Crypto Contest September 27: Bella Protocol

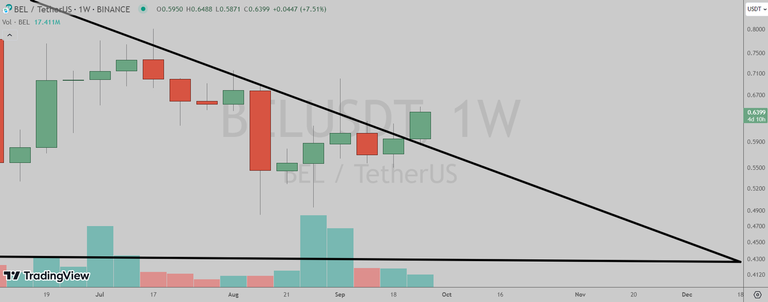

Bella Protocol (Binance: BELUSDT) has broken out of the triangle pattern in the weekly chart.

(Chart courtesy of Tradingview.com(log scale))

Elliott Wave Analysis

In Elliott Wave terms, BEL began a red wave one advance in November 2022. The red wave one (blue sub-waves i-ii-iii-iv-v) peaked in February this year and the red wave two (blue sub-waves a-b-c) correction ended on June 10. If this wave count is correct, BEL should be heading next towards the February peak in the red wave three.

(Chart courtesy of Tradingview.com(log scale))

Funnymentals

Bella Protocol offers a suite of streamlined tools to unleash your liquidity potential and maximize crypto yields. You can find their latest monthly report here.

(Sources: https://www.bella.fi/)

How Will Bella Protocol Trade?

Bella Protocol (Binance: BELUSDT) daily chart by Tradingview.

(Chart courtesy of Tradingview.com(log scale))

Prizes

I will be giving upvotes to the correct answers (posts only).

Rules

This poll will expire in one week. Only one vote per person.

Which one will happen first?

Please select one of the three choices and comment below

BEL will takeout the July 17 peak

BEL will drop below the June 10 low

BEL will stay in a trading range between the June 10 low and the July 17 peak until November 2

Posted Using LeoFinance Alpha

BEL will takeout the July 17 peak

BEL will stay in a trading range between the June 10 low and the July 17 peak until November 2

Correct. Upvoted your post:

https://hive.blog/hive-105017/@ace108/wednesdaywalk-late-lunch-at-astons-with-a-salad-buffet-video-or-astons-by-ace108

BEL will stay in a trading range between the June 10 low and the July 17 peak until November 2

Correct.

BEL will stay in a trading range between the June 10 low and the July 17 peak until November 2

Correct. Upvoted your post:

https://hive.blog/hive-167922/@jfang003/brawl-report-43-an-average-brawl-for-a-change

BEL will stay in a trading range between the June 10 low and the July 17 peak until November 2

Correct. Upvoted your post:

https://hive.blog/hive-191258/@blitzzzz/recap-of-my-weekly-woo-splinterlands-tournament-29th-october-is-this-the-last-of-the-promo-tournaments

BEL will stay in a trading range between the June 10 low and the July 17 peak until November 2

Correct. Upvoted your post:

https://hive.blog/hive-193552/@fredkese/actifit-fredkese-20231101t204938162z

Thank you

You are welcome.

BEL will takeout the July 17 peak

BEL will takeout the July 17 peak

BEL will takeout the July 17 peak

!BEER

!BEER

View or trade

BEER.Hey @roninrelax, here is a little bit of

BEERfrom @maarnio for you. Enjoy it!We love your support by voting @detlev.witness on HIVE .

View or trade

BEER.Hey @maarnio, here is a little bit of

BEERfrom @roninrelax for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.BEL will takeout the July 17 peak

BEL will stay in a trading range between the June 10 low and the July 17 peak until November 2

!BEER

!BBH

!WINE

@maarnio! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @eii. (2/5)

!BEER

!BBH

!WINE

@maarnio, sorry! You need more $BBH to use this command.

The minimum requirement is 1000.0 BBH balance.

More $BBH is available from Hive-Engine or Tribaldex

View or trade

BEER.Hey @eii, here is a little bit of

BEERfrom @maarnio for you. Enjoy it!Did you know that <a href='https://dcity.io/cityyou can use BEER at dCity game to buy cards to rule the world.

Correct. Upvoted your post:

https://hive.blog/mynaturephotography/@eii/mynaturephotography-02112023

!BEER

!WINE

!LOLZ

!LUV

!PIZZA

!WINE

!LOLZ

!LUV

!PIZZA

!WINE

!HUG

I sent 1.0 HUG on behalf of @eii.

(1/3)

!WINE

!HUG

I sent 1.0 HUG on behalf of @maarnio.

(1/3)

View or trade

BEER.Hey @maarnio, here is a little bit of

BEERfrom @eii for you. Enjoy it!Did you know that <a href='https://dcity.io/cityyou can use BEER at dCity game to buy cards to rule the world.

$PIZZA slices delivered:

@maarnio(1/5) tipped @eii

eii tipped maarnio

BEL will stay in a trading range between the June 10 low and the July 17 peak until November 2

Correct. Upvoted your post:

https://hive.blog/deutsch/@monsterbuster/monsterbuster-s-risingstar-block-nr-1097

BEL will stay in a trading range between the June 10 low and the July 17 peak until November 2

Correct. Upvoted your post:

https://hive.blog/hive-193552/@trincowski-pt/actifit-trincowski-pt-20231101t222801456z

BEL will stay in a trading range between the June 10 low and the July 17 peak until November 2

Correct. Upvoted your post:

https://hive.blog/hive-167922/@yeckingo1/hive-power-up-day-november

BEL will stay in a trading range between the June 10 low and the July 17 peak until November 2

Correct. Upvoted your post:

https://hive.blog/hive-150329/@bntcamelo/he-was-science

BEL will stay in a trading range between the June 10 low and the July 17 peak until November 2

Correct. Upvoted your post:

https://hive.blog/hive-193552/@jorgebgt/actifit-jorgebgt-20231102t010148075z

BEL will stay in a trading range between the June 10 low and the July 17 peak until November 2

Correct.

BEL will stay in a trading range between the June 10 low and the July 17 peak until November 2

Correct. Upvoted your post:

https://hive.blog/hive-155530/@femcy-willcy/wednesday-walk-to-a-friend

Congratulations @maarnio! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

BEL will drop below the June 10 low