Bitcoin stabilises, USDC to become most used stable coin and more Bitcoin legalisation

What a month it has been in the cryptoshphere with the market resuming in a bullish run, Bitcoin is still at risk of dropping but all signs are leading to another bull run.

As the globe races to legally incorporate cryptocurrancy and provide non restrictive policies the focus has been on stable coins with many nations investigating developing their own CBDC's. However, researchers have identified the development would be a costly exercise and issuing multiple different stable coins would pose economic risks and challenges.

The current focus has been on enabling or supporting the private sector to lead with the primary focus being on USDC. It is being touted as one of the most secure and safest stable coins on the market.

So much so that the CEO and founder of Quantum Economics has tipped the number two stable coin by market cap to be the most widely used iteration of the digital US dollar. A big statement but with USDC's growth across multiple block chains we can see how USDC has a bright future. The potential for policy makers to sign off and accept USDC as payment is still well away into the not so distant future but talks are underway to provide security for the token to ensure its success.

After all it is cheaper to support something already operational than it is to start a new one. As the saying goes, no point re inventing the wheel.

This further supports recent advancements by Visa to utilise the USDC as its main stable coin for settlements. Visa trials successfully used USDC as their go to stable coin in the purchasing of items. Future roll outs could see individuals paying for bills, purchasing goods and services USDC. You can read more Here this has also led to partnerships with Visa growing by 43% indicating that the market is rallying behing tech advancements in the cryptoshphere. Might want to start looking at buy shares in Visa (not financial advise)

Pivotal mark in Bitcoin

Bitcoin begins to rise after an extremely volatile period in time, hash rates continue to grow after the China bans but its price still sits in a dangerous point. With the ability to crash to the $20,000 mark but resistance is growing which could see Bitcoin go on another run.

This hasn't prevented the market continue to grow with BNB and other alt coins beginning to return to previous pay points. It's an interesting time that still comes with caution.

Botcoin shorts are also on the up which is feeling the price hike which could potentially cause a rally and see Bitcoin on a bull run adding millions to trade volume. You can read more Here

Paraguay moves to legalise Bitcoin

Another South American nation, Paraguay makes a move to legalise Bitcoin as tender in their nation as Carlitos Rejala announces he will introduce policy to accept Bitcoin as legal tender.

However, communication has been confusing with Carlitos clarifying that Paraguay will not be following the same footprints as El Salvador's legal tender bill. Instead the policy will apply to a broad range of cryptocurrancy assets not not solely Bitcoin. He stated that laws in Paraguay prevented the nation from doing similar to El Salvador and a different approach will be taken.

This has left the community confused and awaiting further clarification on the subject. All that is known is that the Bill will be introduced on 14 July 2021 and the cryptoshphere awaits in anticipation. You can read more Here

El Salvador faces growing backlash

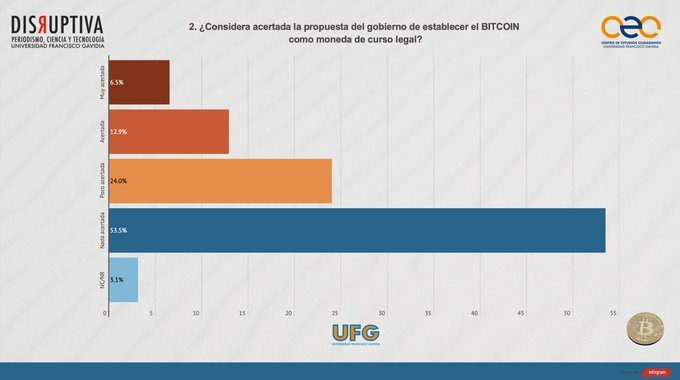

Nayib Bukele continues to face public scrutiny with the majority of El Salvadorians being unsupportive of the move to make Bitcoin legal tender. A recent poll indicated 53% (totalling 77%) of respondents stated legalisation as tender was not supported and another poll of traders shows 61% of traders unsupportive of the decision.

Legal Challenges continues to grow as the nation begins to turn on its popular leader. Will this be the move that cost Nayib the next election? You can read more Here

CUB on a Run

A recent Announcement by @leofinance has seen CUB go on a bull run rising 20c+ in a matter of hours and total pooled in CUB Den exceeding $1.5million adding $500,000 to the pool.

The announcement spoke to recent developments and future plans for an IDO a blockchain first as well as a way to increase utilisation of CUB.

Inclusions on Polygon and more Kingdoms transitions to see more ROI for investors. A break down of fees was also provided which gave me a broader understanding of the structure, one I am supportive of.

A number of important information was provided so if you're a CUB investor or supporter I'd recommend clicking the announcement link and reading in full.

Don't miss out on the bull run (not financial advise)

Images sourced from Canva Pro Subscription and links provided.

Posted Using LeoFinance Beta

I have been super bullish on CUB since the initial announcement of Kingdoms. I have been buying that really long bottom and am happy to see things pan out the way I thought they would (for a change!)

Yeah definitely that's a great outcome too, well done. I'm still tipping a $100 future. It is still a new young token and project. Once it is 12months old then it will shine (maybe even before)

You think that USDC is or would be better than the USDT? (Tether)

Too many issues with USDT and USDC is growing on a number of different platforms and more readily available and accessible. A stronger use case

USDT is really being questioned. I wouldnt be surprised to that get pulled one day.

Posted Using LeoFinance Beta

El Salvador is definitely facing some issues due to being the first country to make BTC legal tender. I don't expect it to go smoothly as the existing banks like the Fed and the IMF will fight to make it tough.

Posted Using LeoFinance Beta

Yeah but maybe a sole focus on Bitcoin was silly. I think the USDC approach is better because less fees and anything can be turned into it for instant transfer

The existing system wants to slow (or prevent) the spread of #cryptocurrency. The fact that El Salvador is looking to embrace #Bitcoin is something they want to stop.

Other countries need to jump in quickly.

Posted Using LeoFinance Beta

I'm in part in agreement but hesitant due to the fact China owns most the mining companies and their actions saw alot of money wiped. I fear for the traders.

I think another 2 years once the transition to the US is complete then it will be alot more stable and secure.

That is true but do not believe that it will take the transition to push the mining up in the West. There are a number of projects that are already implementing crypto-mining even before the move of #Chinese miners.

Certainly they will help but it is expanding at a great rate. I bet we are at least to the hashrate prior to the ban before the end of the year (in #Bitcoin, I dont follow the other mining operations).

But caution is always warranted.

Posted Using LeoFinance Beta

Oh yeah, another bull run in August I'm tipping.

Congratulations @melbourneswest! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 39000 upvotes.

Your next target is to reach 95000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPIt is always good to see advancement. #Stablecoins are starting to get FUD tossed at them. Good to see some things to the contrary.

The bigger question is will Hive Backed Dollars stabilize and keep the peg?

Posted Using LeoFinance Beta

That is an interesting thing to see, I hope it does and I hope to start seeing some investors. 7% APR is quite large. I'd invest but I power all mine up and use the block chain.

Most my investments outside of Hive are purely to try and make more cash to get more Hive/Leo/CUB. Although I'm sitting OK in other areas atm so just been buying CUB.

I'd have a few thousand but I switched to Cake to make divs, I felt bad but I recently learned from the leofinance post that they take a cut of the fees to pay the service so I feel better knowing it's helping the project grow.

Now that it is starting to be decent I'm back into CUB, a few hundred but growing. It's a hard long game crypto is and you miss some bull runs but I'm focusing on BUILD.

I think if HBD remains pegged we will see alot more investment coming our way.

There is no doubt about it. I agree with this statement completely. If we can get the Hive Backed Dollar to peg, it will be a major coup for #hive.

It is one of the more interesting #stablecoins since it is not dependent upon the backing of #USD. Instead, it is backed by #hive and the code in the #blockchain.

Posted Using LeoFinance Beta

And it's a great way of doing it, separates the dollar from cryptoshphere