LeoFinance - Terra's Plyon Protocol Overview

When you first look up Pylon protocol you will likely find this front end page:

https://www.pylon.money/

In turn when you click on "Web App" you get to a page where you simply trade for MINE tokens or stake MINE tokens. Yet it is not very clear what Pylon Protocol is doing?

Could There be Such A Thing as Lossless Investments?

It just sounds too good to be true where you invest and full certainty will not lose your principal yet earn some type of reward. As always devils in the detail. The first thing that comes to mind to me is opportunity cost. Of course if I invest in something that will not lose my principal while earning some form of reward is great, however the yield of the reward is likely lower than if I had invested in something that had greater volatility but higher yield potential. If I were to invest in one asset to earn a little I gave up the opportunity to invest in something else that could potentially earn me even more. This is the opportunity cost and in a way is a loss opportunity if I did not invest in what will later turn into higher yields.

What is Pylon Protocol

Somewhat off a tangent lets get back to Pylon Investments. Here in this protocol there is another link that will direct you to the current investments that will be lossless:

Each one of these pools in the protocol is some form of investment in terms of stable token UST. You invest a certain amount of UST for a specific lock up time and in return earn the pool's reward tokens over that lock up time. This sort of goes back to my original point, that investing will incur some type of risk even if at the front it is advertised as lossless when maybe investor locked up their UST for a give period of time but within that time had better investment opportunities that they can not capitalize since their capital is locked.

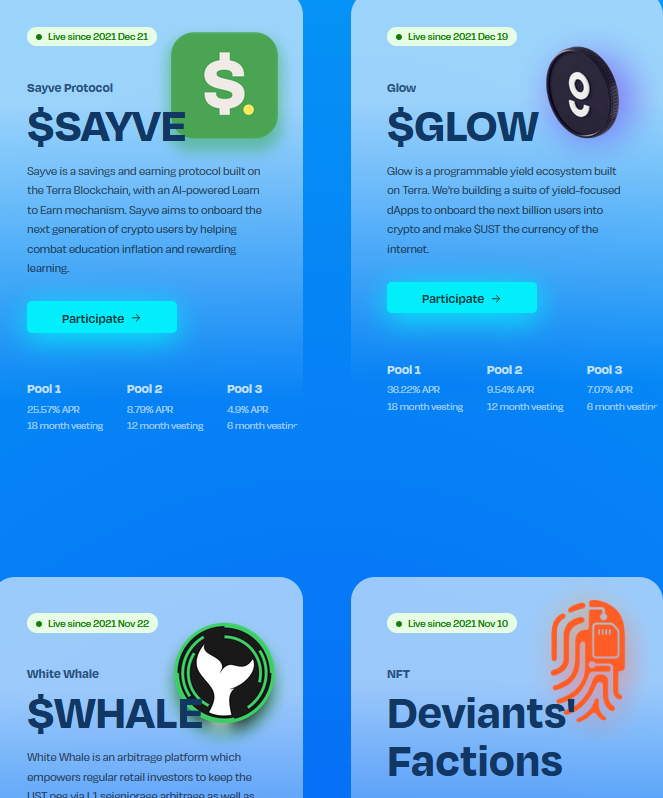

Snapshot above are just some of the current pools users can invest their UST into. Many of these projects are their own Terra Protocols and have yet to be activated or soon to be. The general idea of Plyon is developers who is in need of capital can create a pool to borrow UST for a given period and pay it all back to investors including rewards. The rewards is likely the token of that specific developer's protocol native token.

Example of a Pylon Pool

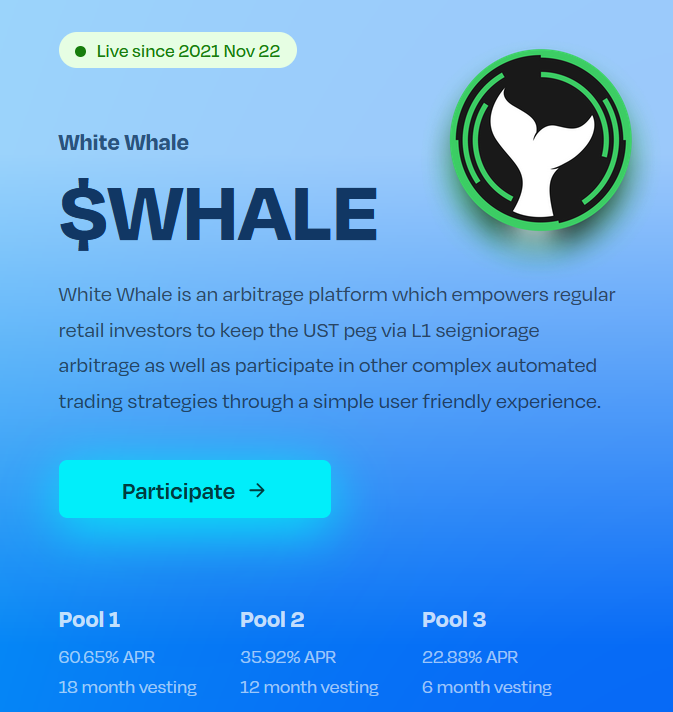

One of the most popular upcoming protocols is the White Whale. Rather going into detail of what that protocol does we look at its pool on Pylon. It offers three UST lockup periods with each increasing lockup equates to overall higher %APR rewards. The lock up periods are 6 months, 12 months and 18 months with each increasing in yields of the WHALE token reward for UST lockup.

The investor basically locks up their UST in the lock up period of their choosing and after that lockup ends they receive all their UST back. In addition to that they earn daily WHALE tokens that is the native token to the White Whale protocol. For those who want to have some skin in the game in the White Whale protocol without actually losing any of their original investment they would partake in such a pool.

Conclusions

You can understand how important UST has to be pegged to $1 in order for Pylon to work. Since all those UST is sent to the developers of the pools invested. The developers in turn converts those UST to real fiat dollars to pay for salaries, rent, equipment, software, and other tools to further their goals toward building their purposed projects.

The key here is time. In the time the investor's UST tokens are locked up the developers have to have set milestones to achieve in order to be profitable and able to return fully the UST tokens given to them. It is unknown if any of these pools have failed but as of now they are operating as intended. Investors provides the liquidity in a lockup. In return the pools release daily rewards or rewards with lockup periods of their own. Pylon basically keeps track of all these flows, from investors investments to distribution of rewards and the time remaining of the pool before it expires.

As of now the first ever pools on Pylon is the MINE pools and they are for the native token of Pylon. The dates of the pools expiring is near and will be the first to be completed and so with that appears to be a success. How interesting it is to be able to invest in a project to earn rewards while at the end of the investment period you receive your original principal back and on top tokens of the projects you wanted to invest in.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

https://twitter.com/LeoAlpha2021/status/1478875982660468738

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This is a very well-thought-out article, I really like the way you wrapped it up in the conclusion.

Loss-Less investments would be a dream, back in the 70s the doctrine was all about banking, safe money, protected money, boy they never saw the banking crisis coming lol

Thanks for the kind words but each day I mostly ramble about what I am thinking regarding Terra blockchain protocols. Over there they have a lot of strange ways but sometimes very profitable ways of investing and Pylon is no exception. However can not just take their word for it. Whether its banks in centralized world or digital protocols in decentralized world the human greed is still the same.