How the process of claiming Crescent’s CRE airdrops incentivizes holders to try out the DEFI platform

Lost out on many airdrops of launched projects in Cosmos but availed CRE token airdrops

Airdrops generally are sweet for crypto holders, at least during the earlier days of crypto. I was fairly late in becoming a more involved crypto person, as I was mostly a passive crypto holder where I held cryptos in Atomic Desktop wallet, so I missed out on airdrops.

This is why even though I had Atom, native token of Cosmos, in my Atomic wallet, I never received airdrops of hot tokens, like that of project Osmosis’s Osmo tokens, or tokens of Akash project, AKT .

Later of course, I downloaded the Keplr wallet and staked my Atom to validators after checking their performance data on mintscan Blockchain Explorer, because if the validator does not perform, slashing occurs where one’s staked Atom to the validator can get slashed.

staked Atoms to Cosmos Network validators on Keplr wallet

At that point of time, this process was overwhelming, the need to research and monitor validators so that your staked Atom is safe from slashing.

Anyway, thanks to those staking efforts I made, I eventually received airdrops of project Crescent tokens, CRE that launched on Cosmos recently in April this year.

CRE airdrops incentivized me to explore DEFI functionalities of Crescent DEX

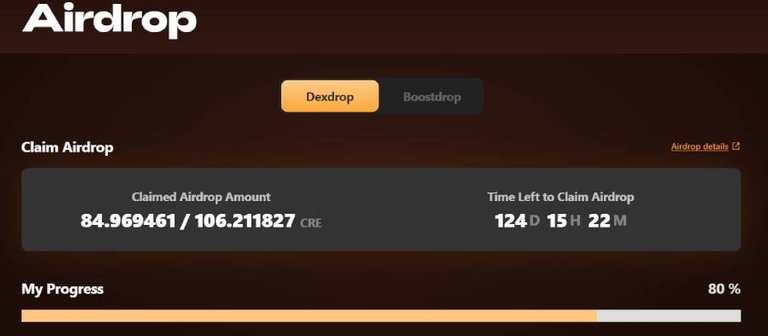

Even though this airdrop trend maybe kind of old and lost its hype, these Crescent airdrops of CRE tokens was sweet to me because well, it made me check out Crescent DEX and engage in basic DEFI activities which one needed to engage in, to unlock all of one’s CRE airdrops.

At first, I received 20% airdrops of CRE tokens for having delegated my Atom to validators. Here again I assume that delegation to crypto exchange validators would not be considered for airdrop so only delegations to more decentralised validator groups would be considered for airdrop.

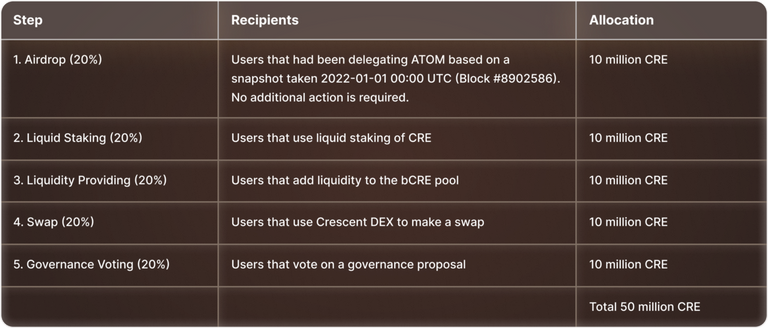

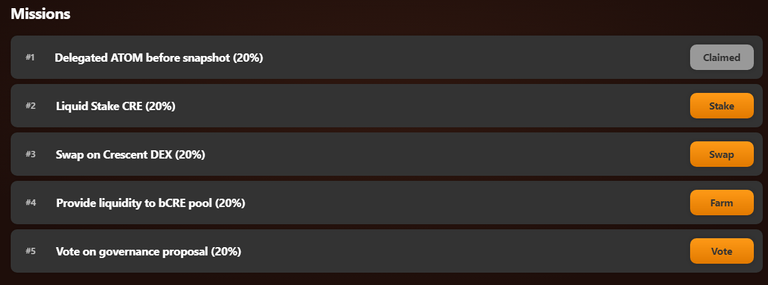

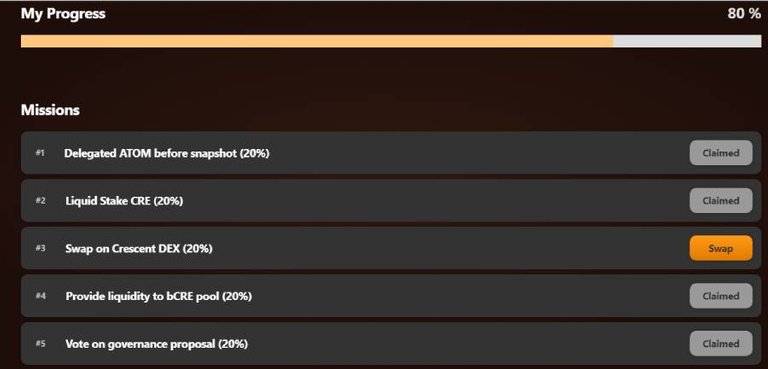

For further unlocking my other 80% of CRE token airdrops I had to complete certain Defi tasks in the Crescent App.

Tasks that need to be completed to receive all of one's CRE airdrops locked in one's Crescent account.

Therefore, there was incentive for me to engage in Crescent DEFI.

The time limit for me to unlock my remaining Crescent airdrops by finishing designated tasks was 6 months, from the April date Crescent launched.

As can be seen at the start, 20% of my CRE airdrops could be claimed because the first task by default was completed as CRE airdrops are based on the amount of Atom delegated to validators through staking in Cosmos Blockchain.

Task 2 to unlock 20% CRE airdrops - Liquid stake CRE

Task 1 by default is complete as all Atom holders who delegated their stake to Cosmos Blockchain received 20% of CRE token airdrops.

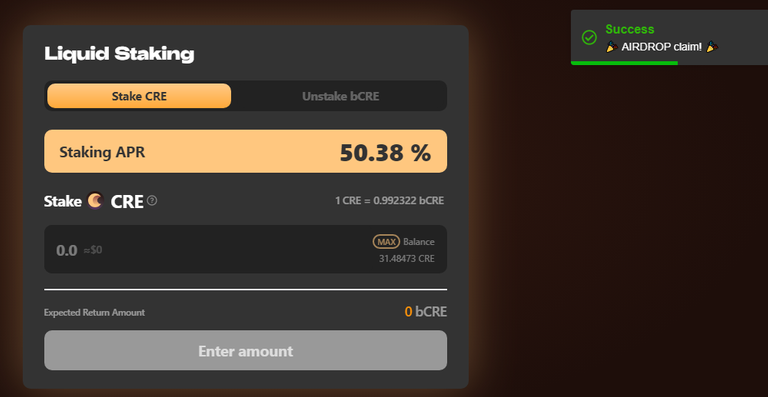

The second task to unlock another 20% of CRE airdrops was to liquid stake CRE.

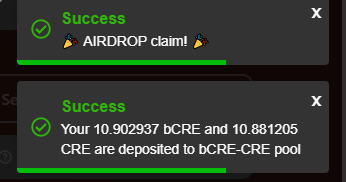

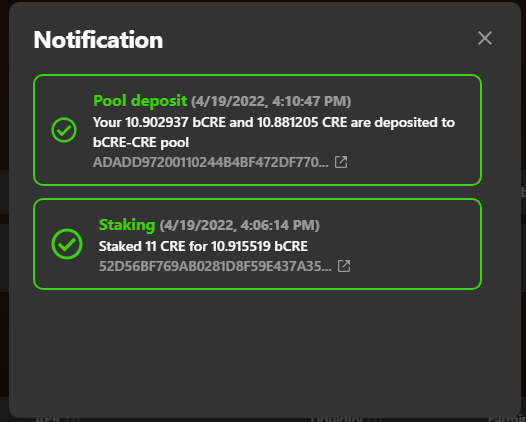

So, I went to the staking module in Crescent dapp and staked CRE converting them to bCRE tokens.

Crescent's Liquid Staking module

This is CRE liquid staking. bCRE is nothing but bonded bCRE, that are delegated in equal proportions to the whitelisted validators of the Crescent Network.

This is a convenient way to delegate and stake because all whitelisted validators that receive delegations are chosen according to their performance and can be changed if they are non-performing. Crescent Networks’ validator set are managed by the community Governance process.

I unlocked 20% more of my CRE airdrops for completing the liquid staking task.

I remember this felt cool, as I got more CRE to engage in Crescent DEFI, this was handy for the next task I had to complete to unlock another 20% of my CRE airdrops.

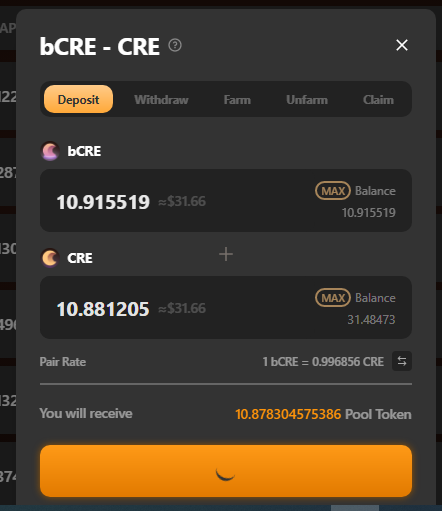

Task 4 to unlock 20% of CRE tokens - Add liquidity to bCRE pool

The next task to complete was to add liquidity to the bCRE pool.

So I deposited 10 CRE and 10 bCRE tokens into the CRE-bCRE pool.

This pool I thought is a good pool for Liquidity providers to provide liquidity as both tokens will be similarly priced, so felt not much chance of impermanent loss, although I maybe wrong.

Plus, this is an important pool which provides liquidity to swap bCRE to CRE tokens when needed, else one has to unbond bCRE and wait for 14 days to get back one’s CRE tokens along with accrued staking rewards.

An instant way to convert bCRE with our accrued staking rewards would be swapping it for CRE.

I finished task 4 and unlocked another 20% of my CRE airdrops. Hurray!!

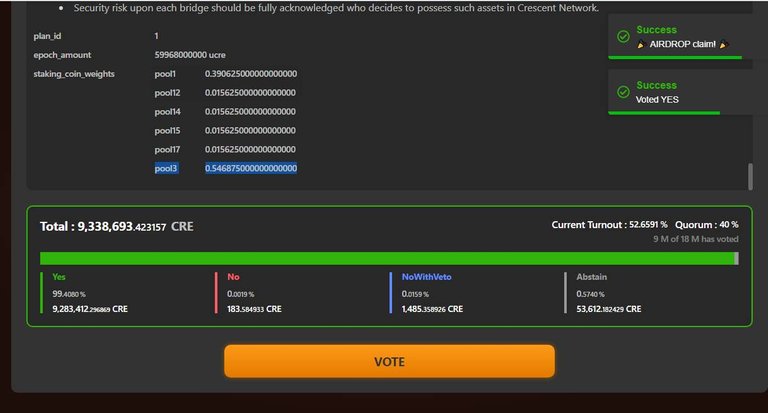

Finished Task 5 of voting on Governance Proposal to unlock another 20% of my CRE airdrops

I had two more tasks to finish to unlock my remaining 40% of my CRE airdrops.

Of this, I very recently finished one task of voting on a Governance proposal and unlocked another of my 20% CRE airdrop.

Missed out on voting some interesting Governance Proposal

Governance Proposal to remove and re-allocate LP rewards from Luna-UST based pools

I have missed out on voting on many Governance proposals and one of which was relating to reallocation of LP rewards from UST and Luna pools because we know Luna and UST crashed and demand for those tokens also crashed.

Since it’s not capital efficient to provide LP rewards to these pools, a governance proposal that was passed changed this, so that UST and Luna pools don’t get LP rewards although some pools still get CRE rewards.

All the unrewarded LP rewards for these pools would be collected to re-allocate these rewards to new pools that would be introduced in Crescent after research by the team.

You can read about that Governance Proposal here -

https://app.crescent.network/gov/4

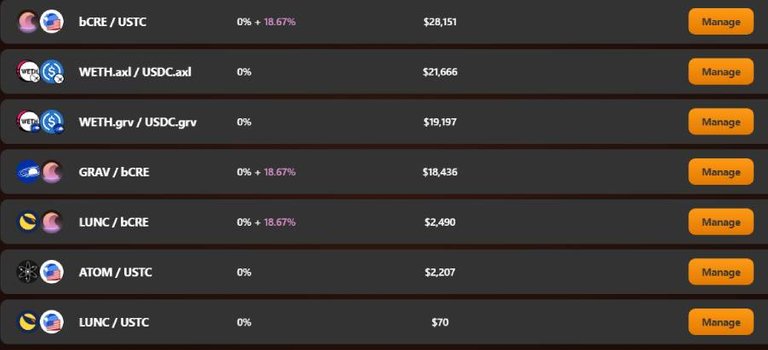

The LP rewards for pool pairs paired with UST and LUNC are 0 now after the concerned Governance proposal was passed!!

Crescent needed to onboard a stablecoin, with UST, a dead unusable stablecoin now

This was interesting news for me, because it appears that Crescent team felt at one time that UST was a good stablecoin to make use of and with UST not anymore a viable stablecoin, they would be looking to onboard another stablecoin for use in their platform.

This eventually happened and can you guess what stablecoin they brought into their app. It's USDC!! , Crescent has onboard USDC as a stablecoin to utilise in their platform.

USDC and ETH assets approved to be brought in Crescent via Governance Proposal

The next Governance proposal was for whitelisting of assets USDC and ETH that will be brought into Crescent via bridges - Gravity and Axelar.

So, as this passed new pool pairs were introduced in Crescent paired with stable coin USDC and ETH.

You can read about that Governance Proposal here -

https://app.crescent.network/gov/5

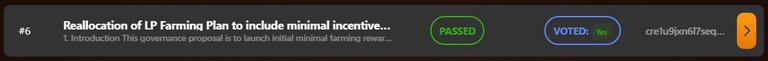

I finally voted in Crescent’s last Governance proposal 6 related to incentivising pools of bridge assets USDC and ETH brought via Gravity Bridge and Axelar.

The incentives would at first be at 1%, until the Crescent team verifies the safety of the bridges. Once the safety of the bridge assets is verified, the team planned to increase incentives to the pools.

Although, it appears that the Crescent team have verified and are satisfied with the safety of both the bridge assets from Gravity DEX and Axelar, because now ETH and USDC pairs brought from these bridges are having nice APYs.

Crescent's farming module

Anyway, so I finished task 5 and unlocked another 20% of my locked CRE token airdrops.

Yes hurray!!

Still, have to complete Task 3 to unlock my remaining locked 20% of CRE token airdrops

Now, I have claimed 80% of my CRE airdrops by completing various DEFI tasks that I explained.

I still have to complete Task 3 for which I am to do a swap in the Crescent App and unlock my remaining 20% of locked CRE airdrops. Obviously I intend to do this sometime before my time period to finish this task expires, and I have more than 123 days to complete this swap task as of now.

I hope you readers enjoyed my narration of how Crescent DEFI through its CRE airdrops incentivized me to try out some DEFI functionalities of the Crescent App.

It's definitely a good feeling to earn your tokens because as the saying goes nothing comes free in life.

About Crescent DEX

Crescent DEX, is a AMM DEX that will have an order book for fair order matching. Crescent aims to provide capital efficient liquidity incentives for LP providers and market makers. Crescent also is designed to prevent the prevalence of front-running and validator extractable value(VEV).

Check out the Crescent App

https://app.crescent.network/

Crescent Medium Blog

https://medium.com/@crescentnetwork

Crescent Twitter -

https://twitter.com/CrescentHub

Thankyou for reading!!

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Congratulations @mintymile! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 20000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz: