Learning to Navigate in Crypto Malaysian Waters for Investment

Recently, Malaysia government instead of issuing anymore major "stimulus cheques" (and draining its value through more money printing), they have allowed working class citizens (and residents) of Malaysia to apply a withdrawal from their Employee Provision Fund (Government based "retirement fund") in case of emergency.

I am pretty sure there was a lot of people applied for withdrawal

Because I know 2 of my colleagues decided to do so. Because technically you are not allowed to withdraw any funds unless you are

- 55 years old

- buying a house

- reimburse medical fee expenses (from hospital's receipts)

- repairing the house

This is partly because that the government knows that they cannot really feed their citizens long term, especially the income tax for lower / middle range working class isn't high.

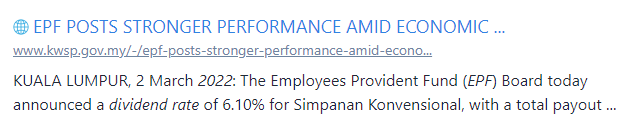

No doubt the interest of 6.1% APY is good enough to keep a part of the wages in for rainy days; but unprecedented days requires emergency funds

Even I personally have withdrawn a small chunk to service my mortgage and medical expenses for my parents during this pandemic and 20% salary cut at the time; and seeing my savings IRL (In Real World) are literally dwindling to minimal, one must find a way to keep the money working for us, but within easier reach

And this is one of those rare occasions where citizens / residents could get hold of cash due to the pandemic struck.

But we can no longer rely on withdrawal and spend mentality, thinking that we can always have our jobs and our wages can always be replenished anytime.

So it is time to look into the most basic passive income that is suitable for N00bs / Newbies to enter into the crypto space.

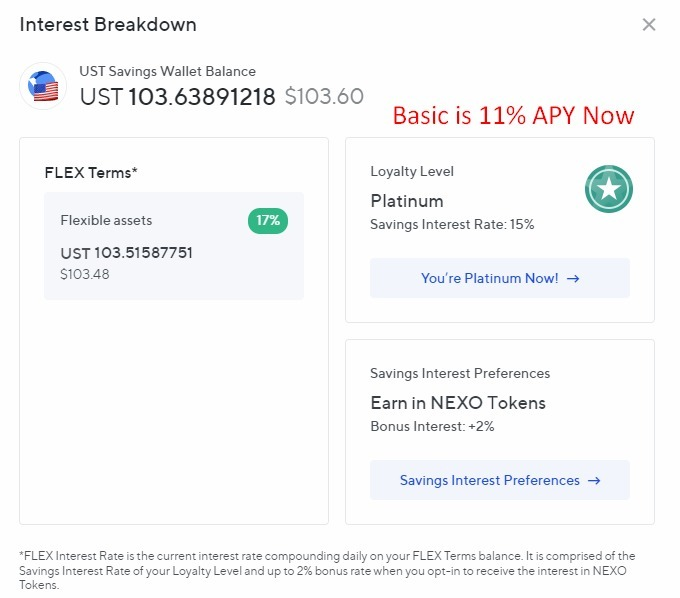

Knowing that my colleagues are ill-literate with crypto knowledge, DeFi is definitely not a place to dabble with; and after looking at several packages, I would have to say that NEXO is currently still the easiest way for entry and they can "technically be excited" to see the progress due to daily compounding interest feature.

Moreover, the latest compounding service by Nexo on UST (Terra stablecoin) is too good to miss out! Not to mention that we can withdraw anytime if needed in case of emergency.

Comparing to Bank's Fixed Deposits in Malaysia which is only around 1.5% APY, it gives enough reason to go through the hassle.

But... isn't crypto unsafe?

Looking at situations in Europe, started from Greece in 2015, following to Venezuela, now Ukraine and Russia where you can't even withdraw ATM when needed, what, by all means, is considered safe?

So how can a person in Malaysia access to this service?

1. The easy way

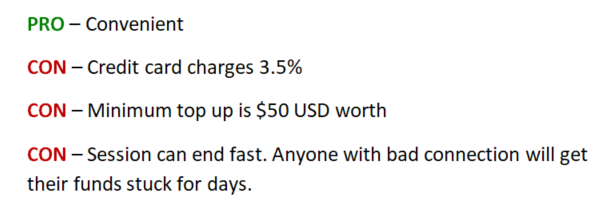

As Nexo is a CeFi (Centralised Finance - service), there is much ease to top up crypto via credit card, debit card / virtual credit card

However, through trial and error (and ended up my funds are currently stuck in limbo), I have found out the easiest approach might not have the best interest for small time investors.

2. The hard way

For those who need every single cent crucially counted, like me, might try to approach the harder way if we are more well versed navigating in these choppy seas of crypto space in Malaysia.

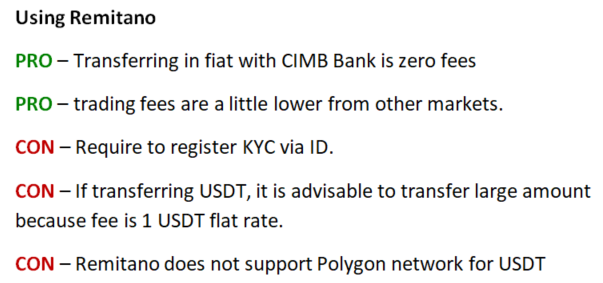

One of my favourite is using Remitano; which is actually around 0.02 (2 sen) cheaper compared to Binance.com (that also requires KYC)...

... but if USDT is purchased, then it is not a good way to transfer because the withdrawal fee is high (for small withdrawals).

Unless you are transferring probably $500 USDT at a go, this is not an ideal way to trade.

That being said...

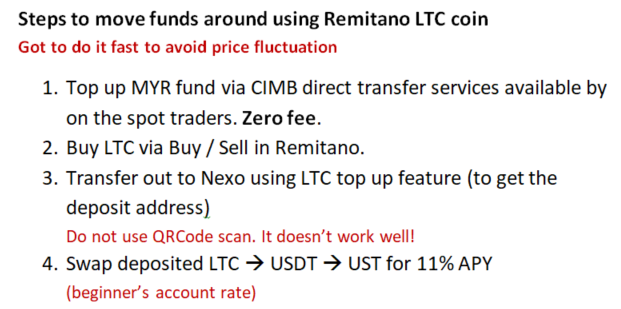

With a calculative DCA (Dollar Cost Average) mind I have and my intention is help small time investors to save as much as possible, the best way I have found using Remitano service is, to use $LTC (compared to the coins available in its service)

At the moment, LTC is still the cheapest with 0.001 LTC withdrawal fees which only round at 10 cents USD (or 44 sen in MYR), compared to ETH is 36.60 MYR transfer fee, USDT 4.40 MYR transfer fee.

Regardless how inferior maximalists like to say about Litecoin, it has its purposes.

Nevertheless, there will always be conversion losses along the way during swap / trade, but if it is traded at the right time, the expenses are definitely not minimum 6.80 MYR fee per minimum $50 USD top up via credit card.

Above is the steps I found it "fast" enough to get through, and the loss of it all for a Minimum 100 MYR (around $22.90 USD) loss is still less than $1 USD.

Bottom line is, if there is a local community that supports initial investors, then things will definitely be more worth while to onboard regular folks embarking their first journey into crypto adoption.

How about you?

Will you introduce your Real Life friends on approved CeFi just to get them onbard for better passive income?

Until then

Posted Using LeoFinance Beta

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Thanks for the encouragement! But it seems that you have a nemesis haunting your automated algorithm?

Ehn... perhaps. it depends on the features of the holding. Telling my friends about HBD and its 20% APR is way more easier for me

I actually have not really figured out how the 20% APR works for HIVE savings haha. Though I do have some in there. It doesn't seemed to be updating. Is it a monthly, bi-monthly, quarterly or yearly update when you add into / subtract out from savings?

And telling your friends about HBD is definitely easy, if you are the one who will onboard them

However a lot of people around me are not interested in "Proof of Brain" HIVE because they are not micro-bloggers / bloggers / content creators; moreover, they like to "see progress" as it goes.

Not to mention, never put all the eggs in one basket. 😉

Thanks for stopping by!