Storm brews in US Congress

China's recent crack down on Bitcoin mining saw the entire global bitcoin hash rate dramatically drop in an unprecedented event. So much so that it saw almost $US100 million dollars worth of bitcoin added to the five top US bitcoin mining firms in one month. The nature of bitcoin mining can easily turn a shed into a Billion dollar annual industry with limited infrastructure and broader impact.

With a further three major mining companies leaving China for the US it is shaping up to be a world dominated by the US. As such it is vital to ensure policy and legislation enables the continued growth of the sector and doesn't push bitcoin mining out of the US and into another country.

With COVID causing many businesses to collapse an emerging industry is what is needed to ensure a economic recovery post COVID.

Which is why a growing number of US politicians are campaigning to have the crypto tax bill struck out of the infrastructure bill.

The US needs cash to fund infrastructure, keep people employed and the nation moving. But doing so by overly taxing an emerging sector when no one knows what its future will be is not the way to do it.

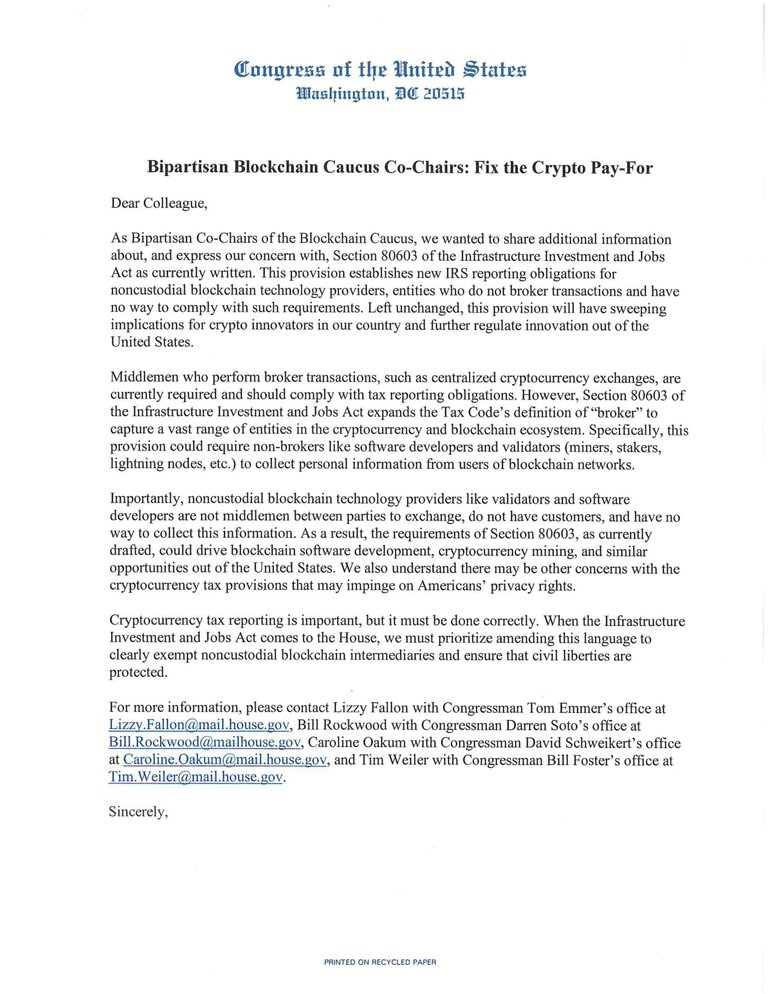

Overnight all 435 representatives in the US house of representatives received the above letter urging them to remove the crypto tax from the infrastructure bill as it is too broad of a legislation and would cause a mass exedus from the US as seen in China.

With the US finally reclaiming global economic power from China whom for the past decade has slowly been growing in the crypto space. This move would undo much of that global economic advantage.

California member Anna Eshoo whom has built her career around innovation in health and technology and is a pro advocate of bitcoin.

Everyone is aware that funds need to be raised and taxes are a sure thing but more work needs to be done to ensure the tax burden is able to be met and not restrictive and causes a similar occurrence as China.

Tax evasion is a serious issue but it isn't upto developers to ensure compliance to tax. A growing amount of people and elected representatives are beginning to understand the unworkable nature of this bill and the overburdened requirements of compliance which can not be met by coding.

The House of Representatives is set to meet on the 23 August and have committed to not voting unless a $3.5 Trillion dollar health package is passed.

Climate change also takes a primary focus from the House of Representatives with bills surrounding climate action being of urgency for the house.

As things move along it is clear that this tax bill is not a priority for the US Congress as it pushes on for more pressing matters.

As each day passes it is looking clearer that it will get chopped.

You can read more about it Here

Images sourced from Canva pro subscription

Posted Using LeoFinance Beta

I don't understand why they would want to make the tax bills even more complex. It tends to affect the people at the lower end of the spectrum because they don't have access to the best accountants.

Posted Using LeoFinance Beta

Spot on and catches people off guard because let's face it, we're not all accountants and bound to make errors.

It's great to see this story developing in more clarity for them politicians that they don't get to regulate this space so easily. 😂

Posted Using LeoFinance Beta

Haha yes! And it has been a daily emerging topic with new information daily so it shows people are fighting it

Who can understand these politicians? they say some things and then others that make no sense, but it is clear that the only thing they want is absolute power over things.

Posted Using LeoFinance Beta

It is confusing

The truth is that the government of China policy on Bitcoin has really affected bitcoin but the truth is that with time bitcoin is going to rise.