2023 the year of Crypto Innovation

2023 the year of Crypto Innovation

2022 has been the darkest period for many Crypto enthusiasts as the third largest Crypto exchange collapses taking with it Billions of retail investor funds. How big is the impact? well it appears it was quite wide spread and an effective marketing campaign saw FTX take in a global client base great than 5 Million users this was equating to a daily turn over of $US12.5 Billion.

Not bad for a company that ran solely on tech algorithms operated by people in their late twenties and early 30s from a penthouse in the Bahamas. But whose fault is it really that they collapsed? The media played a large role in promoting rags to riches stories without the added cautions when running these stories. Unfortunately for many this had a disastrous end as peoples life savings were brought to an end.

A firm example of why you should always do your research, seek professional financial services and only invest what you can afford to lose as investing is a gamble especially in new age technology with many outcomes still left to the unknown.

30,000 Australian's caught in the collapse

Although there were around 1.2 Million American's caught up in the FTX collapse Australia had a relatively low amount but still significant enough for policy makers to take aim at the Crypto sector with 30,000 Australian's coming forward with financial losses. This number is estimated to increase once tax time comes around in the 2022/23 period and more Australian's claim losses.

However, retail investors aren't the only ones learning from the most recent tech collapses with FinTech Australia tipping that the tech sector will bounce back in 2023 as tech companies mark down their company valuations.

There’s a lot of significant business review being undertaken right now, with many tech companies checking to see if they need to slow down their growth aspirations. This introspection is seeing a return to getting the nuts and bolts right – the ‘gravy train’ era is over for the moment,” Mr Parameswaran said.

image source FinTech Australia

No Slow Down in Crypto Market

Despite the crashes there appears to be no slow down in new and emerging FinTech companies entering the Blockchain and Crypto space with Bano Superapp receiving its Australian Financial Services license after a 24 month trial period.

The App is targeted at Gen Z and Millennials to support their financial aspirations within the crypto sector and the app will be available for downloading on Google Play and Apple I store. Based in Sydney, Australia the company is looking at expanding globally over the next few years.

Blockchain meets Adoption

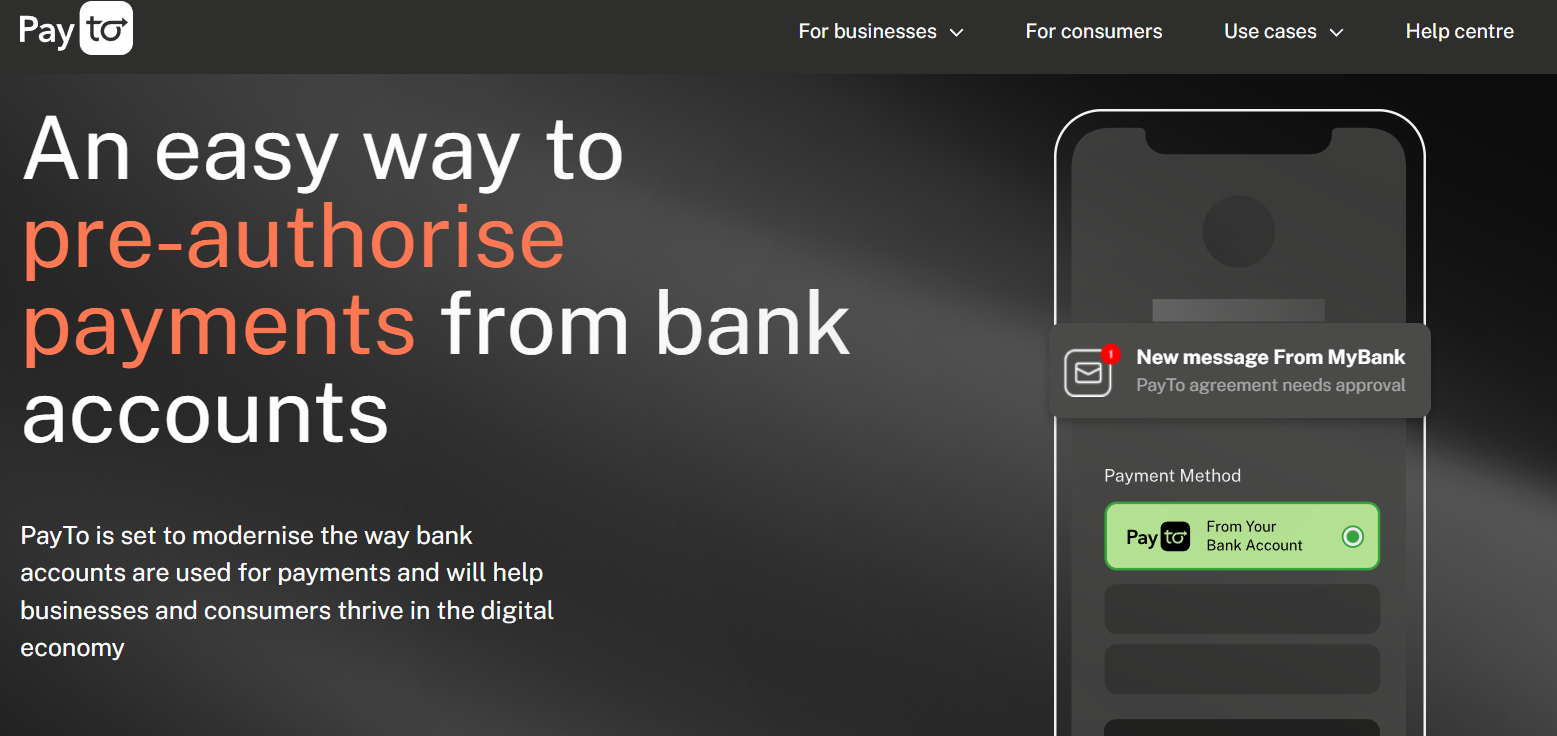

Despite the wild west of the current Crypto sector the industry has continued to develop and produce secure and new forms of payment methods and the latest model to hit our shores is PayTo which utilizes blockchain technology to settle payments in real time.

But the service doesn't end there with the ability for businesses to instantly pay invoices and make payments via secure QR codes and is being built to rival the current direct debit banking system.

How is it different?

Previously users required use of their debit or credit card to pay for subscriptions, bills or just about any and all things. This unfortunately put consumers and the banks at risk if cards we stolen and passwords hacked. Utilizing Blockchain technology you will now be able to set up payments similar to direct debit as you normally would but with a single sign off in the same way you authorise a crypto payment.

This will then be added to PayTo's Blockchain where all transactions will live and can be easily accessible by you and you can keep track on all the transactions you have undertaken.

In short, This is the end of the bank card

The service is tipped to be operational with many more jumping on board mid 2022.

Image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using LeoFinance Beta

.jpg)

https://twitter.com/1291387911238086664/status/1608619738476969986

The rewards earned on this comment will go directly to the people( @melbourneswest ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

The new payment service sounds interesting, I would be a little skeptical that it would be the end of cards for a while though. I think the true downfall of the cards will be when banks are open 24/7 instead of 9-5 m-f.

I’m so glad that I wasn’t involved in any of the nonsense with FTX and others. I don’t dabble with DeFi because it’s too risky for my taste. A lot of profit is off the table for me but also a lot of stress as well lol

It was a monumental crash but as my previous post mentioned it is a dot.com moment. More will rise and there will be many more crashes a head.

I wonder if there is any difference between that crypto app and what you can do with an online bank account. It might make things easier if you have crypto and don't want all the middle transactions to get the money there but that is all I see it doing right now. Or will it also have lower fees than a bank?

Posted Using LeoFinance Beta

Probably not, no doubt another DeFi protocol but seeking approval and registration. I'm iffy on DeFi

I believe the next year 2023 is going to be more of crypto regulation because of what we have seen this year. But after all crypto is here to stay.

Posted Using LeoFinance Beta

There are so many possibilities ahead. Good things coming.