Alpha DeFi and Its Tools on Terra Blockchains...

There is so much on Terra that its would take many man hours to learn and by the time I learn it the data may likely be obsolete. Someone nicked named Alpha Defi has consolidated some of this data specific to UST and Luna. Additionally I did not get any endorsement from Alpha Defi for making this review. I just recently used the platform and am now recommended for others to use.

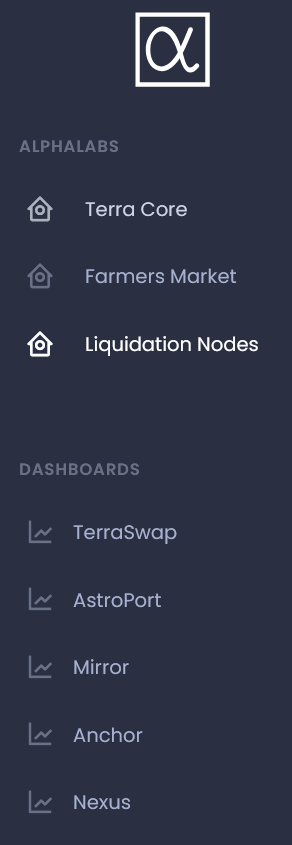

Alpha Labs and Dashboards

In the post I will briefly talk about the tools the platform has to offer. First of Dashboards are nice summary of each of the protocol's native token and how the protocol has been doing day to day.

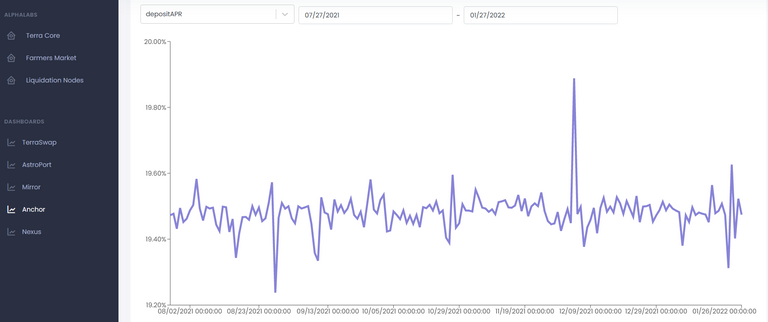

For instance Anchor platform the % APR daily earning rate is shown. This is a good review of the history of the platform.

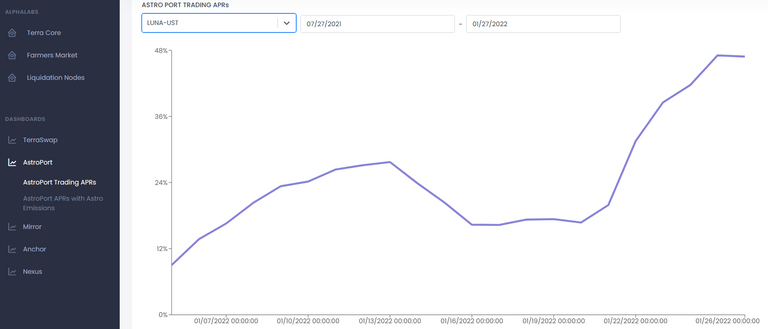

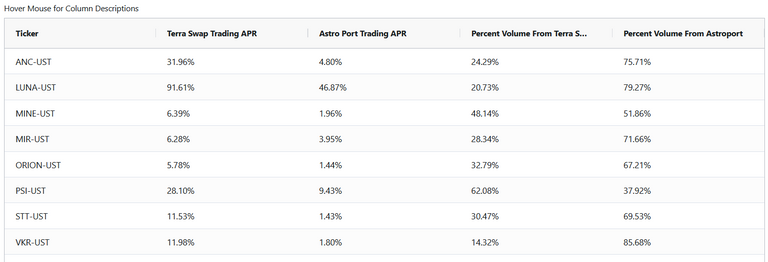

On Astroport it is interesting to see the % APR earned for different pools on Astroport. The UST to Luna pool has been rising recently. This may likely be due to the volatile price movement of Luna. In turn making a lot more in users trading the two assets.

Liquidation Nodes

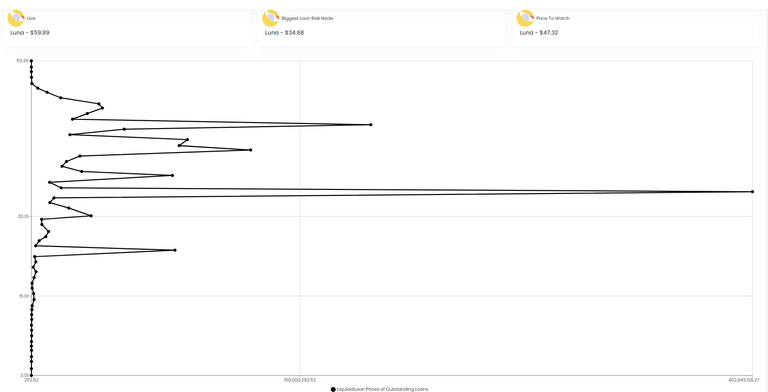

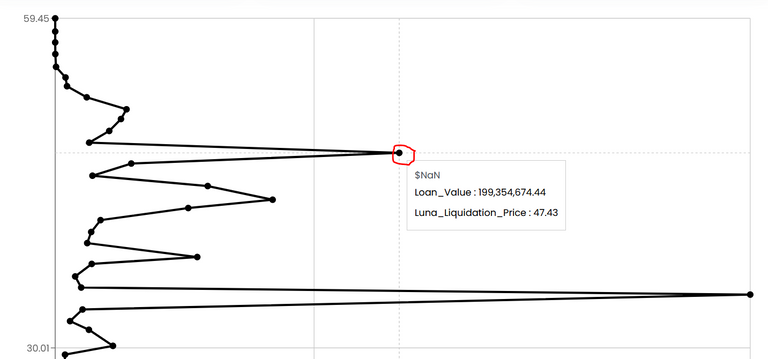

This chart above is a very interesting diagram of the current lending amount of bLuna on Anchor. It updates every minute and is collecting data directly on Anchor.

Each node is a point identifying in the millions of $USD being set as the limit collateral price before the borrower gets liquidated. This chart shows the entire amount of collateral on Anchor. Circled in red there is $200 million at $47.43. To interpret this it means if Luna fell to $47.43 it will trigger borrowers who set their price there to be liquidated. That means immediately $200 million in bLuna will be sold into the market.

Conclusions

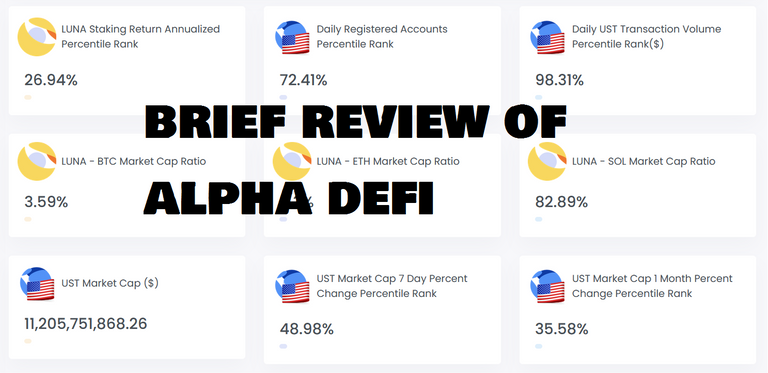

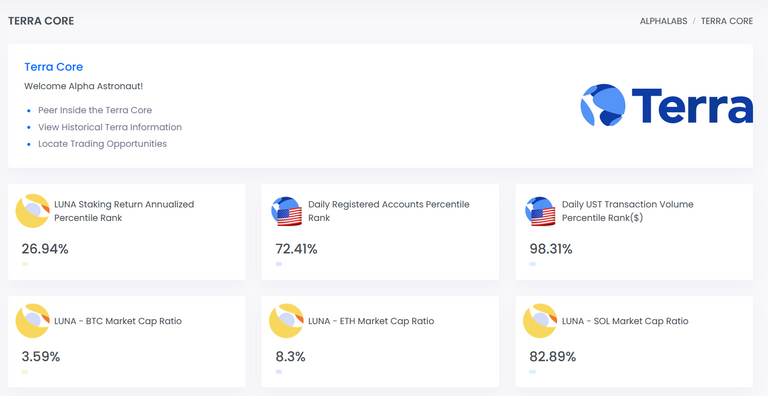

Home page of Alpha Defi has some cool stats. For instance it compares its price versus BTC, ETH, and SOL who are at the top market cap coins currently.

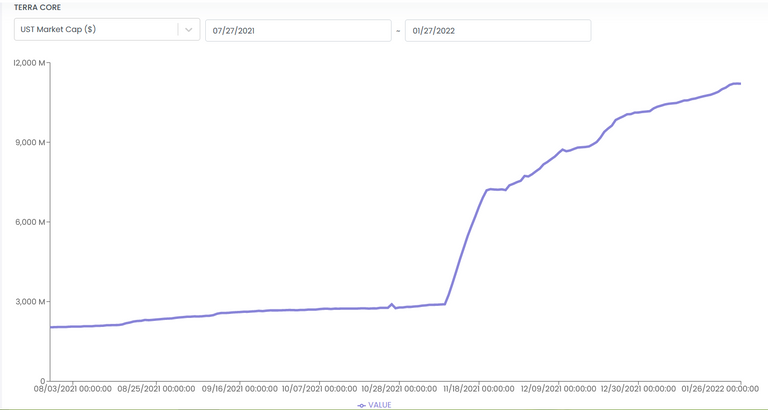

A four month chart of Luna based on total market cap is the default on the home page, but users can adjust the range of date to see further history of Luna price.

All of these neat and organized tools are free to use! Again the site is:

It serves only protocols related to Terra blockchain but very helpful. From determine potential support in Luna prices from Liquidation Nodes to Terraswap and Astroport to see the AMMs overall total activities. The site allows users to have potential actionable investments such as best %APR in pools to farm.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

!PIZZA !WINE !LUV !LOL

Congratulations, @logicforce You Successfully Shared 0.100 WINEX With @mawit07.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/1 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.333

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

@logicforce(2/4) gave you LUV. H-E tools | connect | <><

H-E tools | connect | <><

lolztoken.com

ERROR: Joke failed.

@logicforce, You need more $LOLZ to use this command. The minimum requirement is 16.0 LOLZ.

You can get more $LOLZ on HE.

!WINE !PIZZA back

Congratulations, @mawit07 You Successfully Shared 0.200 WINEX With @logicforce.

You Earned 0.200 WINEX As Curation Reward.

You Utilized 2/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.333

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

PIZZA Holders sent $PIZZA tips in this post's comments:

logicforce tipped mawit07 (x1)

@mawit07(2/5) tipped @logicforce (x1)

Learn more at https://hive.pizza.

now you are so so so knowledgeable in terra + other crypto stuffs!!!

Luna is raising a lot of excitement on the blockchain a lot of people are writing about it.