BlackRock Launches BUIDL Fund and Get's Slammed with NFTs and Meme Coins

BlackRock Launches BUIDL Fund and Get's Slammed with NFTs and Meme Coins

Good morning Lion’s I trust you are safe and well, not to long ago I wrote an article about the dangers of the transparency that the current Blockchain community promotes. This might have been a good structure in the past but as times go on and values now increase it’s time we start looking at privacy and safety.

It is akin to walking around with a sign that says how much money is in your bank account on your head, in public. There are a broad range of dangers that that brings more so if you do have a decent amount of money or holdings in your wallet, it gives hackers a really big sign of who to target.

One example of the dangers has recently occurred and although no malice has currently occurred, we can almost bet on the fact that there will be hackers mobilising to attempt to gain access to a wallet after the recent spate of events that quite literally published to the world the amount of money BlackRock put on chain.

Today while it may be amusing it also provides a red flag for the Crypto currency community in what maybe one of the sectors biggest failures in years to come and could result in massive financial losses and another extreme market crash if solutions are not established soon enough. I am not sure about you, but I am not keen on people seeing how little I hold because in the future if my small holdings turn into large retirement funds, then I want to ensure they remain that.

https://img.inleo.io/DQmbThQ9amQgtNjExgd1aYWTMaZTC836uVAcmSuXTPGXXms/25b24dcf-b6f2-4815-9fd1-20939477f0c9.webp

image source

Black Rock Slammed With Meme's

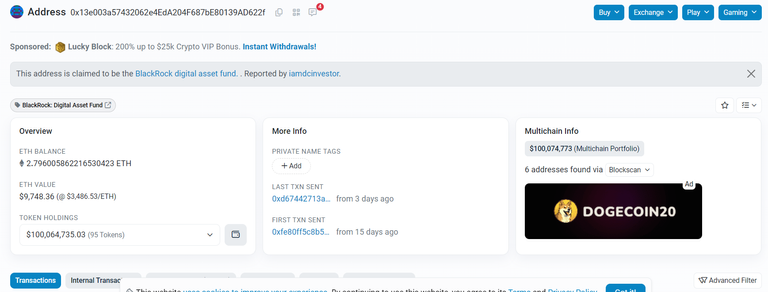

BlackRock the Wall Street titan managing over USD 10 trillion in assets found itself in the midst of a crypto whirlwind. What started as a strategic move to delve into the world of crypto currencies with a USD100 million investment in USDC (USD Coin) on Ethereum, has quickly evolved into an unexpected encounter with meme coins and non-fungible tokens (NFTs). In short, People have flooded BlackRocks wallet with meme coins and NFTs.

The wallet and funds are associated to BlackRock USD Institutional Digital Liquidity Fund (BUIDL) which will be focusing on investing in other digital assets. Some important news we should all be aware of.

The influx of digital assets into BlackRock's wallet has been nothing short of hilarious. According to on chain data the fund manager's wallet now holds a diverse array of tokens, including but not limited to, meme coins like Mog Coin (MOG), VoldemortTrumpRobotnik-10Neko (ETHEREUM) and Shina Inu (SHI). Additionally the wallet also has ownership of notable NFTs such as Chungos and KaijuKingz adding a unique flavor to BlackRock's traditional portfolio.

Among the numerous transactions made to the wallet some stand out in terms of their magnitude. Anonymous crypto users have sent substantial amounts of tokens to BlackRock's address including 500,000 unshETHing_Token (USH) and 10,000 Realio Network (RIO) tokens. These tokens valued at USD 13,755 and USD 11,600 respectively, represent significant contributions to BlackRock's burgeoning crypto holdings. Why are they giving away free money?

BlackRock Launches a number of Ethereum Wallets

The timing of these transactions coincides closely with BlackRock's strategic move to establish its presence in the crypto space. Just a day after filing for the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), the firm executed a massive transfer of USD 99,999,960 to its wallet signaling its commitment to exploring the potential of tokenized assets.

This shift towards embracing digital assets marks a completely different direction from BlackRock CEO Larry Fink's previous skepticism towards crypto currencies stating clients had no interest in it. Fink was also himself once critical of Bitcoin and blockchain technology but he has undergone a significant backflip on this stance.

He also went as far as saying that Bitcoin was the "index of money laundering" in 2017 Fink now acknowledges that his investors want in on the potential of blockchain and advocates for the tokenization of financial assets on shared ledgers.

Flooding of NFT and Meme Coins

The emergence of meme coins and NFTs in BlackRock's portfolio provides an insight to how the sector has grown. What began as a speculative frenzy within the crypto community and buying Pizza’s has now blown out into the mainstream financial world with the traditional realm of asset management now involved. The influx of meme coins and NFTs into BlackRock's wallet not only reflects the exuberance of crypto supporters trying to be seen but also raises questions about the future integration of digital assets into mainstream investment strategies.

Despite the nature of these tokens, BlackRock's entrance into crypto currencies signifies a broader trend within the financial industry. As institutional players increasingly recognize the value proposition of digital assets traditional barriers to entry are being dismantled and paving the way for greater adoption and innovation.

BlackRock's unexpected encounter with meme coins and NFTs serves as a microcosm of the evolving dynamics between traditional finance and the crypto ecosystem. While the flood of digital assets may seem whimsical at first glance, it provides us a view of a deeper shift towards the tokenization of assets and the democratization of finance.

As BlackRock navigates this new frontier, it signals a pivotal moment in the intersection of traditional and digital finance with implications that extend far beyond the confines of Wall Street and also highlights some red flags around transparency.

Image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services

Posted Using InLeo Alpha

!MEME

Credit: amigoponc

Earn Crypto for your Memes @ HiveMe.me!