Why Altcoins Didn't Pump When Bitcoin Pumped - Understanding Bitcoin Dominance and How to Calculate It.

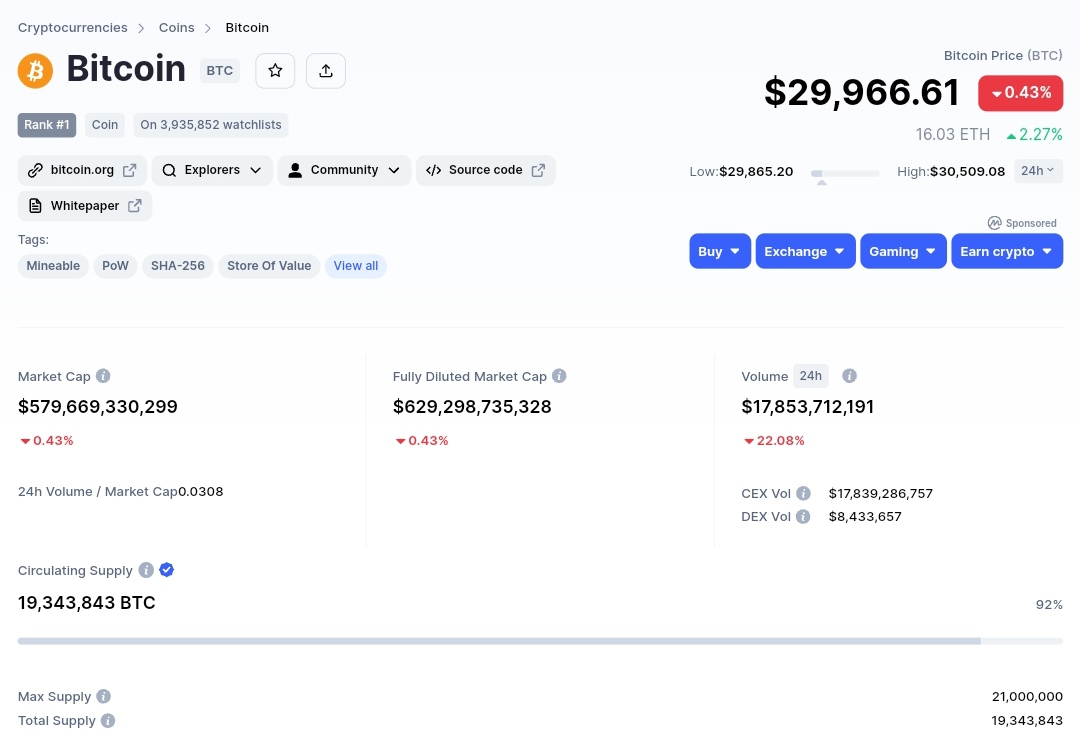

The biggest cryptocurrency by market cap, BTC, saw a price increase of nearly 12% in the past 24 hours, rising from $29,865.20 to $30,509.08. In fact, the majority of the alt continue nuking despite this enormous surge in price of BTC. This left many individuals wondering why this is happening. Being the first cryptocurrency and the one with the largest market capitalization, Bitcoin claims a sizeable portion of the trading volume (and popularity) in the crypto market. When Bitcoin first emerged in 2009, it had a 100% market share because there were no competing assets or any coin. However, as new currencies emerged, especially after the introduction of Ethereum, the market share of BTC started to decline. Amidst this, Bitcoin is still leading the investor selection race, having the largest share of investors' funds.

Calculating Bitcoin Dominance

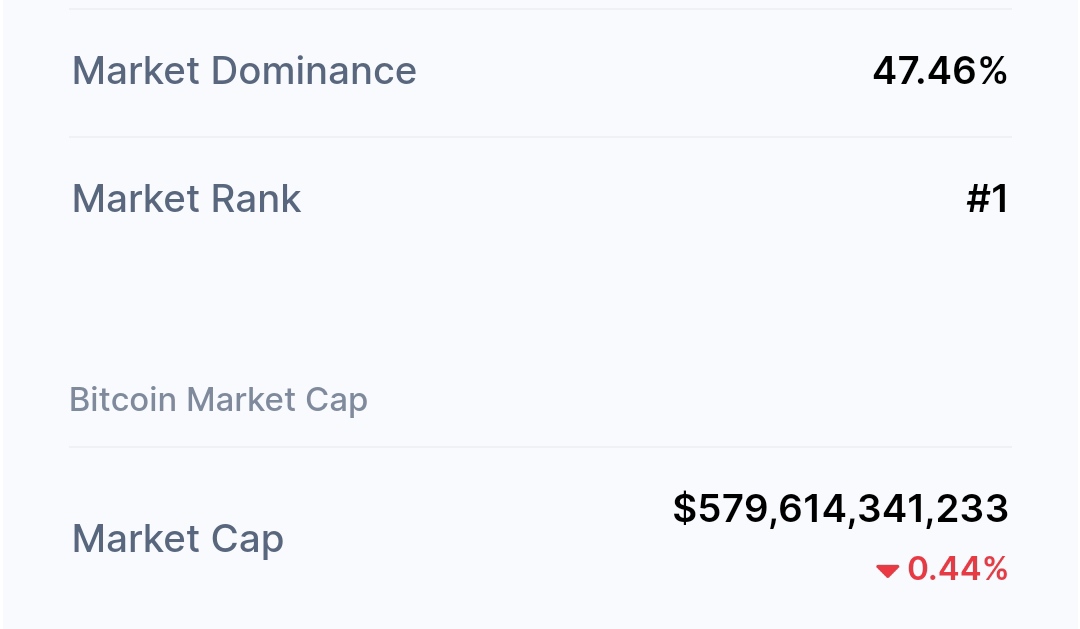

The term "dominance" in the context of the crypto ecosystem simply refers to the percentage of a crypto asset's market capitalization value to that of the entire market. A crypto asset would have a 47% market share, or 47% market domination, for instance, if the global market cap was $1,000,000,000 and the asset cap was $47,000,000.

To determine how much Bitcoin dominates the market, we need to know the total market capitalization of all cryptocurrencies (the global crypto market cap), which is $1,220,384,845,293. At the time of writing, Bitcoin has a market cap of $579,831,441,734. With the information obtained above, we can calculate using the formula below.

Bitcoin Dominance = (Bitcoin Market Cap / Global Crypto Market Cap)%

= (579,669,330,299 ÷ 1,220,384,845,293) × 100

= 47.4

Of the entire market capitalization of all cryptocurrencies, Bitcoin has a share of 47.54%. Meaning that more money is going into Bitcoin than into other altcoins, which is why the price of other coins isn't increasing because less money is going into them.

The dominance of Bitcoin must decline, which means that money must flow out from Bitcoin and into altcoins, before they can see a leg up.

References Sources

https://coinmarketcap.com/currencies/bitcoin/

https://www.google.com/amp/s/academy.binance.com/en/glossary/bitcoin-dominance%3famp=1

Posted Using LeoFinance Beta

!ALIVE | !BBH | !LADY

View or trade

LOHtokens.@vocup, you successfully shared 0.1000 LOH with @mistural and you earned 0.1000 LOH as tips. (1/4 calls)

Use !LADY command to share LOH! More details available in this post.

@mistural! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @vocup. (4/20)

@mistural! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @vocup. (6/20)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want.

Thank you for the support