Buying wine as an investment, liquid Bitcoin?

Investing in Wine: A Savvy Choice for Wine Enthusiasts

For centuries, wine has been cherished not only for its taste but also for its potential as an investment. While most people buy wine for immediate consumption, a growing number of investors are turning to wine as a long-term asset. Investing in wine can offer both financial returns and the pleasure of collecting and tasting fine wines. Let's delve into the world of wine investment and explore its potential returns.

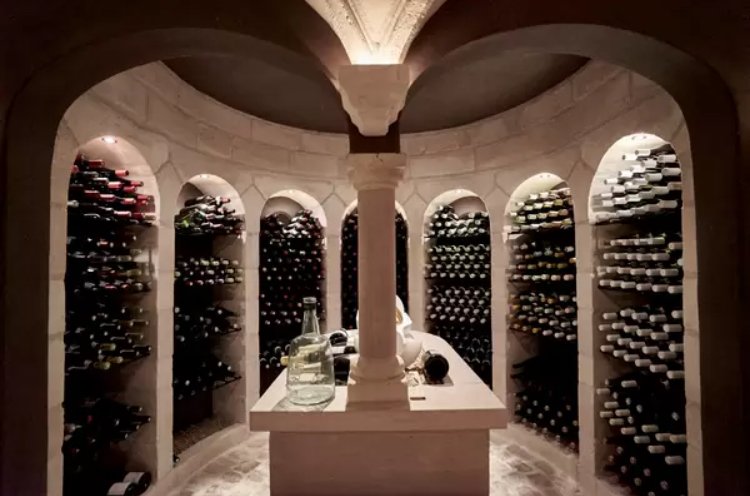

Firstly, buying wine as an investment requires careful consideration of various factors. Investors should focus on acquiring wines with a proven track record of appreciation, such as Bordeaux, Burgundy, and certain vintage Champagnes. Additionally, storage conditions play a crucial role in maintaining the quality and value of wine. Proper temperature, humidity, and darkness are essential for preserving wine's integrity over time. When it comes to potential returns, wine investment can yield significant profits for savvy investors. Historically, fine wine has shown steady appreciation, often outperforming traditional financial assets like stocks and bonds. According to industry reports, the Liv-ex Fine Wine 1000 Index, which tracks the performance of 1,000 top wines, has consistently delivered impressive returns over the years.

Wine investment offers diversification benefits to investors' portfolios. Wine prices are not directly correlated with stock market fluctuations, providing a hedge against market volatility. This diversification can enhance portfolio stability and reduce overall risk.

However, it's important to note that investing in wine carries certain risks and challenges. Market conditions, vintage variations, and storage costs can impact investment outcomes. Furthermore, the wine market is subject to shifts in consumer preferences and economic trends, which can affect demand and prices.

For investors considering wine as an investment, thorough research and due diligence are essential. Consulting with wine experts or investment professionals can provide valuable insights into market trends and investment strategies. Additionally, building a diverse portfolio of wines from different regions and vintages can help mitigate risks and maximize potential.

Investing in wine can be a rewarding endeavor for wine enthusiasts and investors alike. With careful selection, proper storage, and strategic planning, wine investment offers the potential for attractive financial returns and the enjoyment of building a valuable wine collection. While it requires patience and expertise, the allure of fine wine as an investment asset continues to attract discerning investors seeking alternative avenues for wealth growth.

Sincerely,

Pele23

I prefer single malt as an alternative investment. Much easier to store, doesn’t perish and has a very good track record of double digit APR returns over the last decades.

I bought a case of wine just before the pandemic. It seems to go down two bottles a year. I don't drink a lot.

Considering that I got to enjoy the investment, I must say that its done better than my investment in HIVE.

!WINE

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.