LeoFinance - Terra Protocol Apollo DAO of Pool Aggregator

I have not gotten involved in DAOs ever since I heard of the forks of Olympus DAO. That is because I misunderstood what DAOs meant. DAO is short for Decentralized Autonomous Organization. With that I missed some great opportunities in the Terra blockchain protocol just because of fear it was some sort of scam.

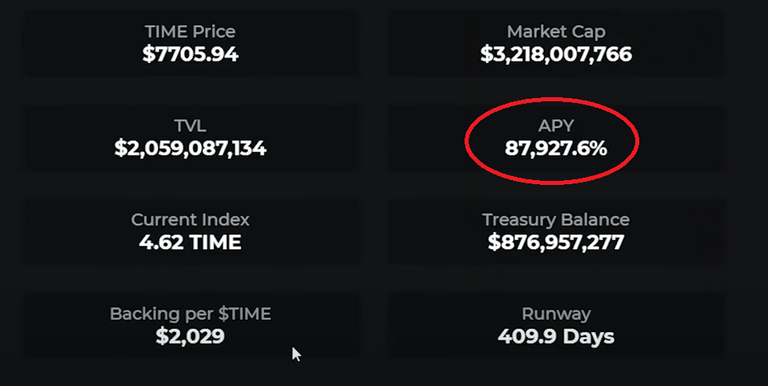

My concern with DAOs is that the multiple Olympus DAO forks were having these ridiculous APYs like Wonderland's TIME

Yet after looking over at Terra's Apollo DAO I have a change of heart and believe its a very good place to park unused liquidity to earn interest. We will see why?

Farming Liquidity Pools

There are now so many ways to earn interest on liquidity that one can find it overwhelming on what is the best options to invest in. Terra blockchain itself has a few options just for farming in liquidity pools. Whether it is Terraswap, Astroport, or Loop these decentralized exchanges offer interest on pool participation and their respective tokens.

Each one of these protocols have liquidity pools for investors to participate and earn rewards. Some offer the same trading pair pools but different interests while they each also offer their own unique features.

Yet what all three have in common is that depositing assets into a pool and reinvesting rewards into a pool have to all be done manually. This is where Apollo DAO steps in to have this automated. In addition it reinvests dividends at multiple times in a given day that it increases the earnings yields in total.

Liquidity Pool Aggregator

There are currently two Terra Protocols that will automate an investor's assets into liquidity pools onces they invest into the pools of choice. This is done in order to achieve higher reward yields. Lets look at an example in Anchor Protocol.

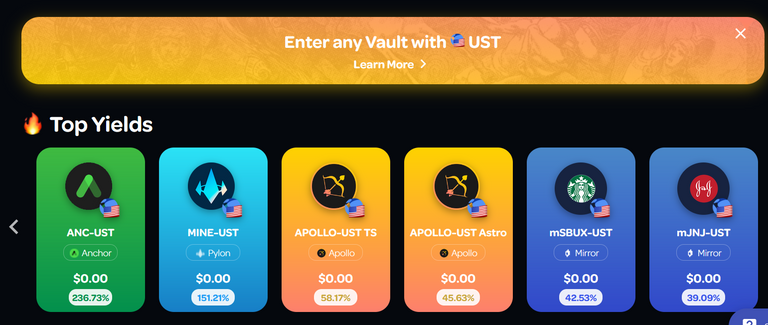

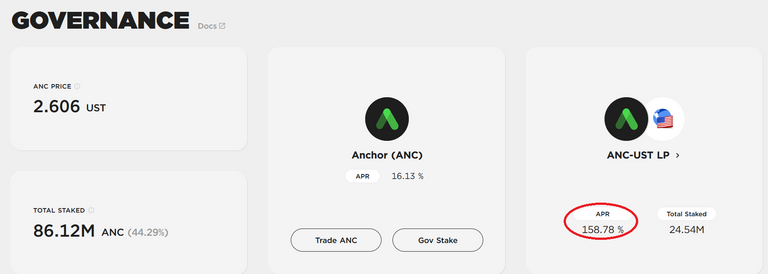

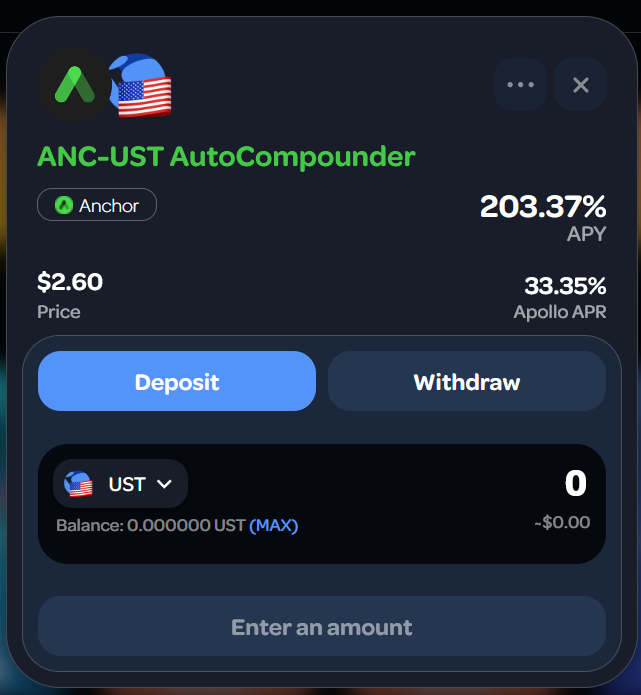

Currently on Anchor user can earn +158% in rewards if it invested in ANC : UST pool. The rewards are both ANC and UST fees collected for users who use the pool swap. Such a rate can be amplified with Apollo DAO.

On Apollo users can see the same ANC : UST pool yielding over 236%. This is broken out to be 203% APY in the pool and 33% in Apollo native token rewards. In total it is 60% more in yield than if one just invested in Anchor, but how is this possible?

Apollo's platform offers an interest compound aggregator. This means once a participant invests into a specific pool the pool itself automatically reinvests its earnings continuously without any supervision. This means continuously as long as more assets are invested into the pool the more assets that can be compounded and in turn earn more.

In our example of the ANC : UST pool if user places their asset into Apollo's ANC : UST it will automatically link onto Anchor with addition yield as Apollo will automatically continue reinvesting the earned interest to compound even more rewards. This allows the additional APY yield on Apollo. To further incentive users to use the protocol there is also native token rewards for investors. The Apollo token's key feature is its governance but it is also backed by assets stored in a war chest and crated by the protocol's developers but allow voters to decide what to do with the assets.

As mentioned the reward yields in the are broken up into the token pairs of the pools. In the Anchor example it is ANC and UST being rewarded to stake holders. What Apollo can do is break out the ANC and UST and reinvest them automatically into the pool to earn more yields. In addition if users want to invest in stable coins while maintaining yields they can automatically have Apollo sell the native token ANC earned for UST there by having a stable coin income stream.

Conclusions

I over looked the Apollo DAO due to my bias view towards DAOs was misleading. Instead after reading more about the protocol I now see it as one of the best options to earn massive yields on Terra blockchain. Yields of over 200% without use of leverage, that is some bullish incentive.

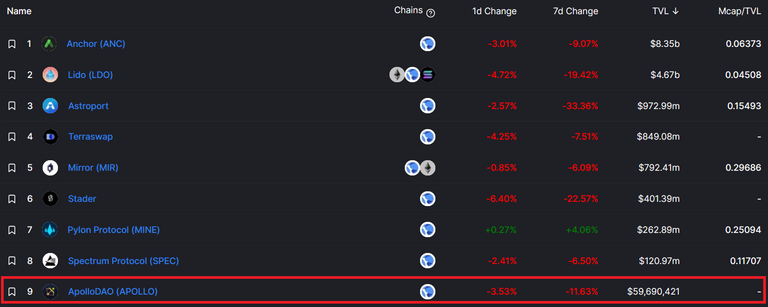

Terra blockchain is collaborative by nature and we are seeing it unfold here again on Apollo Dao. For it uses ANC : UST pool from Anchor and MIN : UST pool from Pylon. It is working since the yields on Apollo is luring users' capitals.

The best parts of Apollo DAO is that it will automatically reinvest dividends into the pool while also distributed native token rewards. In addition in order to invest into any one of the pools listed on Apollo all the users have to do is invest one of the two assets in a pool if they do not have enough. One asset as in UST if placed into ANC : UST pool is sufficient in providing liquidity to the pool and recieve rewards. The purchase of ANC and splitting 50/50 to partake in pool is done automatically by Apollo. Vise versa similar with the withdraw where investor can un-stake their assets from the pool and have the assets all combined into the value of UST. This creates somewhat of a stable coin earnings pool that rivals many of +100% yields. Apollo DAO is currently 9th out of 16 active Terra blockchain protocols in total value locked at just under $60 million.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

!LUV !PIZZA !WINE !LOL

Congratulations, @logicforce You Successfully Shared 0.100 WINEX With @mawit07.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/1 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.270

@logicforce(3/4) gave you LUV.

lolztoken.com

ERROR: Joke failed.

@logicforce, You need more $LOLZ to use this command. The minimum requirement is 16.0 LOLZ.

You can get more $LOLZ on HE.

Cool with all the lingo going around it gets easier to spot things that work and what appears to be scams.