what's behind the current market crash?

Market declines can be quite the heart racing event especially if it's your first experience of one but they're not new and they will continue. This can be quite the hardest thing to deal with as an investor and if you speak to anyone minus the early Bitcoin investors they'll probably tell you the same kind of stories.

However, each decline and increase is often propelled by certain market influences and not the Instagram kind either, actual real world impacts. Bitcoin doesn't perform all to different to traditional stocks. This can be evidenced by the current traditional financial markets also in strong decline. The difference with Bitcoin is that it is easier and at times cheaper to get. A lot of mainstream investments require set buy in prices and you can't dispose of the asset as easy or whenever you feel like it such as Bitcoin.

What's currently happening?

Well lets go back to the start March 2020 when Bitcoin hit one of it's current lowest peaks as CORONA VIRUS wrecked havoc across all economies and investors commenced selling and withdrawing funds which caused a significant amount of liquidations.

In order to defend nations against the pandemic that followed citizens were locked down and a series of stimulus packages were rolled out to families in multiple countries around the world. A lot of this money found its way into the Bitcoin market which caused significant price climbs source

We know this because through data collection an estimated 10% of US stimulus packages equating to $US40 Billion was used to buy Bitcoin. I'd anticipate that the broader global population continued to also do the same with their funds. Stocks and Shares we also a high investment opportunity for many who received the funds. Their decision was at the time probably a good idea as it would ensure the money is retained and value continue to grow if they had of been in early.

Bitcoin Price Surge

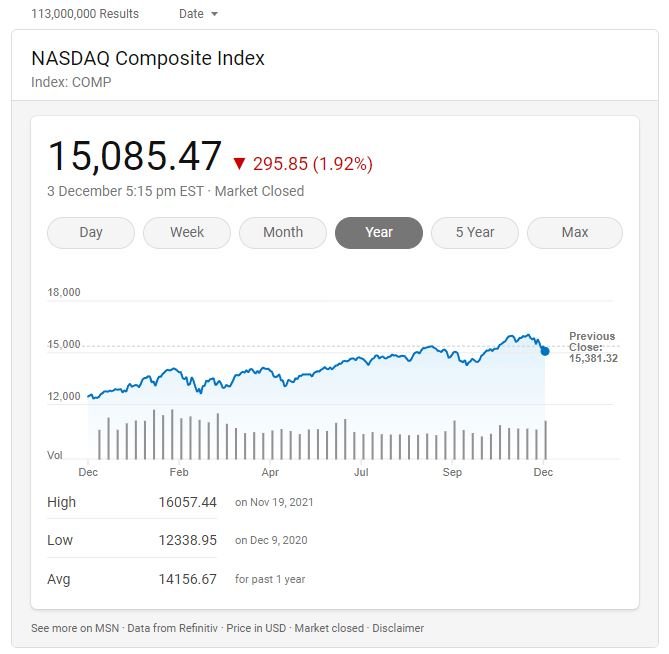

Through Bitcoin Data you can just about map out price increases around the Jan 2021 point returning when Stimulus packages really started to kick in. the May to July down turn can also be mapped to the China ban and than from July onwards is when institutional investors entered the Bitcoin race.

source

Not entirely the same but a few key areas remain with the commencement of the market recovery and even a dip in the May months and then later in the year it continues to match similar growth with Bitcoin which will most likely be your institutional investors.

What about now?

A big part of what is occurring can be put down to inflation and the US Fed Gov announcing it will begin to taper its stimulus packages. What's that mean? well all the money that has gone out needs to come back and usually the way this is achieved is through increased interest rates source.

With that information handy to investors they have a front row seat to a warning that they will need cash so in order to protect their investments and earned income they begin selling Bitcoin which also sets off ETFs and mass liquidations.

I was talking to a friend of mine the other day that works in the stock exchange and it was interesting to hear his opinion. Only 6 months ago he was telling me to buy shares with spare cash. Today's discussion was a little different with a focus on selling profits and putting it into superannuation for retirement.

No one has a crystal ball and no one knows the future but whipping $US300b in 24 hours is no easy feat so it is pretty clear that the market is reacting to news that cost of living is going to increase and people need all the cash they can get.

What are your thoughts? Do you think with COVID now ending and things beginning to open up will the sector continue to drop or will it correct and keep climbing?

Image sources provided. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using LeoFinance Beta

https://twitter.com/ValloneSimon/status/1467967127311114240

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

There are a lot of new investors in crypto in 2021, from banks to hedge funds and many regular people. These all are dipping their toes, and to use a gambling term have weak hands. Any spooking of this crowd will cause a rush for the exit, or to usdt. I expect more volatility and wilder swings. I am surprised the price has held up so well but i don't think, in the short term, there are any guarantees except volatility.

Oh yes that is a good point. I see alot of mainstream investors have joined the run into it also. Lots more cash.

While COVID might be a possible reason, I think it is more likely to be related to the supply chain and economic conditions. Also you have to consider that the market was already showing signs of weakness during the weekdays and the weekends has a lack of liquidity. So whales can easily manipulate prices while the institutional guys are out.

Posted Using LeoFinance Beta