A Turning Point for the Cryptocurrency Industry: CZ Steps Down and Binance Pays Massive Fine

A Turning Point for the Cryptocurrency Industry: CZ Steps Down and Binance Pays Massive Fine

In a significant development for the cryptocurrency industry, Changpeng Zhao (CZ), the CEO and founder of the world's largest cryptocurrency exchange, Binance, has stepped down from his position and pleaded guilty to violating U.S. anti-money laundering laws.

This move comes as part of a $4.3 billion settlement with the U.S. Department of Justice (DOJ) and the Financial Crimes Enforcement Network (FinCEN).

The settlement resolves a long-running investigation into Binance's alleged failure to implement adequate anti-money laundering (AML) and know-your-customer (KYC) controls.

Prosecutors have accused Binance of facilitating the laundering of billions of dollars in illicit funds.

Despite stepping down as CEO, CZ will reportedly retain majority shares in Binance. The exchange has also agreed to pay a hefty fine of $4.3 billion, the largest ever imposed on a cryptocurrency company.

This move is a clear signal that U.S. authorities are taking a tough stance on cryptocurrency exchanges and their role in preventing illicit activities.

It could have significant implications for the industry as a whole, as other exchanges may now face similar scrutiny and enforcement actions.

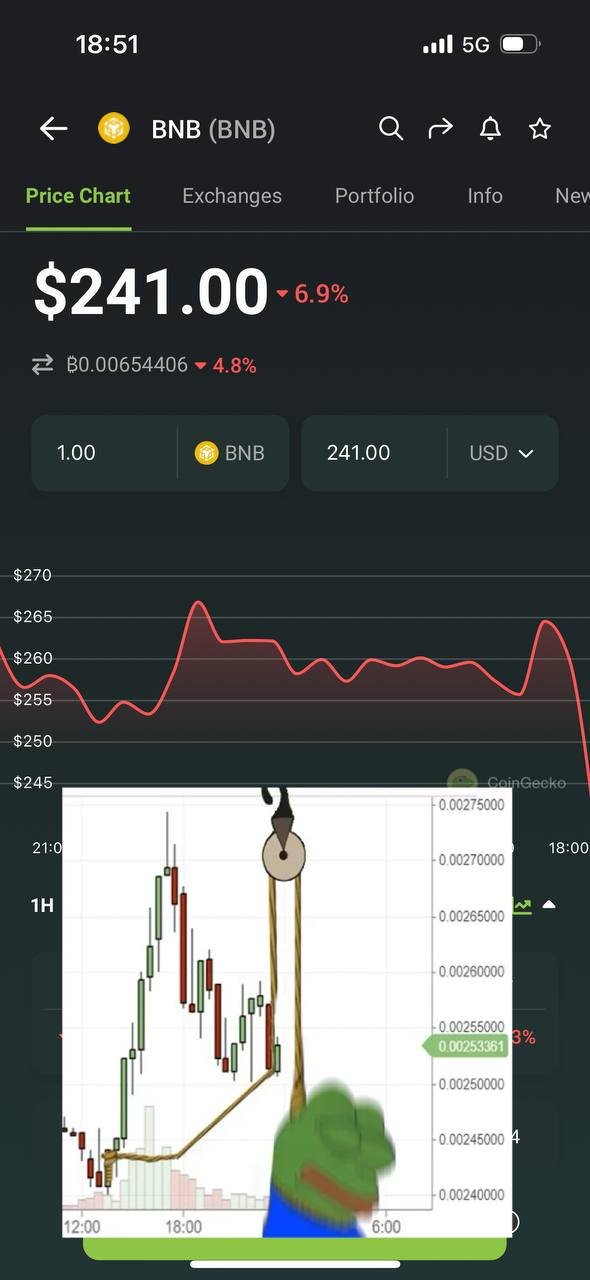

The timing of this development is particularly interesting, as it coincides with a recent sell-off of Binance's native cryptocurrency, BNB.

Some speculate that this sell-off may be related to investors' concerns about Binance's financial stability in the wake of the massive fine.

It's worth noting that this is not the first time a prominent cryptocurrency executive has faced legal trouble with U.S. authorities.

In October 2020, Arthur Hayes, the CEO of BitMEX, a pioneer in cryptocurrency futures trading, was arrested on charges of violating the Bank Secrecy Act. Hayes subsequently stepped down from his position at BitMEX.

The cryptocurrency industry has been plagued by regulatory uncertainty and enforcement actions in recent years.

This latest development is likely to further spook investors and could lead to a period of volatility in the cryptocurrency markets.

Whether this marks the beginning of a broader crackdown on cryptocurrency exchanges remains to be seen.

However, it's clear that U.S. authorities are increasingly focused on regulating the industry and ensuring that it operates within the confines of the law.

what's your take about the image above

Key takeaways:

CZ, the CEO and founder of Binance, has stepped down and pleaded guilty to violating U.S. anti-money laundering laws.

Binance has agreed to pay a $4.3 billion settlement with the U.S. DOJ and FinCEN.

This move is a clear signal that U.S. authorities are taking a tough stance on cryptocurrency exchanges.

It could have significant implications for the industry as a whole.

The timing of this development coincides with a recent sell-off of Binance's native cryptocurrency, BNB.

This is not the first time a prominent cryptocurrency executive has faced legal trouble with U.S. authorities.

The cryptocurrency industry has been plagued by regulatory uncertainty and enforcement actions in recent years.

This latest development is likely to further spook investors and could lead to a period of volatility in the cryptocurrency markets.