Do Kwon Found Guilty, Lawyers Question Legitimacy of Case

Do Kwon Found Guilty, Lawyers Question Legitimacy of Case

2024 hasn’t let go of the many court proceedings that are beginning to reshape the Crypto currency sector and now that Sam has been fried by the U.S Justice system. It’s time for the next culprit who caused one of the biggest collapses in a financial market to date.

Do Kwon who is best known for becoming a fugitive after the collapse of Luna (Terra) Network collapse it the case has unearthed some big things like for one. Do Kwon allegedly misled investors that it’s chain was being used in a popular Korean payment system. This is something that was widely reported and one we believed to be true as the company never came out disputing this allegation.

In fact, as memory serves me well, as many lions will remember that I was an investor in Terra (Luna) Network and covered many stories on the chain, The stories coming out were all being confirmed by major news stories and not one bank or payments service came out disputing that was being stated. Poor form and an indication that the entire finance sector needs to beef up it’s communication.

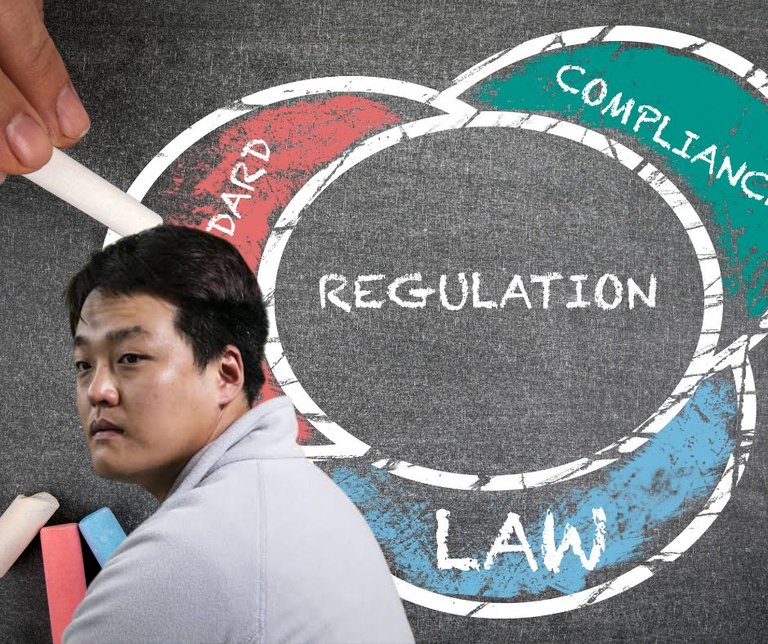

As we are aware the crypto currency world is no stranger to tumultuous events but few have been as seismic as the collapse of the Terra Luna Network and the subsequent legal saga involving its co-founder, Do Kwon. In a recent verdict where a New York jury found Kwon and Terraform Labs liable for defrauding investors a decision that reverberates throughout the crypto industry. But Do Kwon’s legal team don’t entirely dispute many of the allegations, they seem focused on driving the position that the United States does not have jurisdiction to pursue these charges

Rise And Fall of Terra (Luna) Network

Founded in 2018 by Do Kwon and Daniel Shin, Terraform Labs aimed to revolutionise the crypto currency landscape with innovative products like TerraUSD (UST). This was a stablecoin that was pegged to the US dollar. Terra Luna garnered significant attention by promising stability amidst the volatile crypto market. However, the facade of success came crashing down in 2022 when TerraUSD's peg to the dollar faltered leading to panic selling and a cascade of losses. It resulted in a destabilizing death spiral which has left the chain out of commission ever since despite community efforts to rebirth the chain.

The U.S Securities and Exchange Commission (SEC) have alleged that Kwon and Terraform misled investors by overstating the stability of TerraUSD and falsely claiming adoption by a popular Korean payment app. The SEC's case rested on claims that Terraform orchestrated a scheme to artificially prop up TerraUSD's value. Which ultimately lead to devastating losses for investors. Despite Terraform's protests of innocence at the case the jury's verdict confirmed the SEC's allegations and held Kwon and Terraform accountable for their actions.

The collapse of Terra Luna and the ensuing legal battle offer valuable lessons for both investors and the broader crypto currency industry. Firstly, it brings to the forefront the importance of due diligence and scepticism in the face of enticing promises. Investors must scrutinise claims made by crypto currency projects and assess their legitimacy rigorously. Although in this case Do Kwon’s allegations if untrue should have been challenged by the payment systems claimed to have been involved with Do Kwon.

Future Regulator Scrutiny

Regulatory scrutiny in the crypto space is now only just intensifying with authorities like the SEC cracking down on fraudulent activities. The verdict in the Kwon case signals a significant victory for regulatory oversight highlighting the consequences of non-compliance and misconduct in the crypto sector. However, does nothing for those who have lost money on their investments.

The fallout from the Terra Luna collapse and the Do Kwon case will likely continue to be a part of the crypto history for years to come. It will also continue to provide people with a lot more barriers to trusting new projects. Despite this, we are seeing growth in investment of Bitcoin which appears to be holding strong as the preferred investment opportunity for many.

Life Long Failure

The Do Kwon case serves as a reminder to us all of the risks inherent in the crypto currency space and the importance of regulatory vigilance. It will also see significant reform occur for future projects and hopefully lead to a more safer future. Do Kwon also had insurance for people but as we have come to see, that insurance went out the window when the chain failed. The only person to have made it out with any money appears to be Kwon himself.

I can only feel for his daughter, for those that remember he named his daughter after the chain and called her Luna, the Sins of the farther she must carry that burden her whole life. A constant reminder of pain for so many.

Image sources provided supplemented by Canva pro subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using InLeo Alpha

!lolz

lolztoken.com

That was a very fuelish thing to do.

Credit: reddit

@melbourneswest, I sent you an $LOLZ on behalf of tin.aung.soe

(2/10)

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP

Some good projects had started on TERRA, such as Mirror Protocol, Loop Market. But who knows what's behind this story. In my opinion at this moment there is one who pays for many

https://inleo.io/threads/melbourneswest/re-leo-curation-2fdqjc9bc

The rewards earned on this comment will go directly to the people ( melbourneswest ) sharing the post on LeoThreads,LikeTu,dBuzz.