How Are Stablecoins Beneficial To The Investors?

Hello Friends, |

|---|

Greetings to you my lovely friends and families of this great platform. There's this question am always asked everytime I tell some of my friends about cryptocurrencies taking over the world of finance.

And the question was always "how can a trader confidently make profit from an unpredictable and risky crypto market"?

Their reasons for this question was based on the fact that volatility could make or cause loss of profits for a trader. They were anxious to know how a trader in the Crypto space could confidently make profit, without the fear of losing value.

Here comes the answer, "Stablecoins" which are regarded as digital assets that are designed to maintain a consistent and stable value, and they have become increasingly popular among cryptocurrency users as a way to store and transfer value without experiencing the same level of volatility as regular cryptocurrencies.

Follow my article today, as I would be sharing my views with you on stablecoins.

How Do Stablecoins Really Work? |

|---|

Just like I pointed out earlier, stablecoins differ from other cryptocurrencies such as Bitcoin in that they are not limited by their underlying blockchain technology and can be used to pay for goods and services.

This means that their price stability makes them an ideal way to transfer value, as well as providing an alternative to traditional banking systems for payments.

Unlike Bitcoin, which has seen drastic fluctuations in its market price, stablecoins are typically less volatile and more easily used for everyday transactions.

Here's how they work, by being pegged to an asset like a currency, commodity, or basket of currencies and commodities. Pegging allows the coin to maintain its value, as it is backed by the asset and can be exchanged for the asset at any time.

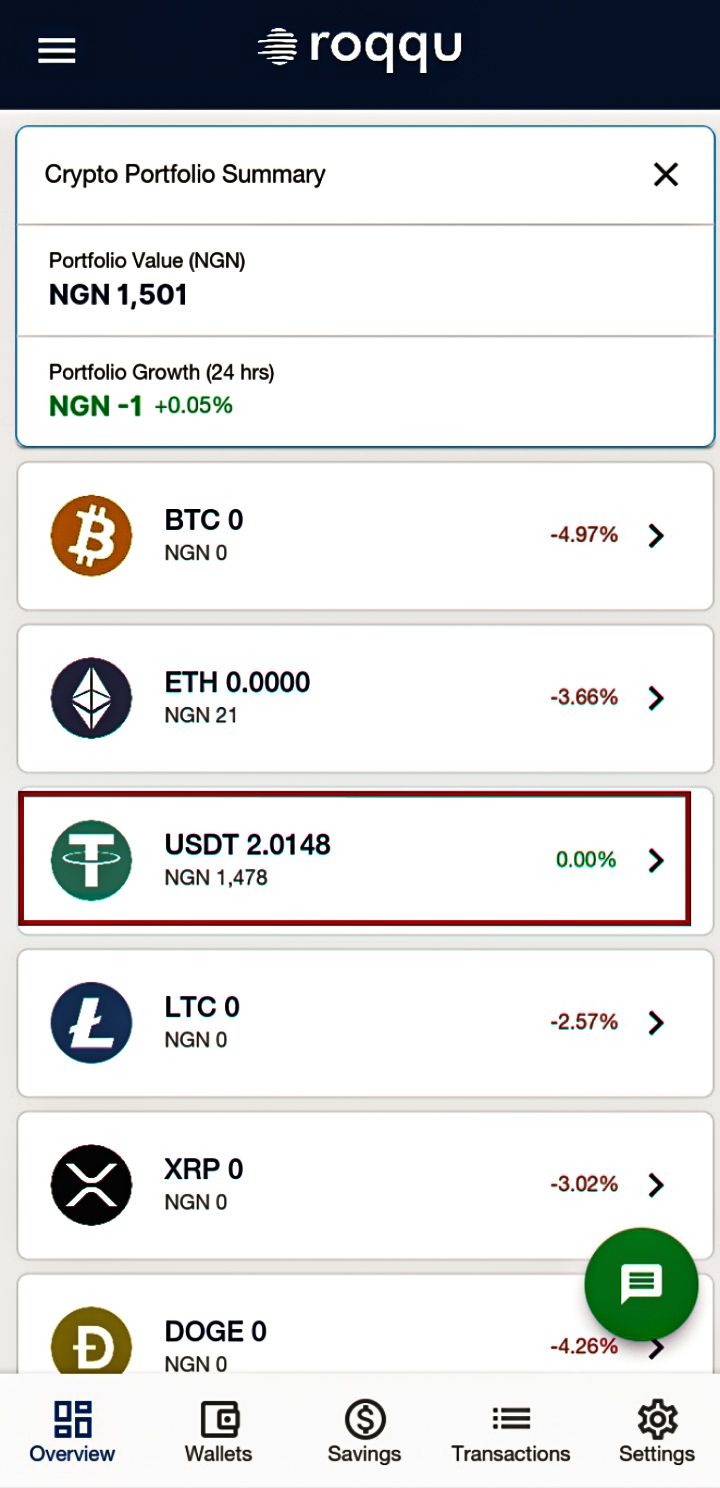

.jpg) gotten from my roqqu wallet

gotten from my roqqu walletAs seen in the screenshot shared above, I held my assets on USDT because I wanted to save them from the fluctuating and bearish trend market. Other assets went down but my assets didn't go down.

Stablecoins can be centralized or decentralized depending on the technology used. Centralized coins are typically controlled by a company or other entity that manages the coin’s supply, while decentralized coins are managed by a network of computers running on blockchain technology.

Centralized stablecoins typically use a combination of various measures to keep the value of the coin stable, including the use of algorithms to monitor market conditions and adjust the supply of the coin accordingly, as well as issuing additional coins in order to create more demand.

Decentralized stablecoins, on the other hand, use a different approach, as they are usually backed by collateral, which can be anything from a physical asset such as gold or real estate, to a cryptocurrency such as Bitcoin or Ether.

This collateral is held in escrow and can be used to back up the value of the coin in case of volatility. The collateral is also monitored by smart contracts that automatically adjust the supply of the coin according to market conditions.

Some Popular Stablecoins Includes

Tether (USDT) is a fiat-collateralized stablecoin, meaning that it is backed by a reserve of US dollars. It is one of the most popular and widely-used stablecoins and has a market capitalization of over $7 billion.

USD Coin (USDC): is a stablecoin backed by the US Dollar, but differs from Tether in that it is issued by financial institutions and regulated by the US government.

Binance USD (BUSD); is a dollar-backed stablecoin created through a collaboration between Binance and Paxos Trust Company. It is an ERC20 token and is one of the few stablecoins that have been approved by the New York State Department of Financial Services.

DAI: is a decentralized stablecoin that is designed to always stay close to the value of the US Dollar. It uses a combination of Ethereum smart contracts and cryptocurrencies like Maker DAO and is supported by users who deposit collateral into the MakerDAO platform.

TrueUSD (TUSD): is another fiat-collateralized stablecoin that is backed by US Dollars held in escrow accounts. It offers users both legal protection and transparent audits, making it one of the most trusted stablecoins on the market.

Unfortunately, even with these measures, there are still cases where stablecoins can lose their stability. This was seen with Basecoin, which was billed as a “revolutionary algorithmic stablecoin” when it was released in 2017.

This coin was supposed to use algorithms and tokens to maintain its price stability, but after a short period of success, it failed to maintain its pegged price.

Basecoin became very volatile and dropped far below its initial peg of $1, resulting in investors incurring large losses.

This example highlights some of the risks involved with investing in crypto-assets such as stablecoins. As with any asset class, investors should do their research before investing any money.

Investors should also be aware of any potential risks associated with holding or using a particular stablecoin before committing funds.