LeoFinance - Osmosis For Terra Users

Although Terra projects are expanding rapidly there has also been growth in other blockchains that has some association with Terra. For instance liquidity pools with rewards yielding triple digits to high two digits for months. Today we get to look at some of these long standing and still highly active liquidity pools on the Osmosis's blockchain.

Terra Bridge

Before we go straight on over to invest in Osmosis with Terra tokens it should be clear that Osmosis runs on its own blockchain, which is separate from Terra. In order to partake in Osmosis we have have bridge assets from Terra to Osmosis. I briefly explain what bridges are and explain the Terra Bridge Here.

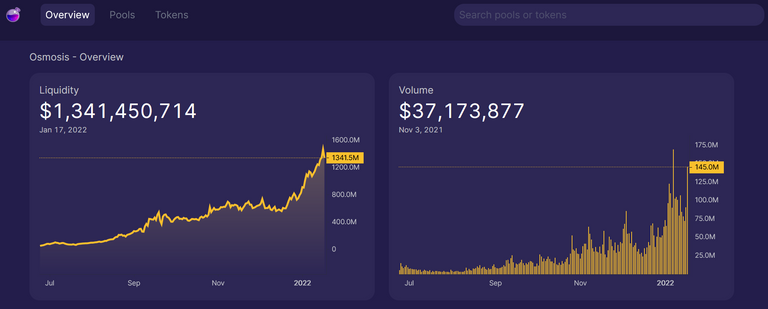

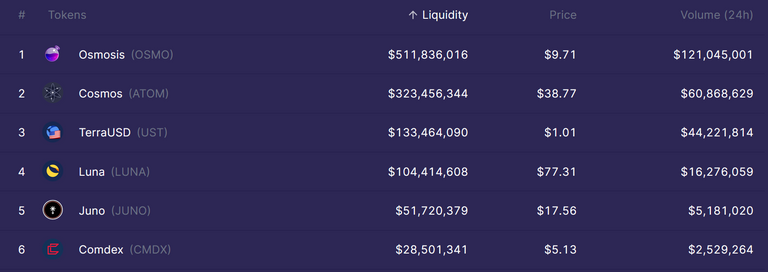

Osmosis

Is a decentralized exchange and currently trading volume is above $1.3 billion. In addition Terra's UST and Luna tokens are ranked 3rd and 4th in most traded tokens on the platform. There is attention on Terra over at the Osmosis blockchain.

Osmosis Pools

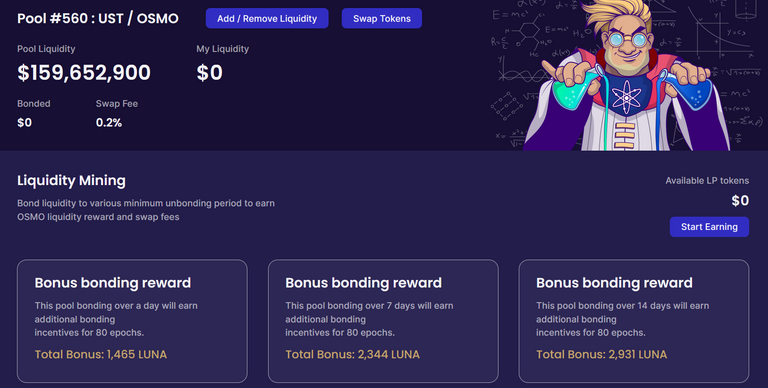

The most APR % earned pool related to a Terra token is currently the UST : Osmosis pool at over 150% APR. To farm in any of these pools you need to provide 50% of each of the two assets in the value of $ into the pool. Then select a bonding term for the assets to be locked in the pool. It can be 1 day, 7 days, or 21 days with more APR the longer the bond. Once the liquidity is staked investors earn daily OSMO token which is the native token of Osmosis. In addition the rewards that is earned daily is free to be used to what ever the investor pleases. They can reinvest in pool to increase earnings or withdraw to invest somewhere else.

The bonding of assets on Osmosis locks up your principal for a fixed amount of days either 1 day, 7 days, or 21 days and at the end of term you are able to move the assets to different pool or withdraw out of Osmosis all together. The ability to pay rewards comes from the fees Osmosis collects from traders who do swaps on the platform and the tokenomics of OSMO token distribution.

Keplr Wallet

Since Osmosis is its own blockchain it will need a different wallet from what we are accustom to of MetaMask for ETH or Terra Station for Terra. For Osmosis it is Keplr.

Conclusions

Getting back to the amazing rewards in the pools on Osmosis we only looked at one out of the current 6 pools that has associated Terra token assets. Yet Osmosis as a whole has over 500 pools to participate in.

In addition to the choices the longevity of the program has stood the test of time in crypto terms. Nearly running over a year with the Terra token pools.

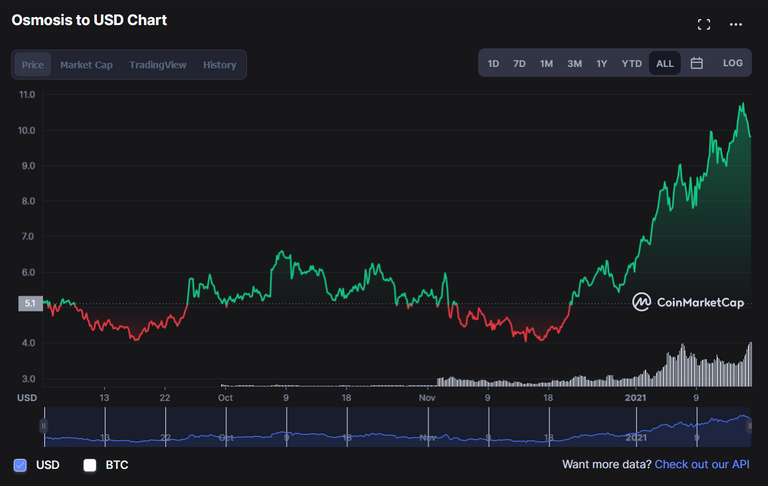

The native token OSMO has continue to rise in price and this is likely due to the ability to convert the token for pool rewards to either more UST or Luna and allow investors to continue compounding their earnings by staking into the pools. The bonding aspect only benefits the protocol even more by making users stick with the platform longer with lock up periods and users earning more and re-staking the earnings back onto the platform.

Osmosis is a great choice to enhance earning yields and also a good outlet to multiple different blockchains beyond that of what is in Terra. By staking on Osmosis there is the potential to swap earnings and assets to different blockchains such as ION, Crypto.com, and many more.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

Is Keplr wallet essentially MetaMask for the Cosmos ecosystem?

Does it work with anything outside of Cosmos?

PS. Instead of putting the word 'LeoFinance' at the front of all your blogs, you should just post them via the leofinance.io front-end and use the topic as your title.

You'll receive higher rewards and the posts will be easier for Google to rank, therefore generating ongoing ad revenue for the community.

Win/win :)

Posted Using LeoFinance Beta

Keplr to cosmos like eth to metamask. I don’t think Keplr can do tokens outside of cosmos. Metamask has a lot more blockchains to choose from.

Very surprising that the native token of this dex/platform did not drop in value like many others. What would be the main particularity of osmosis that would explain it ? Great article !

Posted using LeoFinance Mobile

A few key reasons for its success:

The really risk here is if the value of the crypto token in the liquidity pool drops or participation on Osmosis slows. The less swaps the less fees. But they have been very successful at maintaining investors retention much like curve finance. The more curve investor stakes the higher their yields. Same with OSMO.

There is a ton of development going on in that ecosystem and OSMO is the primary DEX for that platform. Both ATOM and OSMO have basically defied the rest of the markets in the last month. Allot of the projects that launch do airdrops which are paying out very nicely to ATOM and OSMO stakers and LPs (liquidity providers)

Posted Using LeoFinance Beta

Thanks for some insight @hivehustlers, I definitely missed the bus on that one (Well, I had some ATOM so still gained a bit there)

This is the main reason why ATOM and OSMO held in my opinion:

ATOM ecosystem is my favorite after FTM and ETH. Good developers and community there

Posted Using LeoFinance Beta

Yeah for sure! @nulledgh0st is running allot of validator nodes so I delegate as much as I can over to his stuff. Some killer earnings.

Great write up! We love Osmosis and have been in since their first airdrop...It's been amazing to see it grow from holding just 10 ATOM in a wallet, haha. But yes, the OSMO/UST pool is where the bulk of our LP is at the moment. The APR has stayed pretty insane and the extra LUNA earnings have been pretty cool too. Reblogging for the https://coin-logic.com front page rotating feed!

Posted Using LeoFinance Beta

Appreciate the positive feedback. I am just scratching the surface on Osmosis but is sure looks amazing on the APRs. Out of curiousity do you know ball park you are earning in the liquid token UST or LUNA when staking in OSMO/UST or OSMO/LUNA? I am trying to find info if that extra UST and LUNA actually are better than on Terra protocols. I think they are therefore so many are jumping onto Osmosis.

For the bonus rewards you are getting paid in LUNA

All we need is for the folks at @hive-engine or @tribaldex to add ATOM as a SWAP token! My world would be complete, lol. Changelly is handling the job for now, but a native bridge would be pretty cool!

Posted Using LeoFinance Beta

I wonder how difficult it is to have bridges? If a Cosmos to Hive bridge can exist then Hive can join in on the Defi explosion. Having a lot of progress within the Hive blockchain is great, but bridging it with other blockchains through even just tokens would create more opportunities to Hive.

It would be probably the best if the Hive-Engine team could figure out a was to use a SWAP token.

!LUV !PIZZA !WINE !LOL

Congratulations, @logicforce You Successfully Shared 0.100 WINEX With @mawit07.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/1 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.290

@logicforce(2/4) gave you LUV.

lolztoken.com

ERROR: Joke failed.

@logicforce, You need more $LOLZ to use this command. The minimum requirement is 16.0 LOLZ.

You can get more $LOLZ on HE.

!WINE back

Congratulations, @mawit07 You Successfully Shared 0.200 WINEX With @logicforce.

You Earned 0.200 WINEX As Curation Reward.

You Utilized 2/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.290

Great returns, Terra keeps on rotating and developing juicy projects.

Posted Using LeoFinance Beta

Dam I keep hearing good things about this chain, I haven't looked into it but I am thinking I better

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@logicforce(2/5) tipped @mawit07 (x1)

Learn more at https://hive.pizza.

I added some liquidity to OSMOSIS a few weeks ago. I have been fairly pleased with the results thus far.

Posted Using LeoFinance Beta

I'm glad that I've learn more about the Terra project and things connected to it from your blog. Indeed your blog is informative one.

Posted Using LeoFinance Beta

And I mean, isn't it better to buy osmosis directly from an exchange and pass it to the cosmos blockchain? Or is the bridge the best option.

Posted Using LeoFinance Beta

Terra is creating new things every day. There network are trying.

Posted Using LeoFinance Beta

Back when the internet was young and just text. Everything they wanted to build on the internet they first had to come up with uniform protocols making it compatible on all computers.

For example email: consists of two things sending and receiving. To send you used SMTP (Send Mail To People) or (Simple Mail Transfer Protocol) and POP3 (Post Office Protocol)

Imagine building a general protocol for all blockchains.