Bitcoin ninth most capitalized asset in the world, is the era of speculation over?

Since its creation in 2009, Bitcoin has introduced a sort of revolution in the financial sector. As a precursor to decentralized digital currencies, the cryptocurrency devised by Satoshi Nakamoto has mainly relied on speculation to survive over time.

Over the years and with the various changes that the cryptocurrency market has undergone, Bitcoin has continued on its path of maturation and is now no longer just "another speculative asset" but is beginning to be taken "seriously," much like gold.

But what does this evolution mean for the leading cryptocurrency?

A new era is emerging for Bitcoin

Bitcoin is no longer sought after by geeks or some risk-loving investors. On the contrary, the cryptocurrency has attracted a much broader and more serious audience.

In the last 5 years, several countries and institutions have also shown interest in the asset. In 2021, for example, El Salvador decided to adopt it as its legal tender. And more recently, Liechtenstein has integrated it as a means of payment for administrative services.

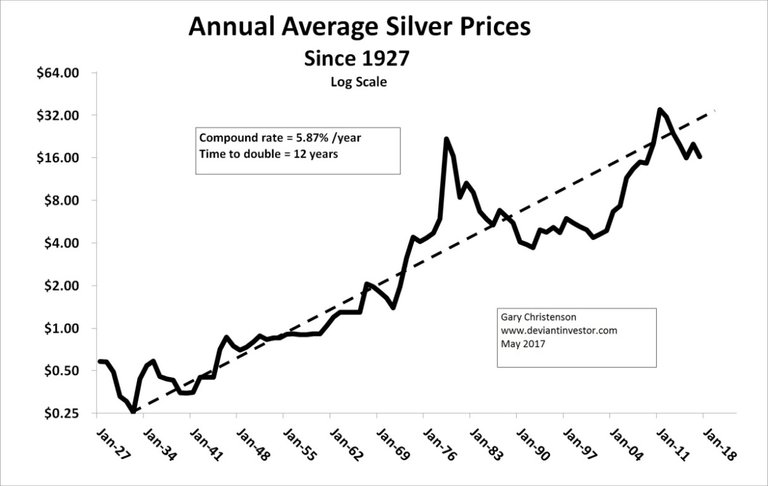

Major companies in the traditional financial sector are "embracing" the Bitcoin market to the point where it has become the ninth most capitalized asset in the world, after silver.

This increasing adoption of the cryptocurrency makes it more sensitive to various macroeconomic factors. In other words, geopolitical tensions, fiscal policies, and interest rates have a significant impact on Bitcoin's value movements.

For example, at the onset of escalating political tensions in the Middle East on April 13th, the cryptocurrency's price fluctuated and currently shows an 8% decrease in a week. At the same time, this global recognition could limit its volatility.

In this new era, therefore, Bitcoin is integrated into a financial ecosystem full of opportunities and challenges that will influence its path.

2024 Halving: A Turning Point for BTC Supply and Demand?

Bitcoin has successfully completed its fourth halving. This is an event programmed into its software during which the reward allocated to miners is halved. It occurs every 4 years or every 210,000 blocks.

It primarily serves to reduce inflation by limiting its supply in the market. Previously, the reward allocated to miners was 6.25 BTC. It has now been reduced to 3.125 BTC.

In principle, there is significant buying pressure on Bitcoin after the halving. However, with BTC becoming increasingly adopted, the impact of the halving could become more predictable over time.

According to JP Morgan analysts, for example, the cryptocurrency is currently in an overbought state and could decrease despite the halving. So, as Bitcoin begins to depend on various economic factors, the past exponential performances so eagerly anticipated may not occur.

Bitcoin: From Risky Investment to Safe Haven Asset?

It is undeniable that the adoption of Spot Bitcoin ETFs in the United States has been one of the factors that has favored the maturation of BTC. These products have opened the door to new informed investors who want to take advantage of the volatility and potential growth of the cryptocurrency while remaining within a regulated context.

The impact of this new wave of investors is significant. It brings a form of stability to the market, as ETF investments are generally considered long-term investments.

Additionally, institutional investors are known for conducting detailed analysis of an asset before including it in their portfolio. This behavior represents a sign of confidence for the majority of their clients interested in cryptocurrencies.

So Spot Bitcoin ETFs now create two types of investors. The first sees it as a high-risk and highly speculative asset, while the second sees it as a digital gold-like store of value that can help hedge against some macroeconomic uncertainties.

What does all this imply for investors?

With all these changes underway, investors need to review their positioning strategies in the cryptocurrency market.

Given that the Bitcoin market is constantly evolving, patterns of past cycles may not repeat. Therefore, the very optimistic forecasts of some experts should not be seen as an indicator of explosive future growth.

Certainly, the currency continues to be adopted, but now, with the presence of institutions, large fluctuations will gradually become less frequent. A situation that could penalize those who are only interested in speculation.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.