What Is Better than Compounding? Auto-compounding!!!

Before I got into cryptocurrency the only compounding investment I really know that worked well in the financial world was dollar cost averaging. I would buy a stock or fund and hold onto the shares until the price appreciates. What ends up being an average of 5% - 8% yearly gains would be consider a good year. Then there was cryptocurrency with the common high single digit %APR on stable coins all the way to degen plays with tens of thousands % APR in token pools.

Today we go over earning through saving in liquidity pools and add a leverage to it without added cost but amplified the yields. This amplifying yields has to do with auto-compounding the original investment. Lets start off looking at an example.

Liquidity Pools

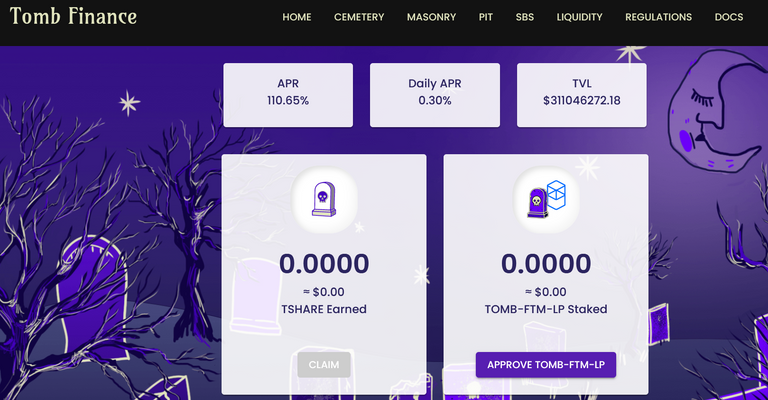

On Phantom one of the most popular protocols currently running is Tomb Finance. Not to go too deep into the applications the protocol has to offer we look specifically at one of their high yielding liquidity pools. The pool is specifically Tomb and Phantom tokens. Put the two tokens into the Tomb Finance pool and earn Tshares at a rate of 111% APR.

Tshares have a value to them and currently is approximately equal to about 4,282 bonded Tbonds. To simplify our example assume 1 Tbond = 1 Tomb. The focus of Tshares really is to know it is the reward we would receive for participating in the pool.

111% APR is extreme in real financial world. However there is risk involved. Neither Tomb or Phantom are real assets but cryptocurrency where people are willing to pay for. Yet with enough demand both Tomb and Phantom are near $2 a piece. Tomb is designed in the protocol to be pegged to Phantom. So overall the is actually delta neutral to Phantom price. This risk that Tomb loses its pegged on Phantom and if Phantom drops in price it will also reduce the price of Tomb are the risk for investing in the pool.

Auto-compounding

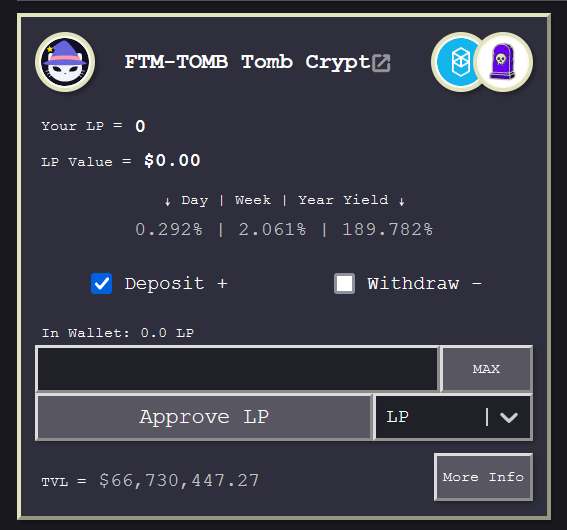

The focus of this example is to use auto-compound from a separate protocol to enhance the earned yield. On such protocol is Reaper.Farm where the Tomb to Phantom pool is currently yielding 190%.

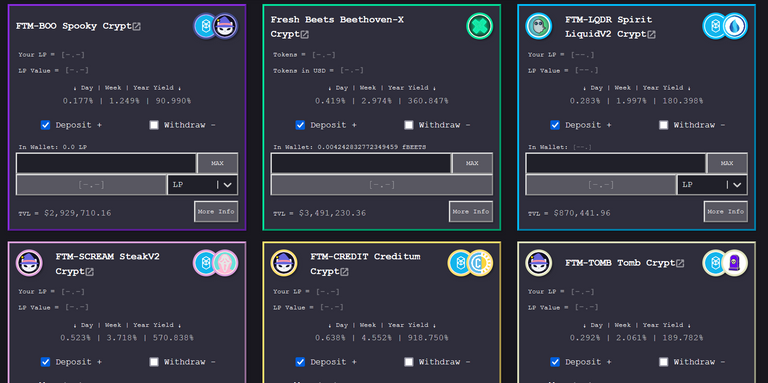

How is this possible you wonder? Well when you place 50% Tomb and 50% Phantom into the pool your earned yield gets reinvesting at a set time daily through Reaper.Farm. This adds onto the original principal yielding higher percentage. Reaper.Farm is consider a yield farm auto-compounder. It has hundreds of different pools to choose from to auto-compound when investing in them.

There are many other protocols with auto-compound such as beefy.finance. Beffy.finance is multiple chains so offers more options to users.

One last item to clarify is that the Tomb and Phantom pool pair is actually directly from Spookyswap.finance and not Tomb.finance. This is important to not because the Tomb and Phantom pool simply because Spookyswap is the custodian of the Tomb and Phantom. In other words in order to obtain auto-compound of the staked assets the user would first stake their tokens on Spookyswap and then go to the auto-compound site to execute the addition interest earning in the pool.

Conclusions

Albert Einstein said it best when describing compound interest as the “eighth wonder of the world,” saying, “he who understands it, earns it; he who doesn't, pays for it.” The real world finance have bank interest rates bearing little to no percentage.

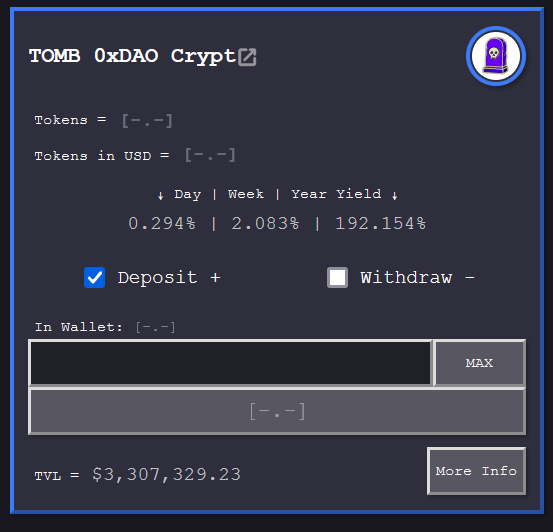

Yet in the cryptocurrency markets we are seeing extremely enticing yields on a daily basis. Would it not be great to see this consist yield on a daily basis. The risk versus rewards favor those who can leverage on their investments. One way of leveraging is to use auto-compounding of farms just like the example one we show. To reduce risk you even while auto-compounding one can invest in single asset pools such as Tomb on 0XDao.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

I just learned about Liquidity Pools and I love what I have found so far. I use the oneup:leo LP on beeswap.dcity.io it's about 200% apr. I don't have a way to auotmatically have it reinvest the daily rewards. If I could have a bot automate the process, I'd have true compounding interest. I mean, I do have compounding interest, but I'd have passive compound interest like you described with phantom...great post!

!PIZZA !LUV

@logicforce(2/4) gave you LUV. H-E tools | connect | <><

H-E tools | connect | <><

PIZZA Holders sent $PIZZA tips in this post's comments:

logicforce tipped mawit07 (x1)

@curation-cartel(10/20) tipped @mawit07 (x1)

Join us in Discord!

$WINE

Congratulations, @theguruasia You Successfully Shared 0.200 WINEX With @mawit07.

You Earned 0.200 WINEX As Curation Reward.

You Utilized 2/3 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.333

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Click This Link

Read Latest Updates Or Contact Us

Auto-compounding is a great feature I actually wish they had this feature in splinterlands to auto compound SPS!

As always great content!

!1UP

You have received a 1UP from @ivarbjorn!

@leo-curator, @ctp-curator, @neoxag-curator, @pal-curator, @bee-curatorAnd look, they brought !PIZZA 🍕

Delegate your tribe tokens to our Cartel curation accounts and earn daily rewards. Join the family on Discord.

That Einstein Quote is great. Often his quotes are philosophical or scientific, hardly ever financial lol

True. Anything practical is worth remembering.