What To Buy In A Crypto Bear Market?

source

The past week has been difficult for investors from all spectrum. Whether it is investment in stocks or cryptocurrencies it has been difficult for bulls. Yet with DeFi in the cryptocurrency space there can be potential opportunities to earn large % APR with low risk to reward ratios in bear markets. There a lot of ways in my opinion to do this and today I will discuss one of the easiest way. The method is farming liquidity pools.

Farm Stable Coin Liquidity Pools

https://app.beefy.finance/#/fantom

Beefy Finance is one of the most well known liquidity pools optimizer in the cryptocurrency space. As I mentioned earlier what are potential investments that have low risk to reward ratio we must first look at where to invest. Beefy Finance is well established and has a lot of users trust. So much it is currently ranked 33 in overall DeFi apps based on DeFiLlama.

With an established history it would be safe to believe under these precarious conditions of a bear market we would have lower the potential risk of rug pulls.

Since Beefy is a multi-chain platform we will be focusing specifically on Phantom as I am seeing some amazing yields on certain pulls. The following list of pools associated to Phantom DAG on Beefy is from the lowest APR and lowest risk in token downward price to highest APR with higher risk of token price drops.

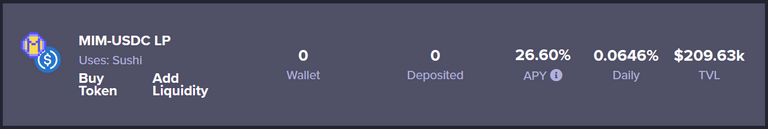

MIM : USDC Pool

In a bear market holding stable coins is ideal. Where you have the chance to purchase cryptos at lower prices. Meanwhile if you are not spending your stable coins you can partake in the Magic Internet Money to USDC pool and earn a insane 26.60% at current APR. Both these tokens are design to peg to the US dollar therefore you would be not risking the value of the tokens dropping while earning a +26% APR. Can not get any better considering the crypto is facing a bear market condition.

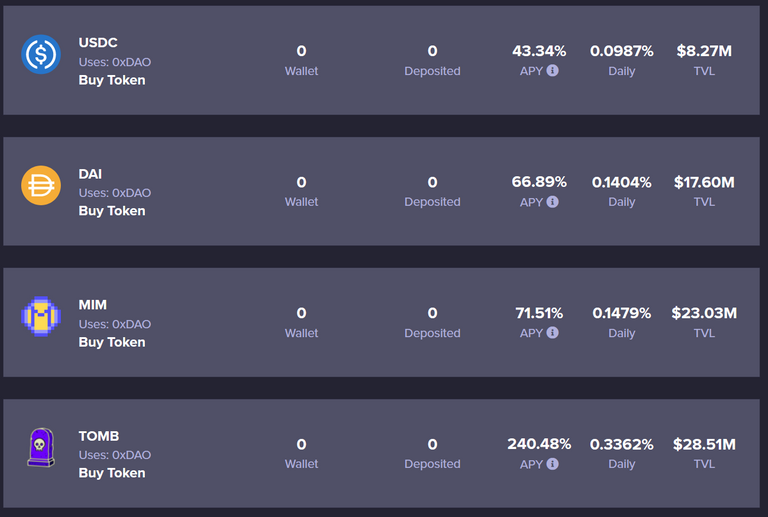

Single Stable coin Pools

These type of pools where you provide stable coin liquidity as one sided earning over 40% APR is why I even started writing this post in the first place. The opportunities on Fantom to yield this much just for one sided stable coin pools in a bear market is just amazing. MIM at 71.51% APR wow!

The reason this is the case will make me drop this into a more risky position than the MIM : USDC pool and here is why. All these single stable coin pools are new on the 0xDAO protocol. At the beginning of new pools the APR tends to be high due to the lack of participation. As more users join the pool the rewards distribution gets divided into smaller pieces therefore yields tend to drop significantly. As of now the yields are impressive, but in the not so distant future once enough people are aware of these pools the likelihood of these yields falling is highly likely.

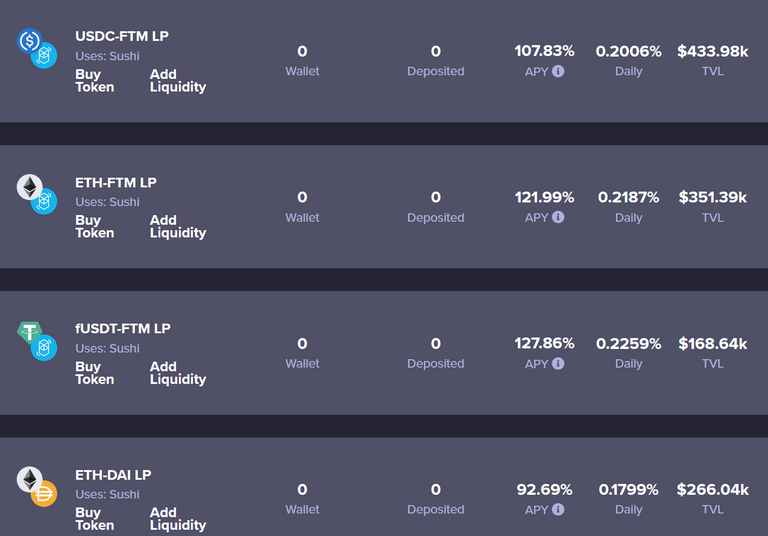

Token : Stable Coin Pools

I end with the simplest way to buying the dip in a down market. When we talk about buying the dip the most common way of doing this is literally waiting for price of a particular coin to drop and buying it with stable coins or fiat. Yet what if the time to buy is unknown but you want to be buying steadily into the token. Why not invest in pair liquidity pools where the yields are also high. Since we are currently looking at pools related to Fantom I thought I would go on with FTM : Stable coin pools to explain what I mean.

Currently the FTM : USDC pool is yielding 107.83% APR. This means if I were to put 50/50 in FTM and USDC into the pool I will be earning that %APR yield. In addition if the FTM token falls in value I will get more FTM tokens when I withdraw while less USDC. This is impermanent lose that I am taking but I am doing this on purpose in order to hold more FTM. When I withdraw while FTM prices are still lower than when I entered the pool I will essentially have bought more FTM while would also have less USDC. On top of that I am earning the pool %APR in the time I had participated in the pool. This is better than buying the deep since I don't necessarily have to time the market and my assets continue to earn me more tokens.

Conclusions

Timing the market is challenging and likely impossible to do it all the time accurately. Yet we can find ways in the DeFi space to invest in whether it is a bull market or a bear market and still earn assets. You can not do that in the modern financial world. It is basically holding the stock until it rise back in price while you earn nothing for holding the price underwater shares.

Fantom is one cryptocurrency space you can invest in and earn while cryptocurrency have just recently entered a bear market, coins and tokens dropping over 20% from all time highs. It remains to be seen if the bears will continue raiding the Fantom blockchain however it feels good to invest in liquidity pools while earning 20% thru over 100% in yields.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

Posted Using LeoFinance Beta

https://twitter.com/Edger_K/status/1485758307855998981

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

!LUV !WINE !PIZZA !LOL

Congratulations, @logicforce You Successfully Shared 0.100 WINEX With @mawit07.

You Earned 0.100 WINEX As Curation Reward.

You Utilized 1/1 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.790

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Read Latest Updates Or Contact Us

@logicforce(2/4) gave you LUV. H-E tools | connect | <><

H-E tools | connect | <><

lolztoken.com

ERROR: Joke failed.

@logicforce, You need more $LOLZ to use this command. The minimum requirement is 16.0 LOLZ.

You can get more $LOLZ on HE.

!WINE

Congratulations, @mawit07 You Successfully Shared 0.200 WINEX With @logicforce.

You Earned 0.200 WINEX As Curation Reward.

You Utilized 2/2 Successful Calls.

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.790

Swap Your Hive <=> Swap.Hive With Industry Lowest Fee (0.1%) : Read Latest Updates Or Contact Us

PIZZA Holders sent $PIZZA tips in this post's comments:

@logicforce(2/5) tipped @mawit07 (x1)

Learn more at https://hive.pizza.

Stablecoins are saving us during bear market, wish I had my stablecoins prepared for this as it barely touches 2% from my portfolio.

Honestly I only looked into liquid pools about three months ago. I have since been on the hunt for highest apr on stablecoins but also be a protocol that is legit. It’s amazing how many opportunities are out there. I was not prepared for this current down turn but believe 50/50 pools whether bull or bear market is a must so that I have liquidity to buy dips in bear markets while earn steady income on the stable coins.