World War III Is Here. Its a Financial War.

With the current optimism in the US stock market one may not know that under the surface there are financial challenges across the globe that can potentially derail any optimism that exists currently in stock prices.

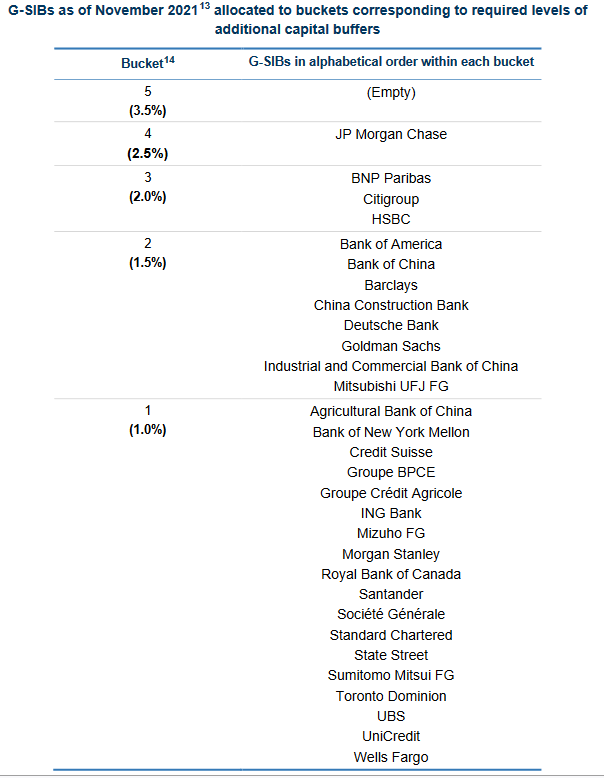

GSIB Banks

What 2008 Great Financial Crisis has taught us is that no bank is too big to fail. Going with that thought there is a list of banks that are big enough that if anything bad was to happen to them and seize to exist then it would create a lot of economic turmoil to many countries. This list of banks is called the Global Systematically Important Banks (GSIB).

Chart above is the latest list of GSIBs based on Financially Stable Board. FSB sets the rules and reviews the stats as to ranking the GSIBs. If there were global escalations such as disputes and even war the banks that are on this list may be effected and in turn cause a ripple effect on multiple countries' economy in a bad way.

The dispute of Taiwan's sovereignty between USA and China is currently in the news more often than not. If at moment notice physical altercation was to escalate it will likely effect many of the GSIBs.

War on Ukraine

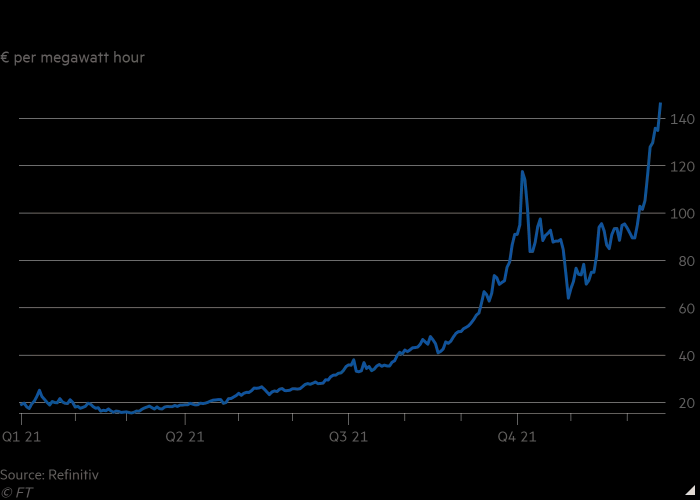

When Russia invaded Ukraine it definitely effected many banks. For instance Russian assets that were held by banks outside of its country were locked and inaccessible due to sanctions. Then Russia retaliates by limiting energy delivery to nations that originally put the sanctions on Russia, aka the European Union.

The limit in energy to Europe has caused energy prices to spike and same goes to USA even though USA is on the other side of the globe.

Where there is war there is destruction. Countries who participate would funnel their resources such as energy into the war rather than for productive use. This is what is happening in the war on Ukraine as basic essentials are limited such as food and energy. While the countries Russia and Ukraine are diverting resources to the war. This form of supply destruction will lead to higher prices to the basic essentials.

Conclusions

With a rise in food and energy it would be inflationary toward the operating economies. To add on top of that the USA printed massive amount of dollars to curb the slowdown post pandemic. Yet that amount of dollars is still circulating in current global economy.

The FED is trying its best to curb the inflation but each time it made a prediction it had fail to account for the parabolic rise in inflation.

It was first no inflation then to inflation is transitory only to later say FED funds rates to rise at a rate of 0.25% but then accelerate the rate hikes to try to curb inflation by going 0.75% rise. The signs are that inflation appears to continue to rise.

This is where the fear of hyperbolic inflation is justify. The better term is hyper-inflation which the FED is fighting to avoid. As prices of goods and service continue to rise due to destruction of goods through wars it seems hard to believe prices can go down. In addition tensions between countries are rising like those of USA and China on dispute with Taiwan.

The FED will likely do what ever it takes to deflate the dollar now by increasing the borrowing rates and taking out dollar out of the supply chain. The bottom line here is if the FED is unable to control inflation the USA dollar can potentially go hyperbolic making the dollar worthless. All this clearly sounds like a war has already started or brewing.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

It all good even if you said it's just for entertainment,

https://twitter.com/Kublai84638557/status/1559078162637676545

The rewards earned on this comment will go directly to the people( @yeckingo1 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Presently, the world economy is not in good shape now and the best way to live now is cut unnecessary expenses and invest more

Posted Using LeoFinance Beta

Certainly the end result of war is downfall to the economy, resources and a hgh rise of the living cost of people who face such things.

And more interesting was the fact that the people knew that a regional war would cause harm only to the people of the territory, but it turned out exposing the truth that : the world suffers terribly through the indirect gate.

Thats what we are facing now and the conditions of the banks do prove that.

I remember saying to myself, investing in Russian ADRs listed in the US would be a good investment because the Russian economy was detaching from the western world order, and their own balance sheet was heavily shifting to gold bullion and dumping US Treasuries.

Then the lockdown of all foreign-listed Russian company stocks were frozen, and they all dumped right before. I don't know how many billions of dollars were lost in that clown show, but, I do know that American and British investors were the biggest buyers of Russian government bonds.

The media does not want anyone to know that the American and European Banks have continued doing business with Russian and Ukrainian clients regardless of what happens on the ground in the war. Someone has to finance the weapons purchases and pay the militaries to fight each other. That money has to come from somewhere, right?

The Fed can't control inflation, because, that isn't possible. All centrally-planned economies fail in epic fashion, there are no exceptions in our recent history to even compare what's happening to the United States.

Posted Using LeoFinance Beta

Fed can’t print oil can’t print food can’t print goods. The dollar is the only thing they can print. Hyper-inflation will greatly impact all and unfortunately not in a good way. The Ukraine war is a distraction or excuse to say we are facing inflation. !PIZZA !LUV

@mawit07(1/4) gave you LUV. tools | wallet | discord | community | <>< daily

tools | wallet | discord | community | <>< daily

HiveBuzz.me NFT for Peace

Amen to all that! Well, the Ukraine War is a distraction to take attention away from the collapsing US economy, which has been in decline, overall, since at least 2000-2001, if not even earlier, before the Dotcom Bubble burst.

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

@mawit07(4/5) tipped @mercadomaestro (x1)

Please vote for pizza.witness!