Alpha Footprints On Ethereum Mainnet And Layer-2: Chasing dreams on zkSync, Arbitrum and Polygon

I earned the right to drop some alpha, and I want to share what crypto dreams I am chasing on zkSync, Arbitrum, Optimism and Polygon! What recommends me to an opinion? I was eligible for the Arbitrum and Optimism airdrops, received $RADAR from DappRadar, a big bag of $ACX from Across Protocol and $ACS from Access on Coingecko!

What's next? I am trying to leave blockchain "footprints" and thick boxes for the already announced zkSync token airdrop. Why I am putting effort into this wild chase? Because I got the taste for airdrops and I want more!

I invite you on a journey across several blockchains and networks, in a search for alpha projects and protocols. We will travel through the rabbit hole and leave the Ethereum mainnet, landing on the hottest layer-2 chains.

Ethereum is the open-source blockchain platform and the base layer on which decentralized applications (dApps) can run. Solutions were needed because of the gwei and expensive transactions, and new chains where built to scale the ecosystem.

The Optimism airdrop took my by surprise, as I didn't do any effort towards it. I got eligible as a DAO voter, as I constantly voted on SuperUMAns DAO and CRE8R DAO snapshots.

I got more interested in the Arbitrum airdrop, but no clear details was shared for months. Then suddenly .... the airdrop was confirmed and the eligibility page was live! I was eligible for 2250 $ARB tokens, due to my constant activity on the chain.

I ticked the bridging criteria, thanks to Across Protocol, and done several transactions over time. Most of them were on Harvest Finance (Dolomite) and claiming NFTs on Galxe. I always said that consistency is the key to success, and receiving this airdrop comes as a confirmation.

**Layer-2 ****Glossary **

**What is Arbitrum? **Arbitrum is an Ethereum layer-2 chain scaling solution that supports smart contracts without the limitations of scalability and privacy. The chain become popular due to low transaction fees and less congestion than mainnet, and FOMO and hype were added in the mix when the token airdrop rumors started.

**What is Polygon? **The Polygon blockchain was the first layer-2 I ever used, and I was instantly impressed by how low the fees were compared to the Ethereum mainnet.

The Polygon protocol is an advanced framework for building and connecting Ethereum-compatible blockchain networks. It has aggregating scalable options and tools supporting the multi-chain Ethereum ecosystem.

MATIC is the native token of the Polygon protocol, an ERC20 token on ETH blockchain that is used for payments and rewards. This is what makes it a bit different than Optimism and Arbitrum, which are using a wrapped version of Ether ($ETH)

**What is Optimism? **The Optimistic layer-2 chain is able to solve fast transactions on the network through optimistic roll-ups. The Optimism Collective implemented a new economic model to fund public goods, as communities, companies, and citizens are united in a positive synergy that will help all parties to improve and earn.

The chain is a layer-2 scaling solution that derives its’s name from its underlying technology, the Optimistic Rollup. The Optimism Network brings fast and cheap, while maintaining the primary security of the Ethereum network.

**What is zkSync? **zkSync is the layer-2 scaling solution on Ethereum that offers low gas and fast transactions, without compromising on security. The ZK-tech increased the Ethereum throughput, while maintaining freedom, self-sovereignty, decentralization – at scale.

The zkSync vision is to provide a solution for the Web3 exponential demand, obtained through hyperscalability. The innovative project was supported heavily by investors, raising a record-breaking sum of $458M from Tier 1 VCs such as USV, Bybit, Alchemy Ventures, Huobi Ventures, Crypto.Com Capital, Ethereum Foundation, OKX Blockdream Ventures and many more.

My zk-Sync Journey!

My journey on zkSync started with bridging 0.1 $ Ether on zkSync Lite, through their official bridge. This was the recommendation from OG airdrop hunters, with a mention that this type of transactions should be repeated for few weeks. If transactions will be part of the criteria, then they should be well spread apart and not in the same day (or week).

The network was busy and the gas price was high. Tell me something new Ethereum... tell me something new! I paid $5.43 fee and waited for the balance on zkSync Lite to update. The transaction was minted and I had to wait for the confirmations.

Meanwhile, I claimed faucet crypto on Era Goerli. This may count as a criteria, but most likely will not. Used Twitter to claim the daily faucet, and got a nice mixed bag of testnet crypto. The faucet may not work with Twitter accounts without an avatar.

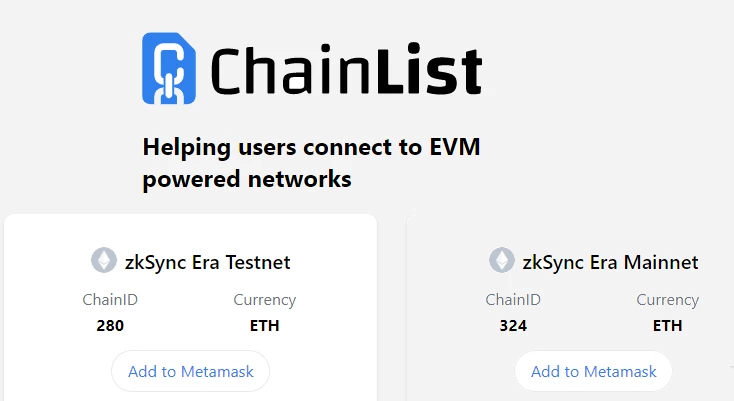

Please note that zkSync transactions will need the Metamask on Ethereum mainnet, while zk Era will require the new chain. See below the details from ChainList, and how to add the zkSync Era to your Metamask wallet

My zkSync Lite journey started on ZigZag Exchange, where I swapped the ETH into USDC. I've done at least one trade every week, as the number of transactions may bring more points. I swapped USDC into $ZZ, ZigZag's own token, and then back into Ether.

Played with stablecoins when prices where low, and tried to gain some profit from trading. Not a trader by definition, and maybe this was the reason why I ended up with losses instead of improvements. The stash of $ZZ kept losing value, forcing me to swap back to USDC.

One month later, and few good trades ago, I managed to reduce the damage to only 3 dollars. I swapped the remaining $ZZ and $USDC into Ether and used the ZigZag bridge to send half of the amount to zkSync Era. I made over 10 transactions on Lite, and the journey had to continue on the Era chain.

I sent half of the $ETH with ZigZag, and the remaining amount was sent with the Orbiter_Finance bridge. This bridge looked cooler than the zk one, with considerably less gas fees. The estimated gas fee saved was nearly 6 USD, and approximately 4 hours faster than the classic bridge.

If something is written in red... do as you are told! Do not modify the transaction or remove digits! I used the Orbiter Bridge to send 0.046 ETH from zkSync Lite to zkSync Era, paying 0.0012 ETH fees. The transfer was done in 2 minutes, and was ready to rumble.

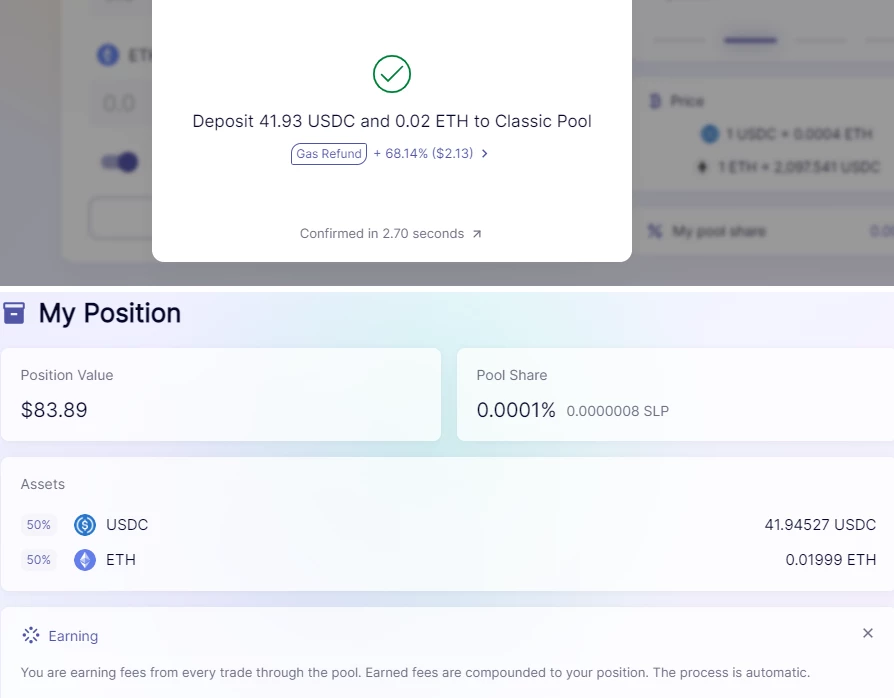

SyncSwap is nice, as you get gas refunds on every transaction. Received back $3.77 after swapping and depositing in the Ether - USDC pool, and the first tasks of zkSync Era were completed. I had a minimal pool share, but the earnings from the fees will compound into my position.

There are so many rumors' about layer-2 airdrops that makes your head spin! I tried to link a series of transactions through multiple chains in order to maximize the potential to become eligible for multiple airdrops!

The DeFi experiment started on Optimism, where the USDC was staked on PoolTogether. I withdrew $183 and used Across Protocol to bridge the USDC to Arbitrum, where the journey for ticking boxes for eventual airdrops starts. We will explore 5 no-token protocols that could potentially make an airdrop (ChainHopDEX, overnight_fi, lifiprotocol, aztecnetwork, VovoFinance) and Across Protocol where you can earn $ACX tokens from bridging!

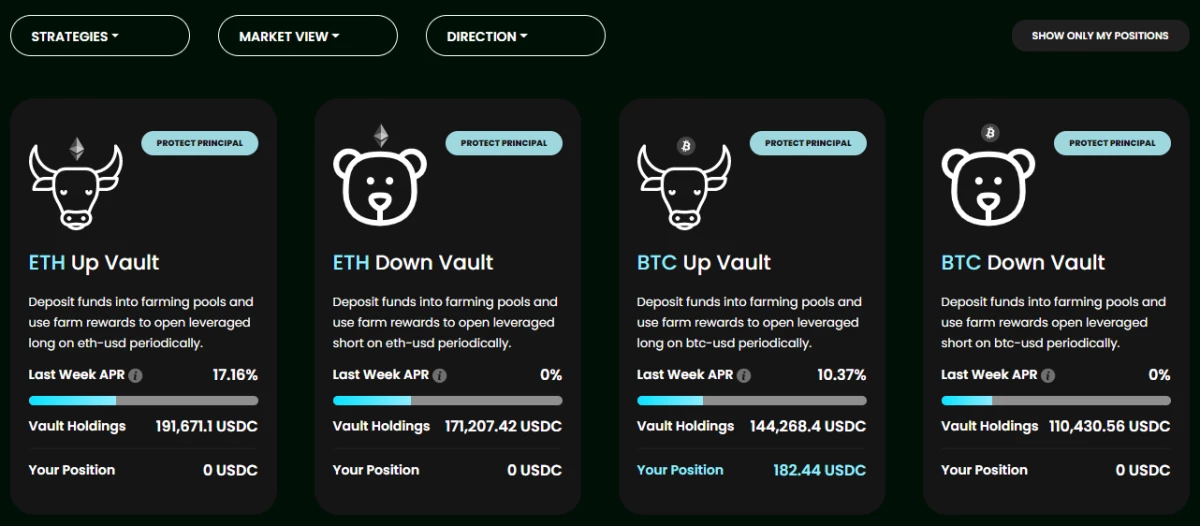

The quest for future airdrops started on Vovo, a protocol that allows speculating on Ether and Bitcoin prices with leverage. The available options are "BTCUP", "ETHDOWN" strategies where you deposit USDC and you speculate on price.

Vovo Finance is on Arbitrum and I used the bridged USDC to deposit them into the BTC Up vault, which had 10.37% APR last week. Took them out after one day and moved to the next step of the airdrop hunt.

I used ChainHopDEX to bridge the USDC from Arbitrum to Polygon. Chain Hop supports several blockchains and layer-2s, with a swap option included in the transfer dashboard. You can bridge a token into another chain, or swap it for another cryptocurrency before it reaches the new destination.

I moved to fine DeFi, as I minted USD+ on overnight_finance. The USD+ stablecoin is backed 1-1 backed with USDC and gains interest at approximately 9% APY. The interest rate comes from the USD+ investments on DeFi strategies that makes it work as a risk fund.

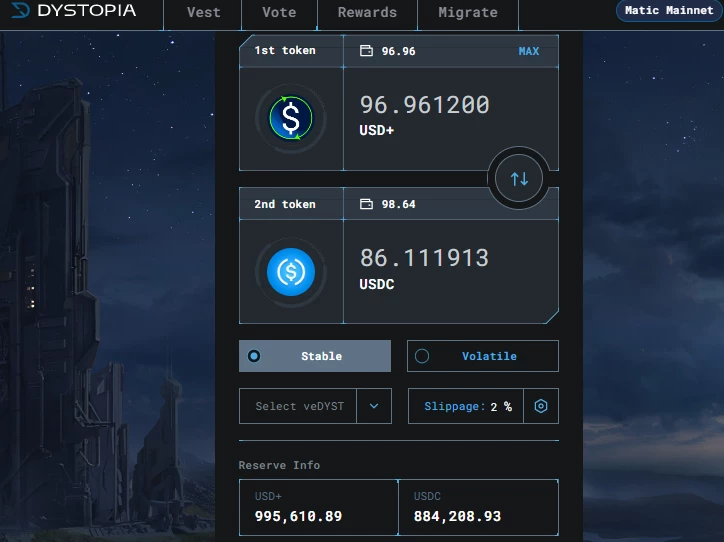

Overnight Finance is on Polygon, and I used the USDC sent with ChainHop to mint half into USD+. The next step was to create USD+/ USDC LP for the farms powered by Dystopia. Free Matic for gas can be obtained from the http://matic.supply faucet.

I enjoyed Overnight Finance the most, as the interface was straight forward and easy to use. Created the USDC/USD+ LP and stake it in a pool that has already nearly 2,000,000 TVL. Most of the steps from this airdrop chase include staking, and hopefully the transactions will be enough to become eligible for potential bounties.

Once the LP was created, I ticked the "I have LP token" button and pooled "MAX" in few seconds. The notification history gives extra points to Dystopia, as the process is made clear and visual even for the DeFi beginners.

Two days later I removed the LP and moved to the next step of the Airdrop Hunt. Time to head over to another bridge, and hope they will announce a token drop soon. I am not interested in the earned income or gains... I want to interact with as many protocols possible and to tick boxes!

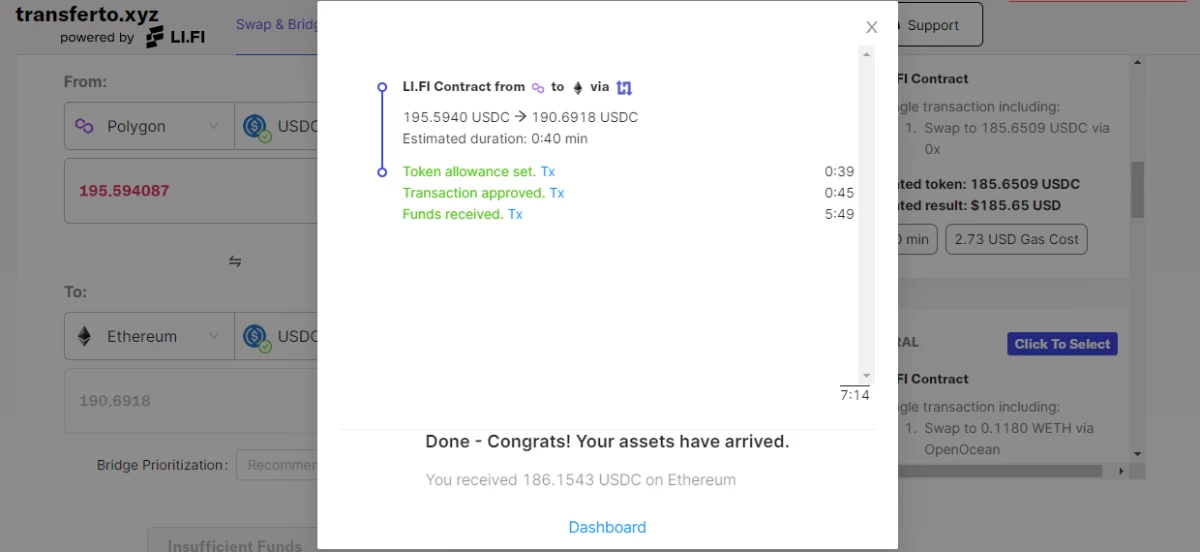

I used tranferto.xyz by lifiprotocol to bridge the USDC from Polygon to Ethereum Mainnet. LI FI is a bridge aggregator, combining and analyzing all the bridging options to identify the cheapest path for the transfer. I took the recommendation and it wasn't great! I sent USDC from Polygon to Ethereum and come one step closer to the end of the adventure. It took only 7 minutes even if the estimate duration was 40 minutes.

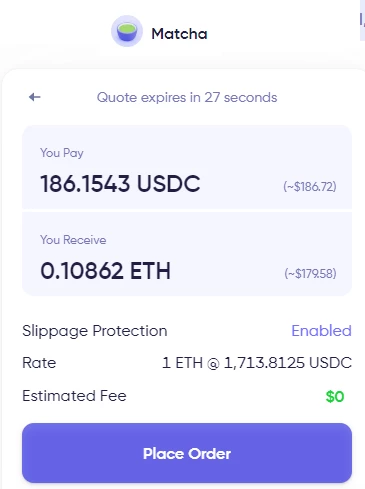

We are nearly at the end, using Matcha to swap USDC into ETH. The matchaxyz Dapp finds the best prices across exchanges and combines them into one trade. This is a tool that I must remember to use more often.

Matcha helped me to swap 186.15 USDC into 0.108 ETH with an estimated fee of zero dollars. The fee was not zero, as I paid approximately 7 dollars for the swap. If you are doing DeFi on layer-2 this may look expensive but trust me it was a good deal on mainnet.

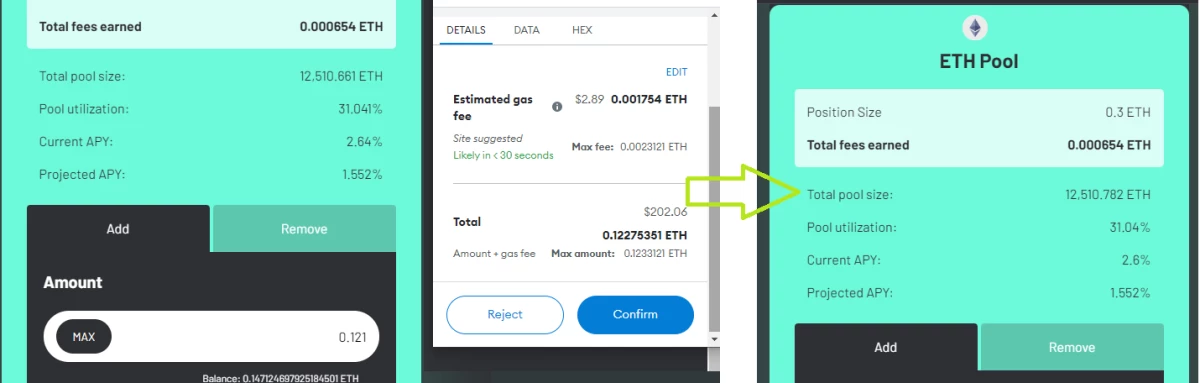

I am sharing a personal Alpha signal! The Across Protocol ETH Pool that rewards the LP providers with both ETH from fees and $ACX tokens from the planned distribution. I already had 0.179 ETH staked in the pool, and earned some fees in the 2 weeks of staking.

I used the ETH swapped on http://matcha.xyz and add it into the ETH Pool to upgrade my position size. I now have 0.3 ETH and will earn more ETH from fees plus some extra $ACX tokens. Read the full Across Strategy in my $ACX article

I lost few USDC while staking and bridging on multiple chains, and time will tell if the hunt for airdrops was successful or not. I played with altcoins and explored some cool protocols.

If one of those protocols I used above will mint their own tokens, then I hope I completed the airdrop criteria before the snapshot. Hopefully some will come strong into the market and getting some tokens will be the payment for my effort.

Patience is a virtue, and hunting for airdrops is an art. However, there are other layer-2 gems that are already out and are going below the radar!

Mayfair is one of the most innovative projects I seen in 2023, introducing DTFs, leverage trading and more DeFi tools! What are DTFs? DFT stands for DEX Traded Funds, a basket of tokens that forms a crypto index! Each DTF will track the performance of a portfolio composed of chosen assets, as the Smart Index Pool is rebalanced by arbitrageurs just like any liquidity pool.

The $MAY token is the token that powers the protocol, with multiple sources of income! Exit fees, swap fees, perp trading fees, minting and redeeming DFT fees will reward the holders! I got 120 $MAY below the market average and currently staking at 34% APR!

The only reason I still visit the Ethereum mainnet is to vote on disputes with my staked UMA tokens! Big alpha in here as stakers will get higher rewards (est. 27% APR) or lower as the voters will experience reward reallocation depending on whether they vote consistently and accurately as part of UMA's optimistic oracle DVM.

The staking rewards will be streamed continuously as one of the best financial opportunities on mainnet. The unstaking period is 7 days, and rewards cannot be earned in this timeframe.

Keep an eye on UMA has always been a pioneer in DeFi and Web3 development, constantly promoting the crypto decentralization and implementing blockchain technology in the Cryptoverse.

The $UMA token is alpha as well, not the type of memecoin with no utility. UMA holders can use their assets to participate in decentralized governance and be part of a movement that keeps innovating the blockchain sector!

Residual Income:

Hive Blogging - LeoFinance, Peakd, etc

CakeDeFi $30 DFI for new users

The fountains: PipeFlare ZCash, GlobalHive ZCash & Get.ZEN

Publishing bundle: Publish0x, readcash, noisecash, LBRY & Presearch

They are good for the moment.