KDI Journey: SUPER SLOW UPDATE, but it is working.

Truth be told!

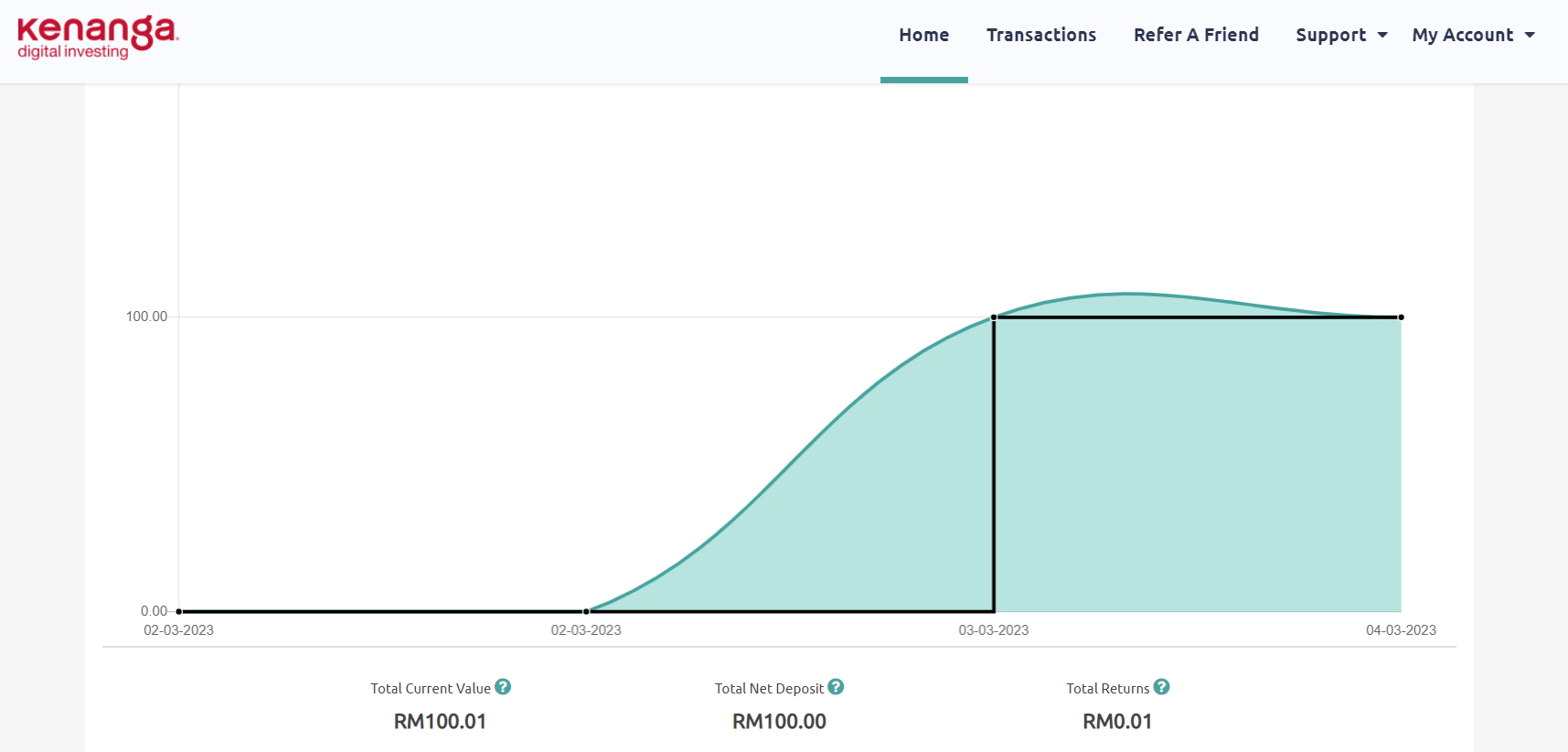

Finally after painfully waiting for a good few days from registratopn to deposit, there's an update today indicating it is moving.

What is it? It's just one cent!

However this indicates that it is actually moving and it allows me to move my 2nd stage plans to get my parents an account each.

These are not for fast use, but it will be for their emergency fund, or something to be left behind for the grandkids if anything happens.

For 100 MYR and getting 1 sen even 2 days is truly considered a blessing; and this can actually slowly snowball to larger.

Imagine every month I can set aside 100 MYR (approximately $25 USD) from 1 sen a day, it can eventually be a few a day.

It is better than sitting in the bank savings account where the bank can FREEZE your account just because it is not active.

This is just unacceptable. I have an account that I forgot to top up a dollar a month to stay active and not only they didn't pay my dividend due, they froze my account thinking "I am dead"

Just because I refused to use e-banking / atm and used the old-fashion way.

I will have to make a trip to the bank tomorrow lunch to find out what is going on 😠 for an inquiry what did they do to my account. 😠

I digress!

Moving forward testing this investment service, I might save up to 250 MYR (approx $75 USD) in the savings and then move to the "investment" section and see how the % works. Running both safe and high risk together and keep the money work hard for me, while I keep saving up for the savings package.

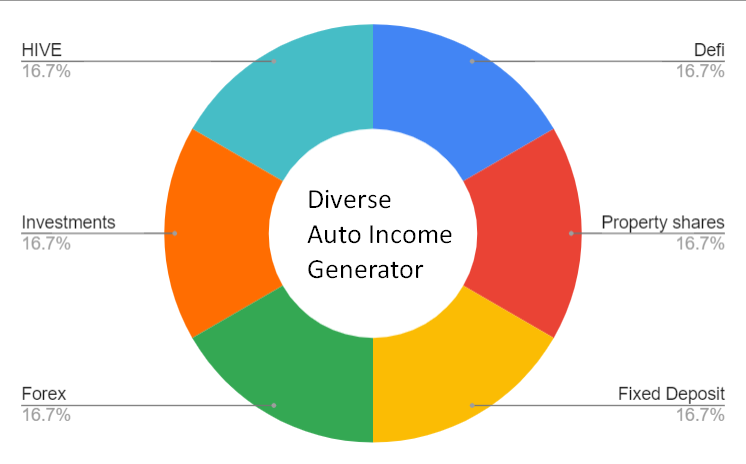

Should you spread out your risk?

Personally, by all means, YES!

Imagine you are a hivian-blogger here, writing a lot, with your day job / side-hustle, other than paying off debts and necessities, with a discipline of 10% set aside can help you to keep everything diversely ready, locally / internationally.

At least in Malaysia

(if you don't mind digital foot print)

- Hive has 20% APR for savings in HBD (which is slightly "stabler")

- Hive has HP that can help you to generate curating rewards when you are actively supporting others.

- 10% of day job / side hustle / business can be invested in places like this one (KDI

- For digital wallets where you need to pay travelling tolls, there's a higher risk savings of 3.45% APR set aside on wallet ( GO+ ) balances that are not used.

- Crypto savvy people can look into defi such as Pancakeswap in BSC, #Splinterlands in HIVE, Liquid Driver in Fantom etc

- If you are lazy you can even hire a brooker like Daily-EA to help you to trade / copy-trade for you on your behalf on FOREX

- If you love to be a landlord shareholder you can even go for RealT if you can wake up at 2am GMT 8+ to fight with the rest of the buyers to catch a share.

- Last but not least, returning to the basics in putting in Fixed Deposits if you have more than 500 MYR

Let your money WORK for you!

Most important is not to put everything at one place

To avoid single point failure

This is not financial advice; but I hope at least this post is a point of reference where you can start thinking to see how you can diverse what you have in your hand.

Prepping besides self-sustaining dry food (like the States) / homestead is equally important.

Not everyone has the luxury to own a land for their own that's for sure.

At least your money is not sitting idly de-valuing every month as the inflation continues

Wouldn't you agree?

Posted Using LeoFinance Beta

practical advise

My gosh, how widely spread out are your savings?? How can you keep track of it?

Not ridiculously wide spread enough 🤪