KDI - New Ways to Make Your Day Job’s Wages Work for You with the Help of A.I

Inflation, interest rates hikes, diminishing ability to purchase in a stressed and stretched market these days are becoming more and more prominent to even the layman’s sight.

During the 80s and 90s even when the world had a season of recession spread out in various countries, no one really noticed that their value money in the bank was diminishing because of the high interest rates.

However with the start of hire-purchase lifestyle started introducing for young families, more and more people leveraged their wages for luxury especially when banks pressed down the idea of “Zero Interest” repayments of 3 – 36 months just to reel in more money by “lending” (using customers funds). But to be able to lower to Zero interest schemes, this means “lenders” won’t have much of the piece of cake that the banks “temporarily” use their money to make money.

Isn’t this the trend of Fractional Reserve to Zero Reserve practice is executed by the various banks across the globe?

In some countries such as Switzerland, Denmark and Japan, they are already implemented negative interest rates when people decided to keep their money in the bank.

And the make the currency in a much worse condition, “stimulus cheques” or fund aids that were distributed during Covid or pre-covid (like Malaysia to buy up voters’ hearts) inflates the markets influencing prices for daily necessities to rapidly increase.

Eggs, for example, one of the simplest and (sort of) cleanest protein in Malaysia, is on its way “stripped from its throne” as the government has decided to lift the price control for eggs soon, impacting wide range of small medium businesses like hawkers of the Malaysian infamous “Ramli Burger” will have no choice to jack up the price even further, potentially losing their “cheap street food” title compared to multi-chained fast food burgers.

Approximately of almost 13% increase per egg is not a laughing matter anymore.

Looking at what all this is happening in Malaysia...

Again and again, I cannot emphasis enough that a part of our savings truly needs to be channelled towards working for us just to get by in the very near future.

Housing is no longer a profitable investment locally, moreover you need to have a substantial capital to “roll” it over, other that the fact you need to get a buyer who can afford it.

That is why when my lady boss from the Finance Department pitched me the existence of this alternate regulated savings (much better than Fixed Deposits in Malaysian Banks) with no locked terms I had to take a look and see it for myself.

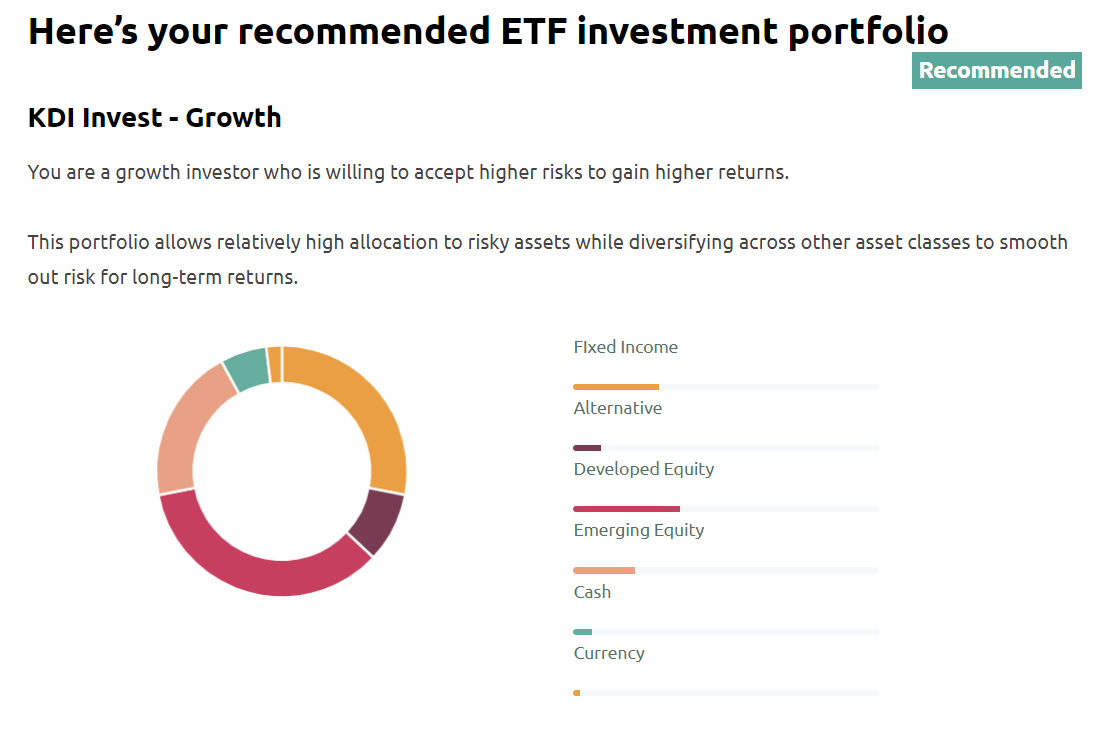

Note that they do have a high risk package, but I am not going to look into that because that is, none the less: high risk.

Kenanga Digital Investing (KDI) – Using AI to grow your savings funds?

From my previous post talking about Yunikonfx forex bot service , there seemed to have a tiny bit of similarities; however, yunikonfx is still programmed by humans , while KDI is apparently using Artificial Intelligence to govern the decisions on how the saving funds are invested and traded for profit sharing.

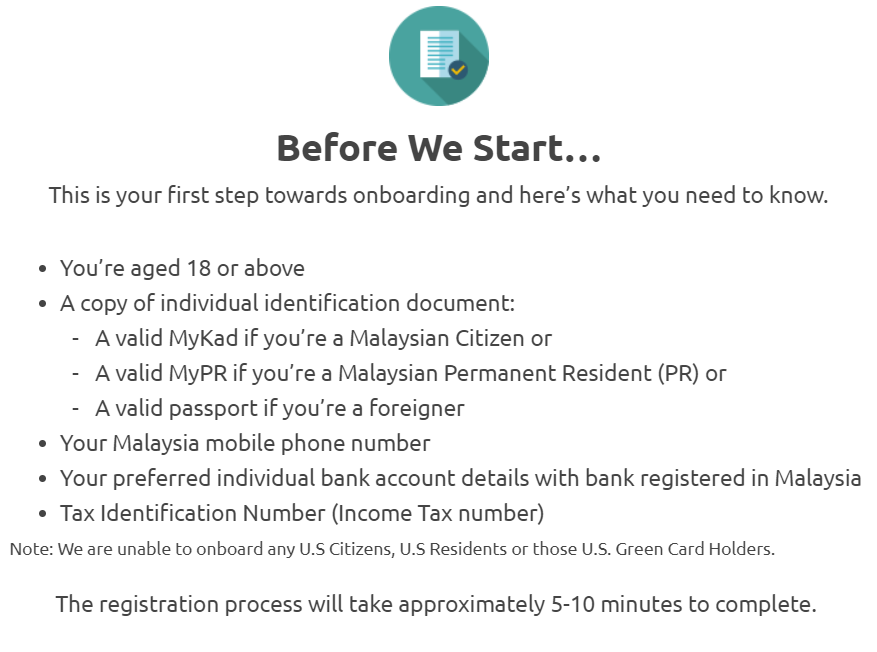

Who can apply for this?

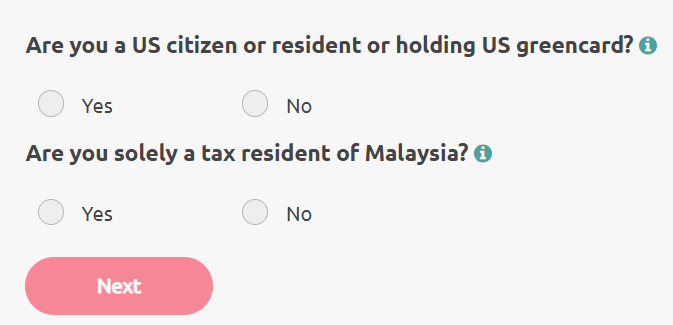

Unfortunately because this is localised Investment Service, it is currently only opens to Malaysians and Permanent Residents of Malaysia – excluding anyone who has an American citizenship / US green card.

Of course, with accountability to our own decisions starting such an account, one has to be 18 and above.

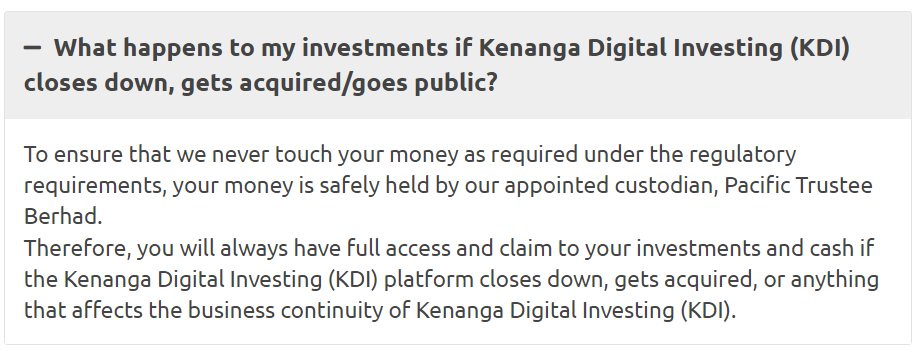

What else enables the confidence that our savings will not suddenly disappear?

Just like Nirvana has its trustee (shared by my friend on my previous post) , KDI also has its regulated trustee (by the Malaysian government) which gives at least a tiny bit of assurance. At least it is better than totally unregulated centralised finance services (like ahem Alameda Research)

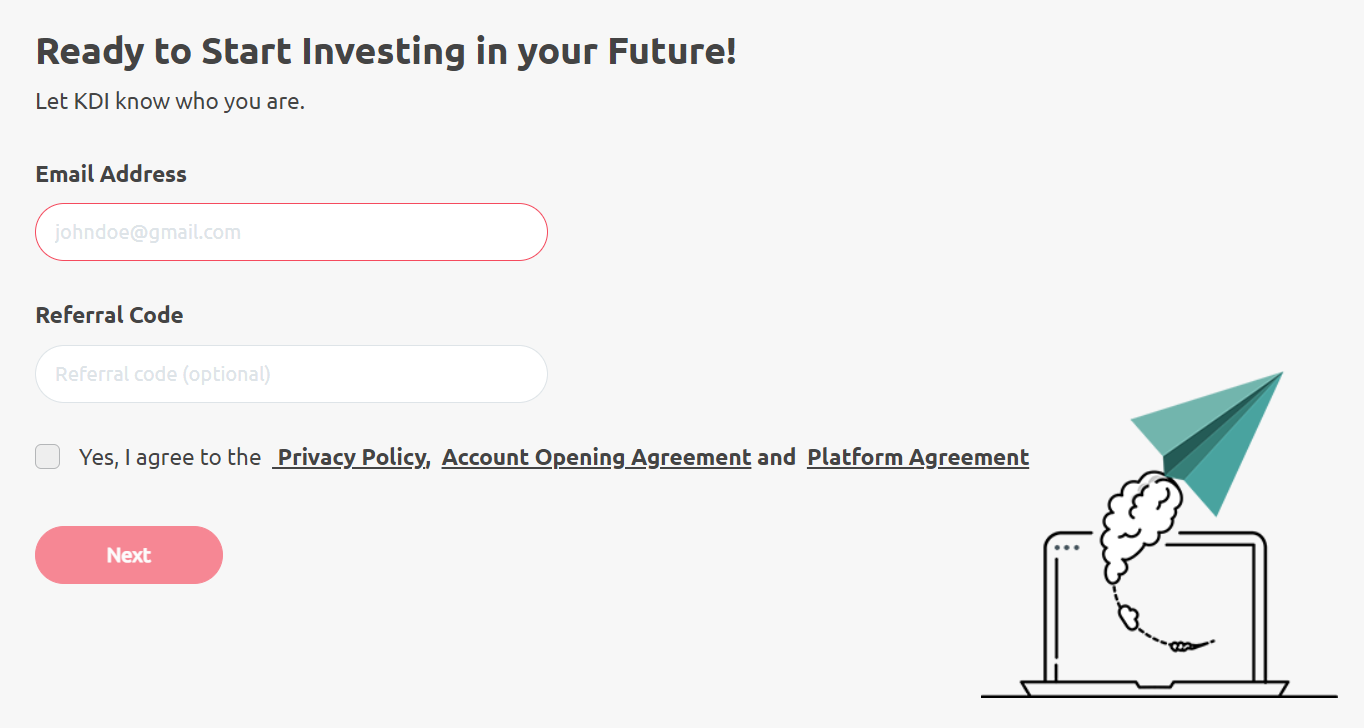

How easy is the registration process?

For a start, a valid email address is definitely important for this to work. Of course, reading the privacy policy from time to time is crucial.

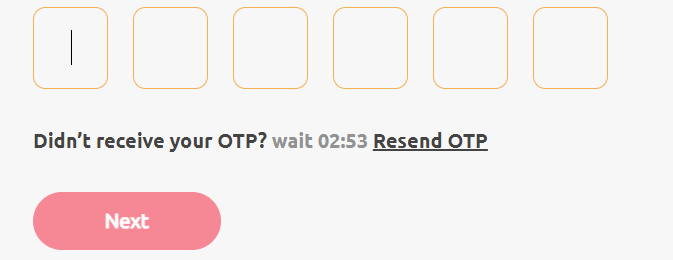

At least there is a 2FA to ensure more security to take place

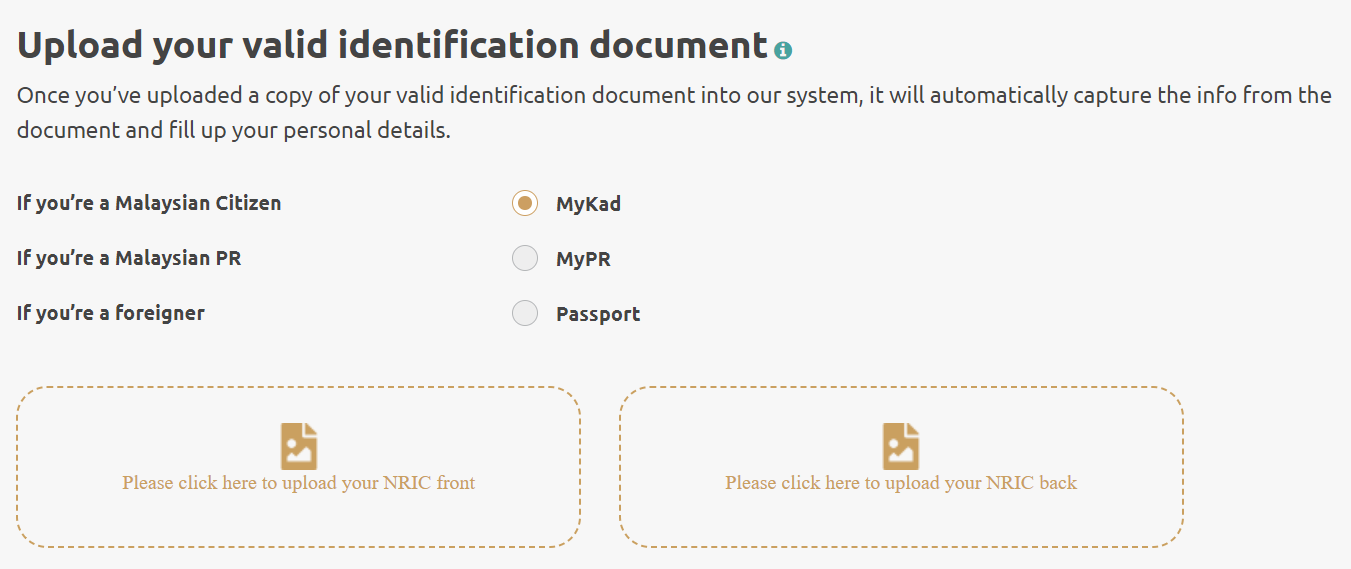

Next would be the official document. Localised regulated financial institutions cannot run away without KYC. Libertarians might screech at this but the human race at this point of time, cannot run away from parallel services (with or without KYC) unless you are a super wealthy off-grid freedom fighter.

This also enables restrictive investor (whales) outside the country from pumping in too much money upsetting the services that is designed for locals at the moment.

After that, selfies are required to verify with the ID with the next filling up of KYC information. The interesting part is because of the uploaded ID, the system actually “intelligently” fill up for you and all you need to do to just double check all the information to ensure it is correct.

However ethnicity is unable to be identified because Asians generally lookalike

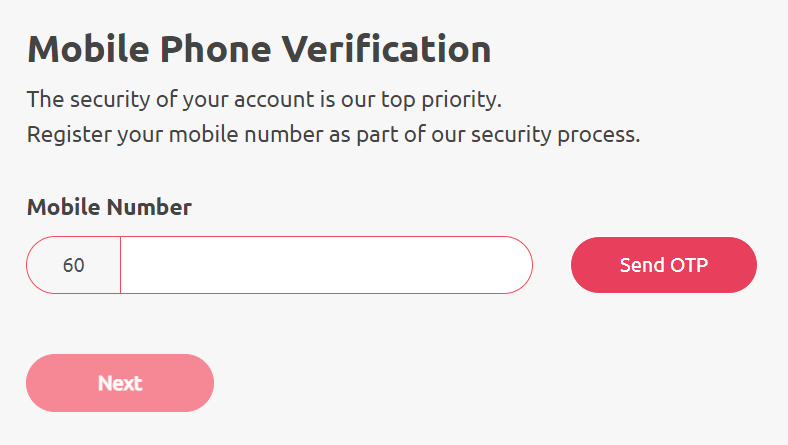

Last but not least for verification, mobile number needed.

They want to know you are paying your taxes?

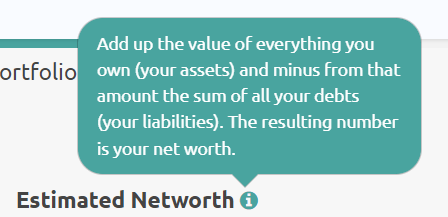

Next interesting part is that they want to know your net worth, which is kind of odd. Nobody really knows your net worth unless you deliberately check things through. However for a person like me who has a mortgage, car loan and lots of expenses on my elderly, choosing the bare minimum in the list is the safest choice.

You will be needing a local bank

And no, e-wallets / independent financial services are not allowed. Even oversea bank accounts are limisted. I guess it is based on the types of foreigners who are staying in Malaysia.

Last but not least – Making sure you are not overly leverage

(From taxes and other country’s obligations)

That also includes if you are closely associated with politicians. That can be tricky. Look at ahem FTX and you know how paranoid financial services are behaving these days.

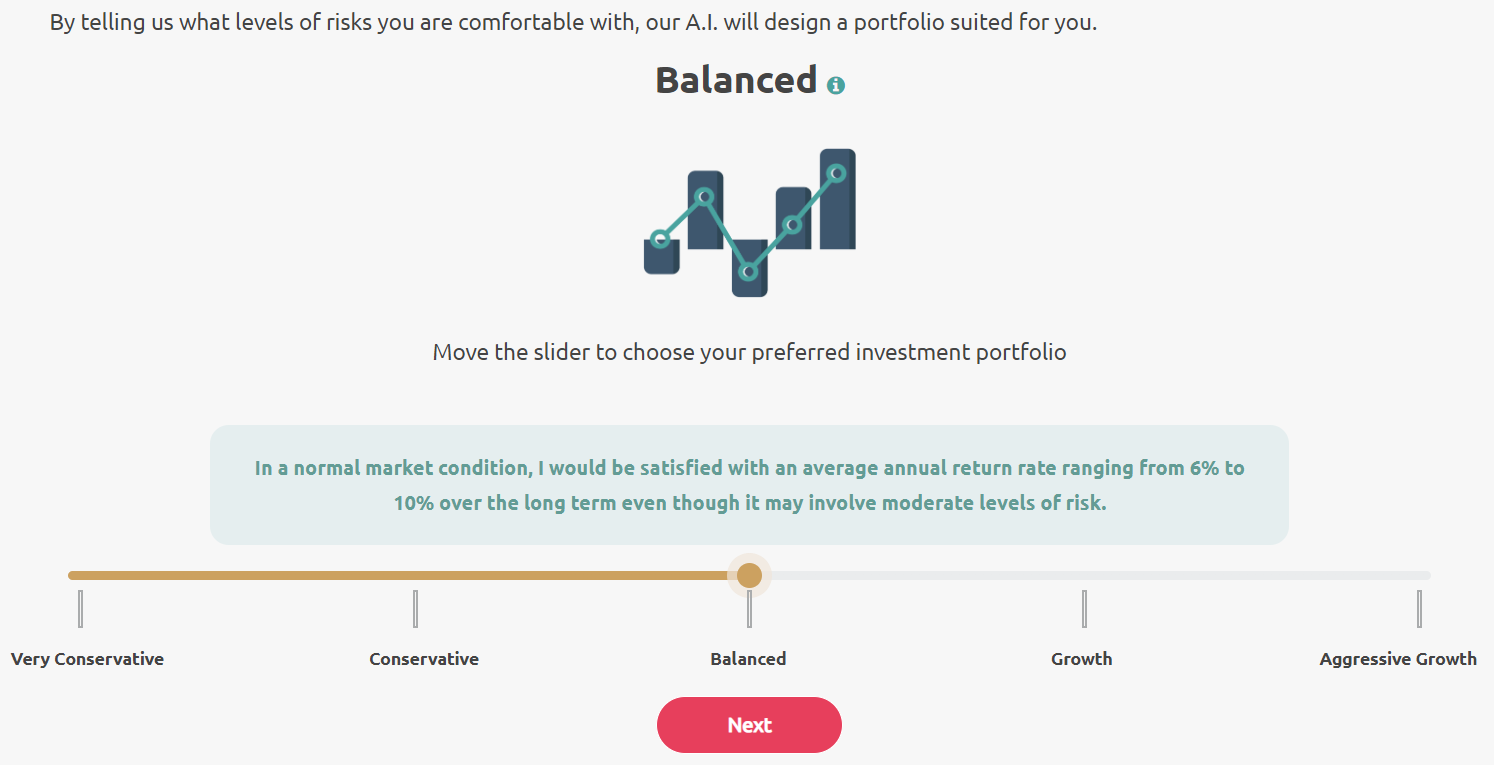

Let the Bot know you

Just like any investment schemes that is introduced by mutual funds, having a list of packages for you to choose is very important.

I have decided go for a “tiny bit riskier” because I need to build something to cover whatever I am in debt if anything happens to me before I complete my re-payments.

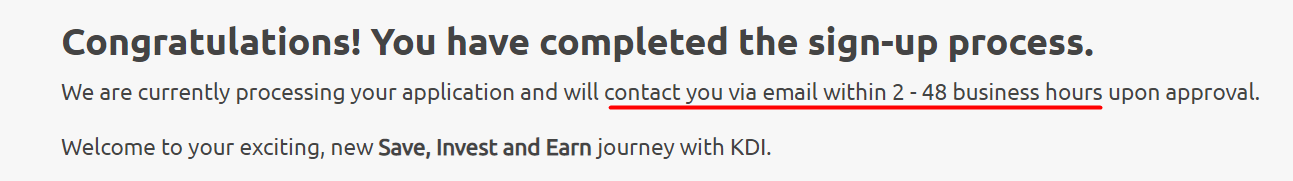

Another interesting part is that if the institution decides to approve my portfolio, I will be able to get an acknowledgement as fast as 2 hour’s time. The longest will be in 48 hours.

I will try to update everyone, especially people in #teammalaysia should there be any good progress. If this seems to be the more reason to settle in Malaysia for foreigners outside US, then by all means, look into it for future planning.

Posted Using LeoFinance Beta

ouh, how long do you think you need to wait for the confirmation whether they approve or reject you?

It says 2 - 48 hours. Is it working hours?

Business hours should be working hours. I applied it after lunch so could be earliest tomorrow I guess. You know la bro, Malaysian working hours 😅