENT pools. Could also add to the @leo.voter HP delegation. Will likely do a combination of these things.

We sent out 192 LEO as dividends this week (worth almost $11). With the increased burn continuing as LBI is still cheap in the pools compared to it's asset backing. 19 LBI burned this week.

Liquidity report

Another slow week for the pools, with the HIVE pool the busiest despite it having much less liquidity than the LEO pool. Volume was up a bit on last week. 22,023 LBI in pools this week, up a bit from 21,829 last week. 11.2% of all LBI tokens in pools, and it's nice to see this number grow a little each week. A big goal for LBI is to be a liquid token, and we are slowly achieving that. The LEO pool rewards will end in a few weeks, and I have a few more weeks to save up to renew them. The new round of rewards might be equal parts LEO and LBI and we can give that a try. The LEO pool remains our most significant, and I think it will be important to maintain a decent APR for it moving forward.

Conclusion.

Value's may be down, but we push on with growth in our asset base in terms of the number of tokens held. 19 LBI burned for the week, so LBI circulating supply slowly decreases every week. Over time this should drive up the asset value per token of LBI. The market price, well that is up to the market. But the asset backed value should grow over time.

Thanks for checking out this weeks update, if you have any comments, thoughts or feedback, feel free to share in the comment section.

Have a great Christmas, enjoy the holiday break for those having one.

Cheers,

JK

@jk6276 for LBI.

Posted Using INLEO

As always, thank you for the update. I appreciate the transparency!

Sorry for late reply.

As I mentioned earlier we need to think about how we can help ourselves by helping Hive. Selling our HBD and powering up Hive is one option, but it won't change much in general because the excess inflation comes from DHF.

It's quite funny how whales are in the trap. On one hand, they loose tons of cash they'd invested in Hive, their stakes bleed like pigs. On the other hand, they're also the beneficiaries of the DHF.

Witnesses on the other hand they start to talk about dropping the APR on HBD, but let's not panic 10% on a stablecoin is more than decent.

Hey, my turn for a late reply. Yes 10% on a stable is still decent, if it remains stable. As for helping HIVE overall, I think that task is beyond my skill level and available time. My focus is on helping the projects we are invested in, and growing our positions over time. The big picture is beyond my ability tbh. As a fund we are not big enough to be influential really in governance, and do we want to tread into that minefield anyway?

If we can work with projects we are involved in, and mutually benefit each other, then we can help keep a HIVE layer 2 economy alive and healthy. That's how I think LBI can be most beneficial in the big picture, backing builders and projects that are positioned for the long run.

As always, thank you for your input. Have a great 2026 mate.