Why Tether ($USDT) Hasn't Collapsed (Yet) And When It Will

Tether’s USDT remains unaffected by accusations and the blows the crypto market receives.

USDT, a stable coin with limited transparency and a model that attracts various allegations, so far manages to survive unhindered by market downturns.

Also, USDT delivers a perfect indicator for the market since traders can “play” the USDT new mints or the rare occasions Tether burns USDT to stabilize and reinforce the peg.

Tether has replaced the use of USD in the crypto exchanges and reduced the savings in USD of these financial organizations.

Yet Tether maintains the dollar peg probably due to negotiations and less because of the capabilities of the iFinex parent company.

Upon researching the topic further, we discover potential risk posed by what we can consider a flaw in Tether’s design.

Issues to worry about:

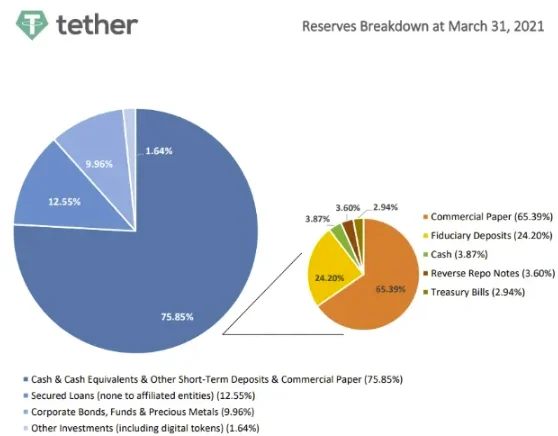

Source: Tether.to

- Lack of transparency

- Centralization and trust requirements

- Accusations of "pumping" the price of BTC

A possible de-peg of USDT could create long-lasting implications on the price of assets like BTC, Ethereum, and more. Somehow exchanges integrated stable coins so much in their systems that a failure of one of them destroys the value of any other cryptocurrency. We watched this happening with the Terra USD (UST) stablecoin as the Terra Luna Ponzi collapsed. Indeed the part of this market that is supposed to be the most professional is prone in making horrible mistakes.

The way the market operates with centralized exchanges in control and trading algorithms adds liquidity to BTC and sustains exit-liquidity for Bitcoin (BTC) whales.

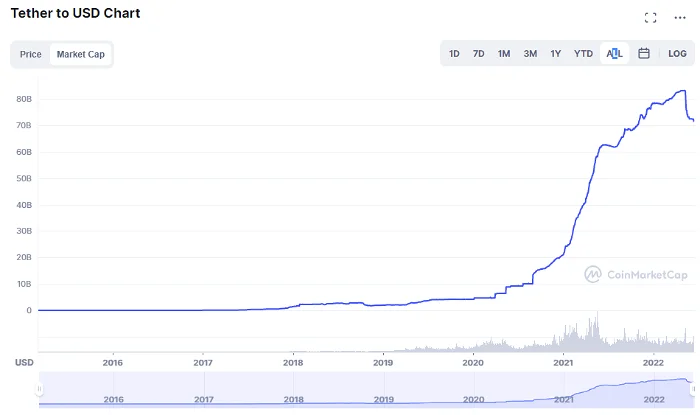

(image: source)

Tether mints new supply and lends to various entities during bullish market conditions that expect to profit from BTC price and pay back the Tether borrowed (with an additional interest).

A model that could work as a lending service but lacks long-term viability since it is based on pure speculation instead of growth developments and infrastructure for the sector. The terms are sustained on unidentified guarantees and collateral containing vague value create a giant with glass legs, easily collapsable.

We previously examined the lack of an independent audit and inadequate transparency of the reserves supposed to be backing USDT.

With this topic, we focus on the centralization factor that also includes the manual intervention of Tether executives in the total supply of USDT in the market and intervention in the movement of funds.

An issue that should find opposition within the overall crypto market as (most) stable coins are not different from the legacy financial system of trust.

Tether sustains the 1:1 peg today, yet throughout the years, it de-pegged until manual intervention readjusted the rate.

In 2022, we encounter the second time USDT's total supply shrinks as billions of dollar-pegged tokens burned.

Valid Concerns by Crypto Critics

Tether has encountered fierce opponents within crypto, but also from the side of a group of (primarily) rational crypto critics or better crypto skeptics. This group may contain individuals supportive of the legacy financial establishment, yet for the most part, ideas based on logical opinions while contradicting evasive arguments and "Ponzi-like" behavior many displayed lately in the crypto market.

Bennet Tomlin is a fierce critic of Tether, yet also someone that understands the use case in the permissionless and censorship-resistant nature of decentralized cryptocurrencies.

Fundamentals that Tether lacks.

Tether is not a decentralized blockchain but runs on top of blockchains that some can be considered decentralized.

Tether is a smart contract containing an option for the developer to freeze any amount of USDT in any wallet, custodial or not.

Holding the keys to an Ethereum or Tron wallet and using Tether does not eliminate trust.

Tether is not permissionless or censorship-resistant. Those with access to the smart contract ( Tether devs or execs) can freeze any amount of USDT tokens at any address.

Tether is centralized, this has already been explained and discussed by Tether's executive Paolo Ardoino, and it is verifiable as well.

Paolo Ardoino (Tether's CTO) mentioned centralization in this Tweet because he was making a compliance point. Indeed it reduces Wall Street's worries that Tether tokens are controllable and even more the fact they are censorable.

Tether, in this case, is the enemy of the enemy of the bank establishment, although it acts as an ally of the crypto market.

Tether (as well as USDC and other stablecoins) are a mirror image of the legacy financial establishment.

Regulations is a keyword in this tweet since Tether was under scrutiny from US authorities for years.

The state demands a footstep in the field, and Tether is there to offer it, being one of the coins with the highest volumes and having reached an $80 Billion market cap.

Tether did not implode so far (as many suspected) because it reached a deal with US authorities. What does this deal contain though?

Tether: “We constantly work with regulators”

(Image: source)

Is it a coincidence that SEC took no action yet imposed only a small fine on Tether?

Tether was [fined for $41 million] on October 18th, 2021, by the CFTC commission for misleading the public concerning its reserves (in the 2016-2018 period).

Tether did not collapse since the financial authorities allowed it to grow. Yet, the SEC will oversee stable coins from now on and demand more transparency.

Tether (USDT) is at the hands of the SEC right now, and with the pretext of the Terra USD stablecoin de-peg and collapse, new regulations will soon apply.

As a centralized network operated by a small party, Tether follows the same course as previous (to Bitcoin) private attempts that produced digital currency networks (examples: e-gold, Liberty Reserve).

Satoshi mentions (in the whitepaper) the need to remove trust, which was the decisive feature that provided long-term viability in this digital currency network. Removing intermediaries and control of the network was paramount for the success of money uncontrolled by the State.

Bitcoin removed trusted third parties from money.

The high cost these operations demand is redundant today, as P2P Electronic Cash networks effectively render all the banking payments networks (Visa, AMEX, Paypal) obsolete.

In case anyone wonders why the banks fiercely opposed Bitcoin (until 2015) and why multiple attempts designated to undermine and hijack the network occurred (with private entities dictating developments), this is the reason. Furthermore, this is also the reason banks still oppose and undermine any robust alternative (or fork) that contains features to compete with the upcoming CBDCs. Any decentralized alternative to fiat money is a threat to what today is the legacy financial system.

Tether And The Bitfinex Hack

Source

Tether’s future appears to be at the hands of regulators. If Tether contained no advantage, the US financial authorities would have already ordered Tether to shut down operations.

The CFTC slapped the wrist of Tether with a 41 million fine, and it seems that was all (for now).

Tether was allowed to remain as a centralized entity in a rather difficult-to-manage environment.

Since Tether's smart contracts allow the freezing of USDT no matter the chain, it still holds value to regulators and financial agencies.

Still, it wasn't just that. The ability to intervene in a rather large part of the crypto ecosystem helped not just Tether but also the rest centralized stable coins (USDC).

Tether, though, had to accept another trade-off. We have the case of the Bitfinex "hacked" or "stolen" BTC, currently worth more than $2 Billion.

120,000 Bitcoins were stolen from Bitfinex users' accounts in August 2016 after the exchange suffered a hack.

Let us consider how the Bitfinex team handled the hack.

In an unprecedented move, it created a new token called "Unus Sed Leo", presented it on Bitfinex Exchange (the only exchange it is traded), and recapitalized with this method.

The hacked Bitcoins in dollar terms was approximately $70 million in 2016, although today it stands at $2,4 billion.

Bitfinex exchange is also the operator of stablecoin Tether. Both these firms belong to the parent company iFinex.

During a time of uncertainty in 2021, when regulators investigated Tether's rapid expansion in market cap (from $1 billion to $80 billion), the supposed Bitfinex hackers were discovered and arrested, while most of the "stolen" Bitcoins were seized by the US DoJ.

The US government has access to more than 94,000 BTC from the Bitfinex hack.

This will be another leverage point against Bitfinex, as the exchange claims it has reimbursed its customers (with the Unus Leo tokens), and it will certainly challenge any procedure or use of this BTC currently in the custody of the US government.

Certainly, the significance of this event is enormous and will generate more heat in the following years, as the seized Bitcoins will become a bargaining chip for both Tether and the US government.

Tether Will Collapse When The US Government Decides So

Tether's future lies at the hands of the US government. Blockstream has initiated a PR campaign with ties to Tether and Bitfinex and has been perhaps the most vocal supporter of this stablecoin, while at the same time making claims it only supports Bitcoin BTC and everything else in the field is not worth our attention.

It seems there is a conflict of narratives here, if not a conflict of interests, as VCs that funded Blockstream contain banking behemoths such as AXA and Mastercard.

The SEC can end Tether any time it decides to, and when proper conditions arise, it will do so. As long as it can serve the financial authorities, it will remain relevant.

Tether is nothing else than an entry point for achieving partial control in the cryptocurrency market. Upon demand of US officials, it will freeze tokens or shut down Tether's operations.

Unlike decentralized networks (with miners operating worldwide), Tether is a smart contract controlled by the developer.

Even before Bitcoin’s release, centralization was a single point of failure that led to the shut down of multiple other digital currency creations.

Considering Tether, as long as it keeps offering value to authorities, it will not remain operational as it did so far.

USDT becomes a tool supportive of the legacy financial establishment.

Upon deeming it useless, authorities will end it.

It may take an event (perhaps, a black swan event), with every effect these events produce that usually create a public outcry. Usually, financial authorities find these times of extreme situations relevant enough to exercise their power.

Usually, state-run (financial or not) institutions have this tendency to allow unpleasant situations to escalate instead of acting preventatively.

Originally published at read.cash

*Cover Photo by " geralt " on Pixabay (modified)

Writing on the following platforms:

Noise Cash - Read Cash - Hive - Medium - Vocal - Minds - Steemit - Den.Social - Publish0x

Twitter - Reddit

Don't forget to Subscribe & Like if you enjoyed the content!

Congratulations @pantera1! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 200 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Yay! 🤗

Your content has been boosted with Ecency Points, by @pantera1.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Well researched. I’ve done a lot of my own research into this issue, and your article highlights most of the concerns brilliantly. Excellent!