Bear Market Bounces

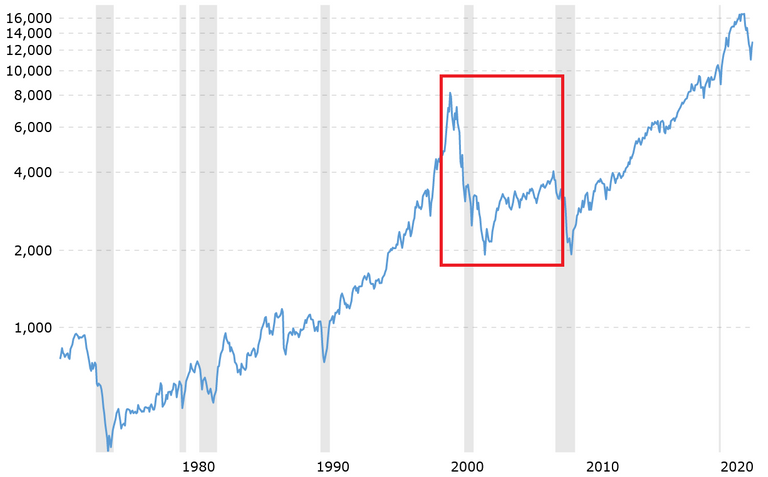

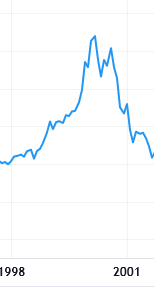

In 2000 the Nasdaq top price got blown out. This even is know today as the Dot-Com bubble. The Nasdaq index reached a high of 8,000 and drop to as low as 2,000. The drop took almost one full year to play out.

In March 2000 Nasdaq hit a top but six months later it bounced to almost come back with 50% of its lows since March 2000 top. This would end up being a bear market rally since late Sept. / Oct. 2000 the Nasdaq continue its decline. It won't been until late summer of 2002 did the Nasdaq bottomed.

Bear Market Rallies

Bear market rallies are significant counter-trend recoveries in stock prices that can last as little as a few days or as long as months before the market reverses to new lows.

Over on investopedia.com is a description of what happens during a bear market rally. The stock market prices appear to rise for a period of time only to end up lower down the road in the future.

It is not predictable that a bear market rally exists until it occurs since lower low may not happen. This is where speculators and traders have to predict and place their bet on before it actually happens.

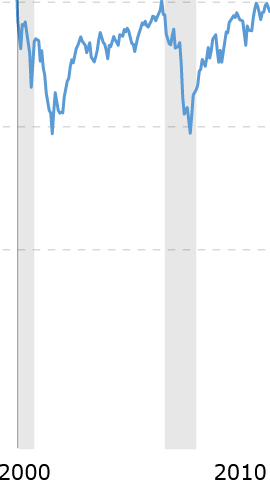

Even after August 2002 where Nasdaq hit a low it would be tested almost one decade later during the Great Financial Crisis in 2008/09. The test then was a double bottom and price remain steady above the 2,000 points on Nasdaq.

Now two decades later Nasdaq is closer to a all time high than at 2,000, but it does not mean it could fall back to that support price. Nasdaq as an index is now around 13,000 but had peaked near 16,000 at late 2021.

Conclusions

Current market indexes had hit a bear market in 2022. A bear market is defined when the price of asset has drop 20% from its top. Now since the drop has hit a bear market it was not that long that indexes and many multiple stocks had recover a decent amount in price that the drop from its peak prices.

Looking ahead its not known if in fact the current stock market is in a bear market and the recent rise in price is just a bear market bounce. What can be stated is that as of right now it appears that the bear market rally has played out.

As of now the SPY which is index of USA top market cap leaders in multiple sectors is showing some long term weakness. Whether it can break through and continue to rise in price remains to be seen, but it certainly looks like it had headwinds moving forward.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

Congratulations @mawit07! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Dot-com bubble. I heard about it. Thanks for sharing.

!wine !PIZZA !LOL

Congratulations, @mawit07 You Successfully Shared 0.100 WINEX With @beyondhorizonmm.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.175

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

lolztoken.com

He said nothing.

Credit: reddit

@beyondhorizonmm, I sent you an $LOLZ on behalf of @mawit07

The LOLZ Tribe is here! Stake your LOLZ now to earn curation rewards and continue using the !LOLZ command. Please read our latest update for more information.

(1/8)

It's hard to tell which way the market will move and it's at a key point. I am opting more to not trade this week as it could easily go in either direction.

Posted Using LeoFinance Beta

Think this is a safe bet to do nothing. The reality many younger traders don’t realize is that if this current stock market drops as much as 2008 it will take years if not decades to break even. !LUV !PIZZA !WINE

Congratulations, @mawit07 You Successfully Shared 0.200 WINEX With @jfang003.

You Earned 0.200 WINEX As Curation Reward.

You Utilized 2/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.175

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

@mawit07(1/4) gave you LUV. tools | wallet | discord | community | <>< daily

tools | wallet | discord | community | <>< daily

HiveBuzz.me NFT for Peace

Robert Kyosaki (Rich Dad Poor Dad) states that we are about to see the biggest collapse in history.

Sure bet, as supply chain destroyed by COVID perpetrators.

Stop the scamdemic https://bit.ly/aa22zz

Now checking it against my database of known compromised or unsafe domains.. you'll see another reply if it's in there. If not, it's likely safe to open.

For more information about risks involved in shortened URLs, read this article by Forbes.

{average of post/comments with shortened links that I found: 14.3/h}

@cryptoshots.nft 🔫

P2E 3D game @ Hive

All Safu

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @mawit07, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.PIZZA Holders sent $PIZZA tips in this post's comments:

mawit07 tipped beyondhorizonmm (x1)

@mawit07(2/5) tipped @jfang003 (x1)

Please vote for pizza.witness!