In 2023 Liquidity will be king

In 2023 Liquidity will be king

We're into the first two days of 2023 and the opportunists are already on the hunt for a good deal in the hopes that one will deliver a mighty outcome at the end of 2023. While many of us in the game don't take time off because taking a break could literally be the difference between making it or breaking it there is one clear focus point already emerging this year.

Liquidity

2022 was a year of risk where millions even billions of dollars were thrown at hopeful projects in the event one took off transforming a mere investment into profitable gains for anyone. But what we're starting to see already emerge in 2023 is the hunt for liquidity which brings us back to an old but mighty saying, Cash is King.

.jpg)

Why is Liquidity emerging as a valued 2023 pattern?

Liquidity is important because it enables investors to quickly buy and sell assets without destabilizing the entire market and for someone who has made big purchase orders or who has built up a large stake in an asset the last thing they want to see happening is that asset begin to crumble as they cash in on a small percentage of their gains.

Crypto in 2022 was awash with false liquidity and when tested many pools crumbled under relatively small weighted sales. Yes the figures appeared large within the millions but those sales greatly destabilized the broader asset indicating that the market liquidity did not exist.

If market conditions are good and markets remain liquid then initial investors can quickly find a buyer for their asset without having to drastically reduce the price of their asset. Unfortunately as we saw with FTX many liquidity pools were so thin that an initial sale brought down many tokens. But investors appear to be on the hunt for other liquid markets and investments.

Bitcoin the Liquidity King

Bitcoin remains on par as the liquidity king although markets are still shy in jumping in just yet despite Bitcoins year to date data indicating it is at a good price point. The last time Bitcoin was at this stability point was back in 2017 with a much smaller overall crypto market cap.

But Bitcoin continues to trade with relative ease without much price impact having a 24 hour market volume exceeding $US9 Billion of course Ethereum is the other top contender but trading far smaller volumes over the 24 hour mark at only $US2.4 Billion.

Outside of these two digital assets if we remove stable coins USDC and Tether the rest of the crypto market remains flat with 24 hour trading not breaking half a million with the main trade volume looking around $US100 Mill as an average. Now these figures aren't exactly chicken feed but what we can see occurring is people focusing their funds on assets with strong liquidity and where they can easily purchase and dispose assets without destabilization.

.jpg)

Crypto Market isn't the only anomaly

The Crypto market isn't the only anomaly where this is occurring and after inflation ran riot in 2022 we're starting to see the impacts of raising interest rates and a slowing in market spend at the check out. This is probably one of the important things to watch over the next quarter as it will indicate what reserve banks will be doing throughout 2023 in relation to raising or lowering interest rates.

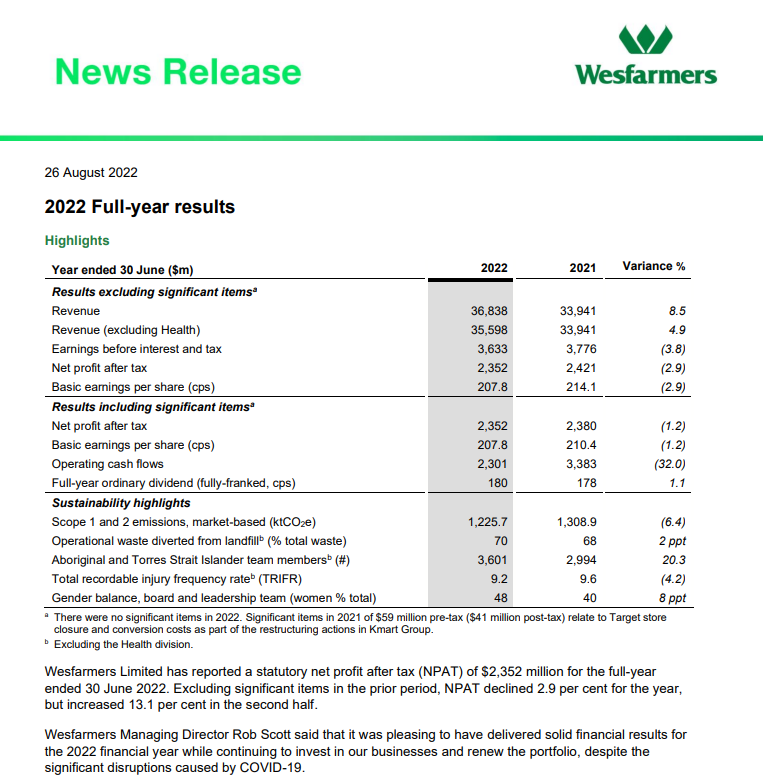

By now many household have received the memo that interest rates are going to go up so many households eased spending which has caught a few companies off guard. One of those companies being Wesfarmers which operates the beloved Bunnings warehouses in Australia.

Bunnings is now over stocked and it is a massive red flag for the company and an indication that people are withholding their funds in the anticipation of interest rate rises which means less spend at the check outs.

Bunnings best year to date

Despite the global pandemic and COVID disruptions Bunnings increased profits by 5.2% to a total tune $AUD17.7 Billion and if we zoom out from 2019 til now to see how COVID impacted the company we can see that home renovations were a top time consumer with the company growing by a whopping 39.6% which most likely indicates why things have felt a lot more expensive when visiting the warehouse.

.jpg)

Red Flags for Companies, Discounts for Purchasers

Although across the board many other stores are also coming under the same impacts with a world returning to normal as profits are shifting away from the companies that performed well under COVID now shifting to a reopened economy so the purchase power will most likely begin to turn away from these stores and back on small businesses.

But it isn't all bad news as these red flags brought on by over purchasing means the companies will take a valuation hit at the next financial reporting year with many now having to drastically reduce stock prices lowering annual profits in order to move the stock.

I suspect, many like me have their eyes on a few new toys from hardware stores and can see these flags and are awaiting a more turbulent time (for them) as end of the financial year gets closer we will see these companies slash prices.

And that my fellow readers is why cash remains king, because as the world begins to stabilize it is the over capitalization of markets that opens up opportunities for others.

.jpg)

Why do I care about cheap power tools?

You might be wondering why do I care about cheap power tools? well once those items become reduced this will lead to lower profits better known as a Market correction which will devalue share prices. If you're looking for an in to your future retirement as these companies cut losses and move to tax write offs there will be plenty of opportunity to buy into these companies at heavily reduced prices and commence building or rebuilding your retirement savings.

Start saving your pennies and stop spending because opportunity is about to come knocking!

Happy New Year!

image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services

Posted Using LeoFinance Beta

https://twitter.com/1291387911238086664/status/1609748452711464964

The rewards earned on this comment will go directly to the people( @melbourneswest ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

I don't think prices will drop that much. Stores tend to hate lowering prices once they increased them and when prices go up, wages also tend to get pushed up slightly. So the companies will be trying their best to pass that cost to the customer and those without enough reserves are bound to just go out of business.

Posted Using LeoFinance Beta

Maybe not to bottom prices but enough for me to pick up a few things that I need and am awaiting for. Stocks will have bigger movements when returns are lower than the previous years and will trend down now that COVID is over.

I started going to cash last year, this real estate bust will bring all things down again. It was so easy to see this happening.

I'm mostly all in on miners and the physical metals now.

Posted Using LeoFinance Beta