SDRs and the IMF Coin - Was Crypto Planned?

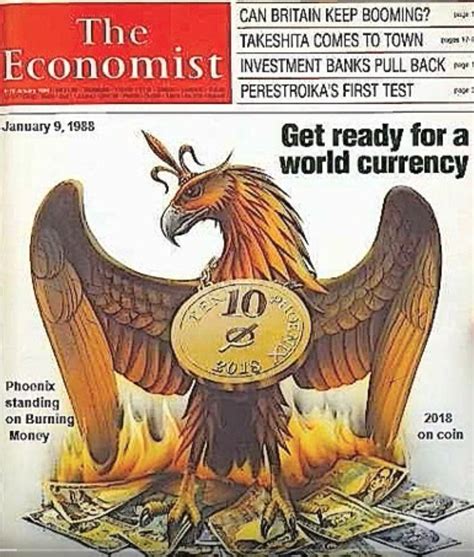

1988 Economist Cover

Special Drawing Rights and Bretton Woods

This is going to be one of the rare posts where I actually attempt to discuss finance and explain some of the details. I normally try to stay away from this subject, not because I do not understand it, just because, well, money does not motivate me. Money to me is a tool that allows me to have experience. That being said, this subject is one that fascinates me. The idea that the entire crypto "movement" was designed from the beginning is just, wow! But the more I look into it, the more I am convinced that is EXACTLY what happened. Please allow me to explain.

Bretton Woods

According to Corporate Finance Institute .Com

The Bretton Woods Agreement was reached in a 1944 summit held in New Hampshire, the USA on a site by the same name. The agreement was reached by 730 delegates, who were the representatives of the 44 allied nations that attended the summit. The delegates, within the agreement, used the gold standard to create a fixed currency exchange rate. The agreement also facilitated the creation of immensely important structures in the financial world: the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD), which is known today as the World Bank.

So, in one swoop we have two of the major influences of the twentieth century, the World Bank, and the Internation Monetary Fund created by the "winners" of the second world war. I for one would argue that those "winners" were really the banking interests, Rothschilds and others, but we will not get into that in this post. For this post, we are going to stick to what SDRs are, why they came about, and what role they are playing now in relation to crypto.

Collapse of Bretton Woods

When we look at SDRs, it is important to understand why they were created in the first place. According to Bretton Woods Project .Org

SDRs were first introduced in the context of the Bretton Woods’ fixed exchange rate system which came into operation in 1944 and saw many countries fix their exchange rates relative to the US dollar (and, by extension, to gold). The idea was that SDRs, which were initially created with a fixed value of 1 SDR to 1 US dollar, would boost international liquidity at a time when the future of the fixed exchange rate system was uncertain. However, with the collapse of the Bretton Woods system in the early 1970s, SDRs would go on to play only a minimal role as an international reserve asset, making up a small proportion of global reserve assets, which continue to be dominated by the US dollar.

For the next part of the story, we can look to the International Monetary Fund itself. According to their website, "The SDR was initially defined as equivalent to 0.888671 grams of fine gold—which, at the time, was also equivalent to one U.S. dollar." It then goes on to state that, "After the collapse of the Bretton Woods system, the SDR was redefined as a basket of currencies." It is this "Basket of currencies" that is especially relevant to this discussion. I first became aware of SDRs, or "Special Drawing Rights" about five years ago when I saw the news that the IMF had allowed the Chinese Renminbi to be included in the SDR "Basket."

Side Note

I know, I am a nerd, but I follow the United Nations and other globalist groups like the IMF and World Bank because, well, I am the HODL'er of the "Tin Foil Crown," and I am especially interested in the so-called "One World Currency," otherwise known as "The Mark of the Beast."

Moving On...

Now, you may be familiar with the famous statements made by the IMF about crypto such as "IMF warns of global risks from unregulated cryptocurrency boom", and the defining word in that statement is "unregulated." Other statements made by the IMF do not get the same sensationalist attention. For example, there has been "talk" largely unreported, about the so-called IMF Coin, which would be THE Central Bank Digital Currency of all CBDCs. If you want to go through the paywall, you can read a Wall Street Journal Article About It Here. For the purpose of this post, it is enough that it exists and is being "talked" about...

SHA-256

There may be people reading this post that are not aware that the SHA-256 algorithm that Bitcoin runs off was developed by the National Security Agency. This is not a "Conspiracy Theory" at all, it is a fact. According to Wikipedia, "SHA-2 (Secure Hash Algorithm 2) is a set of cryptographic hash functions designed by the United States National Security Agency (NSA) and first published in 2001." This brings me to the conclusion of this post, where I will attempt to put the dots together for you...

Conclusion

SDRs were developed many years ago but really did not serve a function while the Dollar was the world reserve currency. When the Chinese currency was added five years ago, it signaled the end of the Dollar in that role. Now, governments the world over are developing CBDCs in an effort to subvert decentralized platforms and assets. While all of this is happening, the IMF is developing a "main" CBDC, one CBDC to rule them all, I guess you could say, based on the SDR. Bitcoin was created by the NSA. The NSA specializes and is the foremost computer hacker on the planet. They have tentacles in everything from Google to Twitter. Now, if you consider that algorithms control what trends on the various platforms, it is easy to come to the conclusion that the entire crypto "movement" was planned and designed from the beginning. Every time I see "Doge" trending on Twitter, all I can think about is wondering whether the "DogeArmy" is an organic movement at all or something designed by Artificial Intelligence?

Something To Think About...

Posted Using LeoFinance Beta

https://twitter.com/shirelanemedia/status/1481093981878603779

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more