2022 Wealth Destruction? - Great Reset Coming?

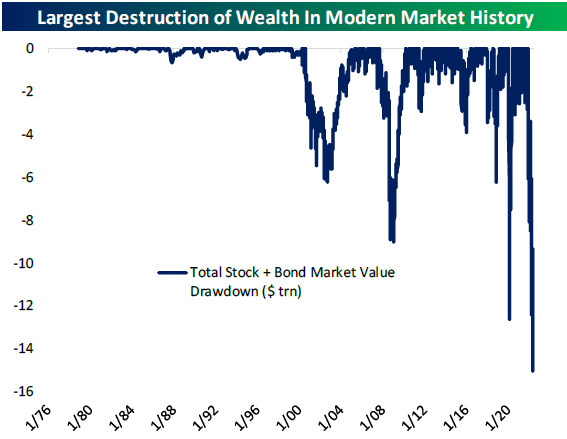

Chart courtesy of Bespoke at twitter handle bespokeinvest. The chart was based on up to yesterday's market close in regards to the total loses investors are having to deal in 2022.

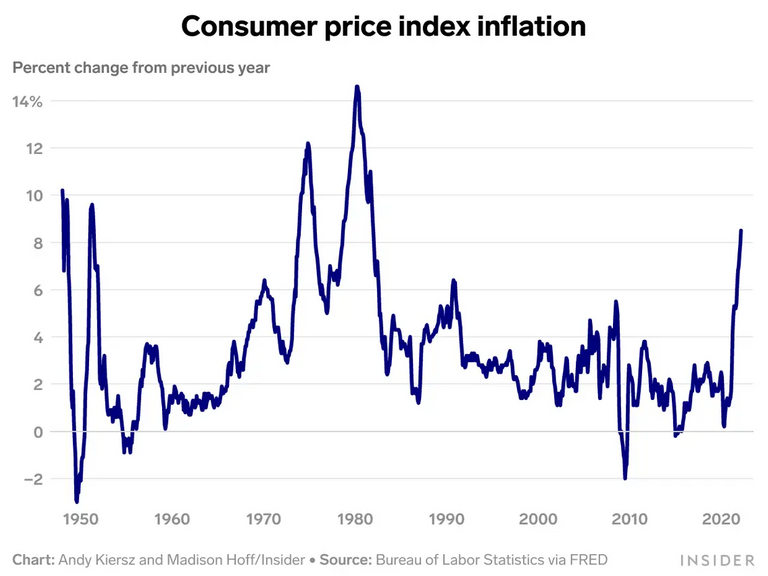

It is shocking to see the total amount of losses is more than what was the trough in 2007/08 during the Great Financial Crisis. Even with all the stimulus and central bank support investors if holding bonds and stocks are taking a hit in their nest egg. There is no safe space to protect one's investment. Even cash is bad considering inflation is at 8.6%.

Stocks Down

The current equities markets although is technically in a bear market due to indexes having fallen more than 20% within the year, does not equate to the damage the bond markets have created.

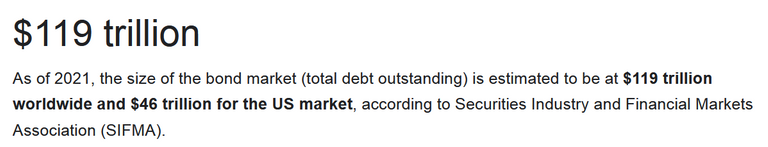

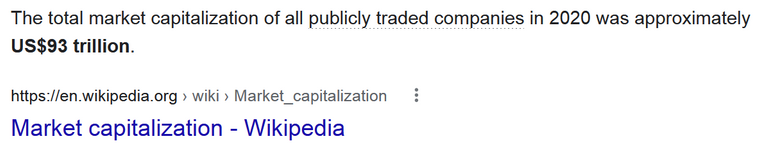

A quick google search between total market cap of bonds versus equities, aka stocks, the immediate results are showing investors are holding more bonds than equities. This is likely due to the less volatile price and steady dividend payouts in bonds versus that of equities. Folks that saved up a retirement nest egg will likely have a significant portion of their savings in bonds.

Bonds Down

Yet bond prices have been in a downtrend since the start of the year with yet a bottom in site.

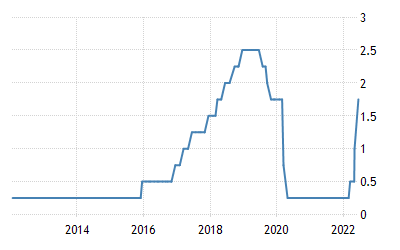

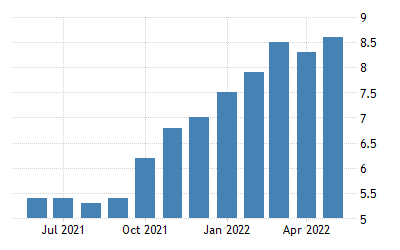

The FED raised lending rates to 1.75% in total while it started the year at 0%. This is to fend of current inflation in the economy as it currently stands at a staggering 8.6%.

For months the narrative by the FED was inflation would be transitory therefore once inflation settles the economy will continue running smoothly. However that was not the case as prices on assets and commodities went through the roof.

Consumer price inflation hit a 40 year high in April but it was even higher in May. This no longer became a transitory inflation but one that has steadily and continue to climb.

The challenge for the real economy now is to sustain operating while inflation continues. The FED can not do much beyond controlling the supply of currency. So they have now been raising rates and selling assets such as mortgage back securities back to the public to reduce the currency circulating in the real economy.

This process of taking money out of the real economy can lead to a recession or worse depression. Where we stand now is questionable, but at current pace of losses investors are taking it seems more like a recession is likely and possibly worsen into a depression.

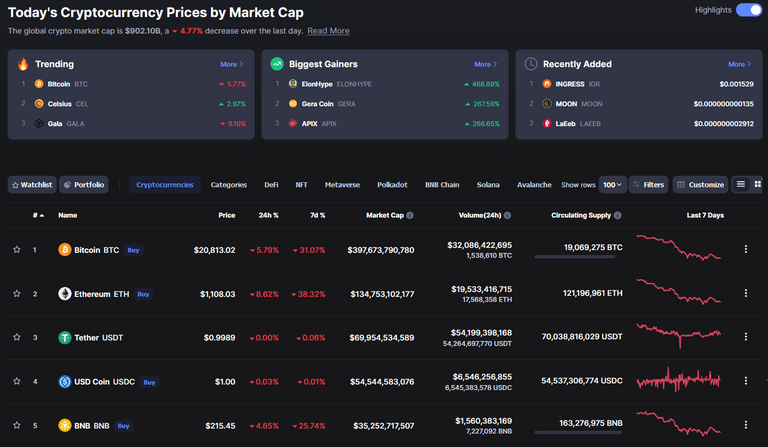

Crypto Down

With stocks down, bonds down, and crypto down it is all adding up to huge losses for investors. There is no safe asset to be in beyond that of some commodities such as oil. Even gold has been mostly flat for the year.

The bitter sweet reality may likely come in the form of continue losses for investors while inflation recedes and price of assets start falling in value. This will cause some people to lose their jobs and it all equates to a economic slowdown. Signs are all around us as many if not all asset prices are falling dramatically from their all time highs.

So are we facing a head wind that is worse than 2008 or even the Great Depression of 1929?

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

We will see more people getting liquidated too. For the past 2 years of blooming market, more people feel that they are good in the market and even start to leverage. I am curious to see how microstrategy will it off in this bear market if it continues.

Posted Using LeoFinance Beta