Splinterlands - Splinterlands Liquidity Pools Overview

With the continuous drop in prices for Splinterland's native tokens SPS and DEC it has been somewhat unsettling to me. Personally I have held onto a majority of my DEC in game wallet and have seen its price depreciated from $0.016 down to currently under $0.004. I want to earn more daily SPS by holding the DEC but at the same time reduce my losses from holding DEC. This is where liquidity pools would have helped in curbing the losses. Had I participated in some of the pools that has DEC in them I may have been able to reduce my losses. In this post we look at the benefits of participating in the liquidity pools that has Splinterlands tokens in them.

Over a Million in Hive Liquidity Pool!

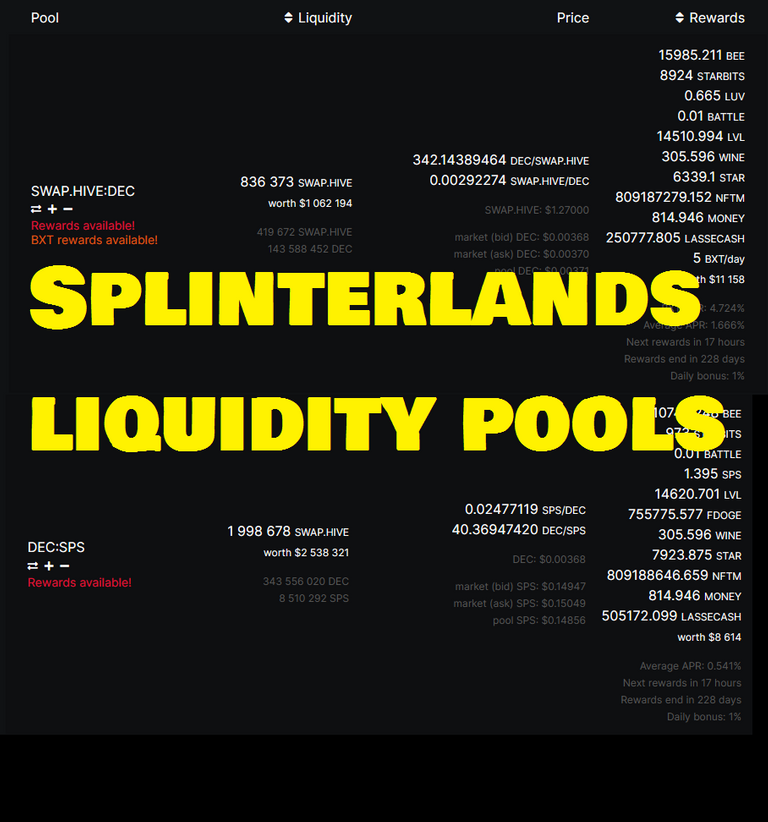

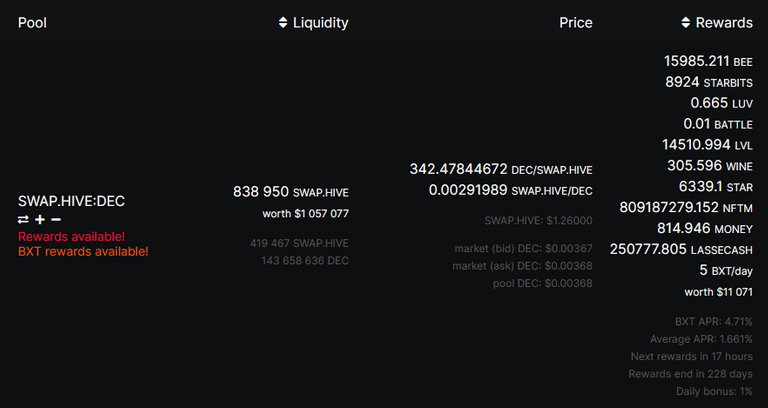

Presently the swap.hive : DEC pool has over $1 million in assets even with the drop in both Hive and DEC prices. A lot of investors are partaking in the pool since it earns them daily rewards of many secondary Hive tokens at a rate of 4.71% APR. The secondary Hive tokens ranges from BEE to LUV and so on. Plenty of rewards that could potentially rise in value down the road.

In a less rewarding pool the DEC : SPS there is even more participating at a tune of $2.5 million. Now with increasing participating the division of rewards also increases which in turn lowers the overall APR on rewards earned. Still there are plenty of rewards in the DEC : SPS pools ranging from BEE all the way to Lassecash.

Why Liquidity Pools?

The main benefit of putting assets into the pools is to earn passive income. Just the two pools we looked at consists of nearly $4 million in tokens and that is at its current going rates. Imagine six months back when the value of DEC and SPS where almost 500% higher these pools would easily have been in the tens of millions. Since the value of the assets drop it reduced the overall value of the pools. So why would people store so much in the pools?

Besides earning passive income the in game Splinterland's daily SPS air drop is rewarding players to participate in pools a doubling in earn points for each DEC they put in a pool. In other words for each DEC in a pool the player gets 2 points counted towards their daily SPS air drop rewards.

In addition a hidden benefit of participating in pools is the mitigation in loss of value in the asset prices themselves. Let me try to explain with a simple example based of whole numbers to understand this easier. Lets say the Hive to DEC pool is 1 Hive to 100 DEC value. This means in order for me to partake in pool I need to place 1 Hive and 100 DEC equivalent in value of the time in the pool. If DEC prices fall 80% while Hive prices stay flat I essentially lose nearly 80% of my Hive while gain about 500% in DEC. My balance would likely be 0.2 Hive to 500 DEC if I withdraw. Now why is that?

Impermanent Losses

The 0.2 Hive down from 1 Hive and 100 DEC up towards 500 DEC is called Impermanent Losses. By participating in the liquidity pool my original $ value in assets has almost remain the same even though DEC prices have fallen significantly. This is due in part the mechanics of being in a pool. As the pool itself is a re-balancing of $ assets aimed to be at 50 : 50 between the two tokens at all times.

While I may have ended up losing a large portion of my Hive at the time it is nice to know that I retain the same $ value in total assets as I also gain the same $ value in DEC. If I had just held my Hive and DEC in their respective wallets without partaking in any pools I would have incur the $ value losses. That is I hold the same DEC but have less buying power if it drops 80% in value. I would not have 5x the DEC without being in the pool.

Conclusions

Outside the game there are other ways to earn in game tokens. There are plenty of liquidity pools to partake in with Splinterlands tokens associated. I just looked at the top two most heavily invested but there are plenty more.

There is BEE : DEC, PIZZA : DEC, and some even in SPT : SPS or PIZZA or ONEUP. The list goes on. With so many opportunities to invest in there is a game in self to find the best way to retain value of the Splinterland's tokens even though currently it is free falling in prices.

Liquidity pools will always try to balance the assets in terms of $ at a 50 to 50 rate. The balancing creates an hedge against lost of $ assets. In addition participants earn daily rewards and double air drop points for every DEC put into the pools. This is much better than just having DEC in a wallet.

Until next time thanks for reading!!!

https://images.ecency.com/p/HNWT6DgoBc1692QWn5trsLBYecSp3jKD1kzdmSDR4FGzPSXomkgLtisN5TzrwHTsD1D4ocqDPHpFztKzeH4ibh1vQVU3d3dSaB6VYJ1U3RdsSDi5spmdafX25ph.webp?format=webp&mode=fit

I have plenty of other cards for rent! Just go on peakmonsters and check out the market place and if you are curious what I offer here is a link:

If You have yet to take part in playing this great game called Splinterlands please click on my referral link. It is free but in order to earn real assets such as cards and token you would have to invest in a starter deck or purchase game cards. Join the discord to learn more. Good luck!

THANKS FOR READING! CONTINUE TO PLAY SPLINTERLANDS!

!WINE !LUV !PIZZA !LOL

Congratulations, @logicforce You Successfully Shared 0.100 WINEX With @mawit07.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/1 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.600

@logicforce(1/4) gave you LUV.

lolztoken.com

ERROR: Joke failed.

@logicforce, You need more $LOLZ to use this command. The minimum requirement is 16.0 LOLZ.

You can get more $LOLZ on HE.

PIZZA Holders sent $PIZZA tips in this post's comments:

@logicforce(1/5) tipped @mawit07 (x1)

Please vote for pizza.witness!