Aping into Arbitrum: Exploring GMX & GLP

Not a hype chaser and maybe this is the reason I landed on GMX soo late! The perpetual trading platform was launched in September 2021, offering perpetual contract trading with up to 50x leverage.

GMX doesn't trade tokens, as users will deposit collateral to take long or short positions. The traders will be paid in USDC as settlement profit for shorts or the pair token for longs. The Arbitrum airdrop announcement turned GMX into "El Dorado", as the token-hunters tapped into zero price impact trades to tick boxes.

The market prices are based on Chainlink's oracles, which aggregates price feeds from leading exchanges. This makes positions safe from liquidations due to random ticks on a single automated market maker. This innovative system helped GMX to became the top dapp on Arbitrum by TVL and the leading perpetual exchange in DeFi.

The $GMX token powers the GMX ecosystem, and the total maximum supply is estimated at 13.25 million. Staking $GMX tokens will bring three types of rewards: escrowed GMX (esGMX tokens), variable ETH and multiplier points that boost APRs and encourage long-term staking.

The leveraged trading on GMX bloomed thanks to the low fees on Arbitrum and Avalanche, as crypto savvy people dived into leveraged positions without an expiry date.

GMX relies on the liquidity pool to enable instantaneously transactions. The liquidity pool has it's own token, called $GLP, and the holders will provide liquidity to the exchange, whilst getting exposure to an appealing mix of underlying crypto-assets.

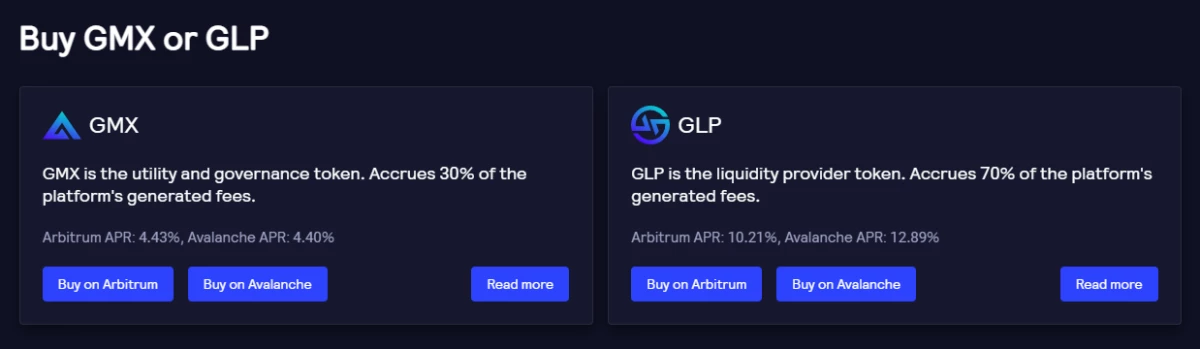

GMX shares 30% of the accrued platform's generated fees to the holders, while GLP holders will share the remaining 70% of the generated fees. Which of them is a better token to hold? Probably GMX, but I didn't bought any when it was $40 so I had to chose GLP.

The core feature of GMX is the community-operated ‘unionized' liquidity pool (GLP Pool). The $GLP token is in fact an index used to provide liquidity for leveraged trading, which can be bought with any of the assets that are in the LP. The fee depends on the liquidity pool demand, being cheaper to buy GLP with index assets that are demanded by the market but are underrepresented in the pool.

I decided to explore GMX and add GLP tokens in my portfolio, mainly because of the impressive APR. The GLP’s APR is generated by real yield, meaning the profit is not generated by deflationary mechanics such as token emissions, but by awarding token holders a share of actual revenues.

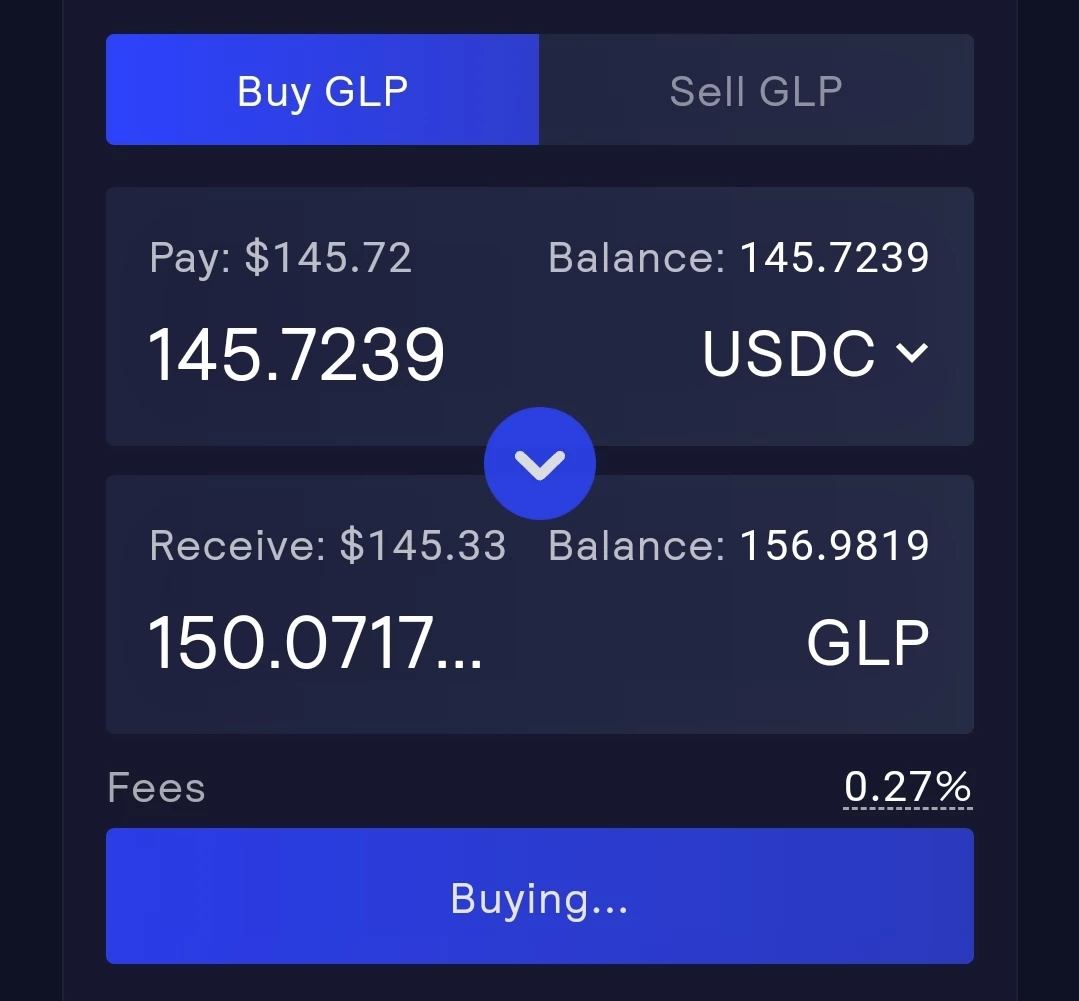

The GLP price was lower then usual, so felt like a bargain to get it at $0.862 per token. The low volatility is given by the 52% stablecoin percentage, which is reassuring ... unless USDC depegs again!

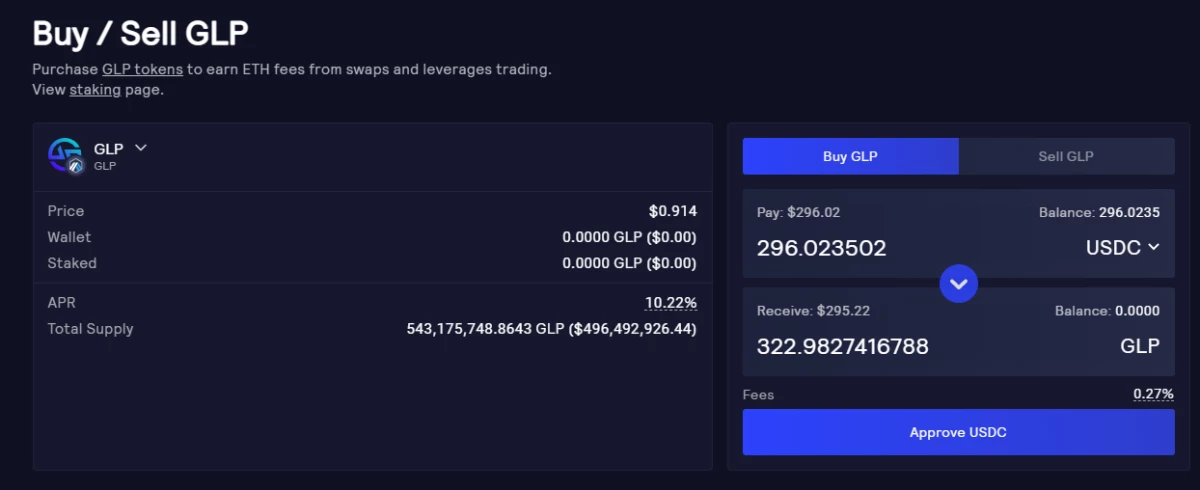

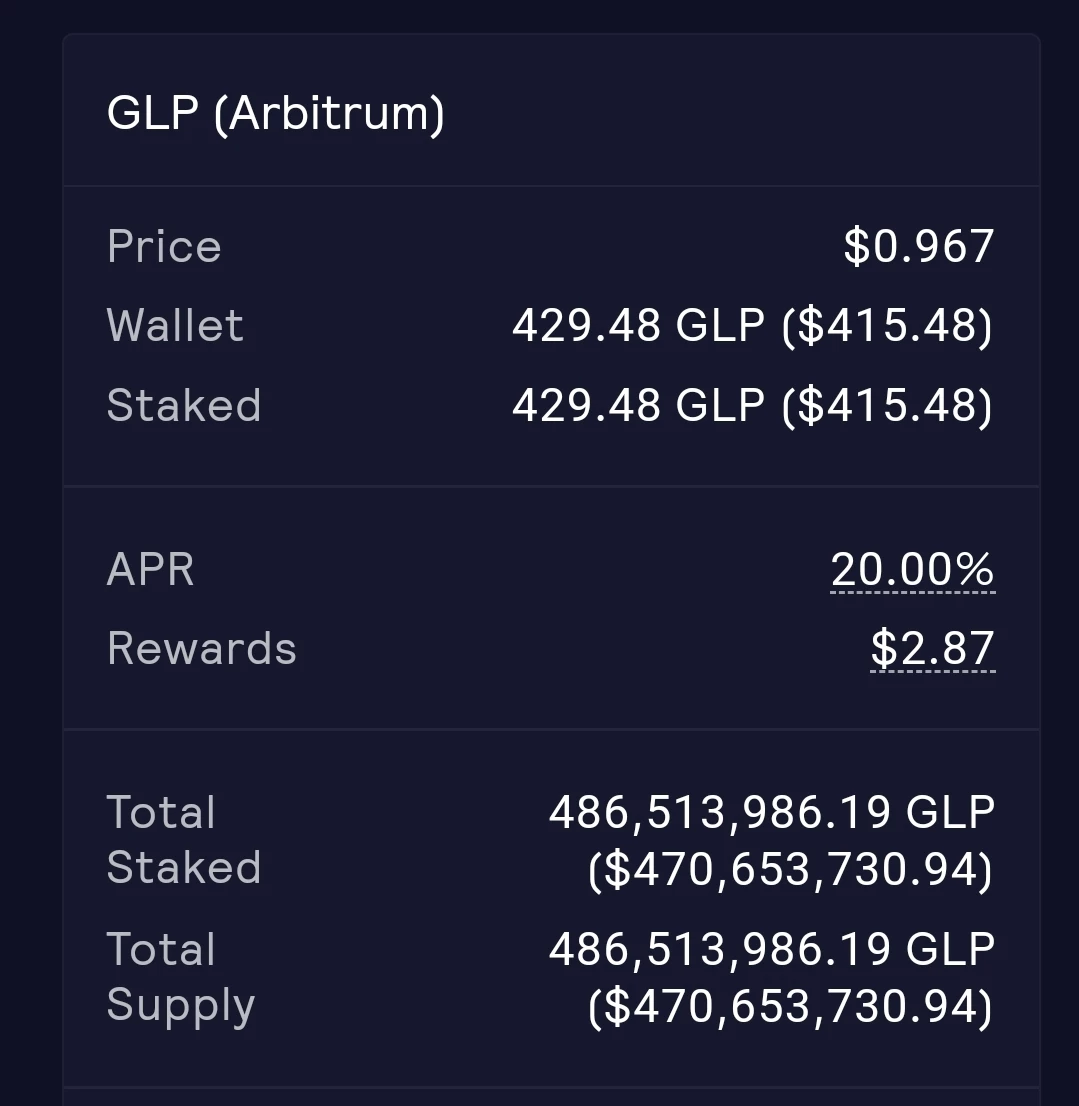

Unfortunately I got busy with other stuff and never completed the trade. I came back to GMX and bought 322 $GLP tokens, now at a higher price then the previous day. From $0.862 to $0.971 may not feel like a big deal, but the price change made me buy 15 GLP less.

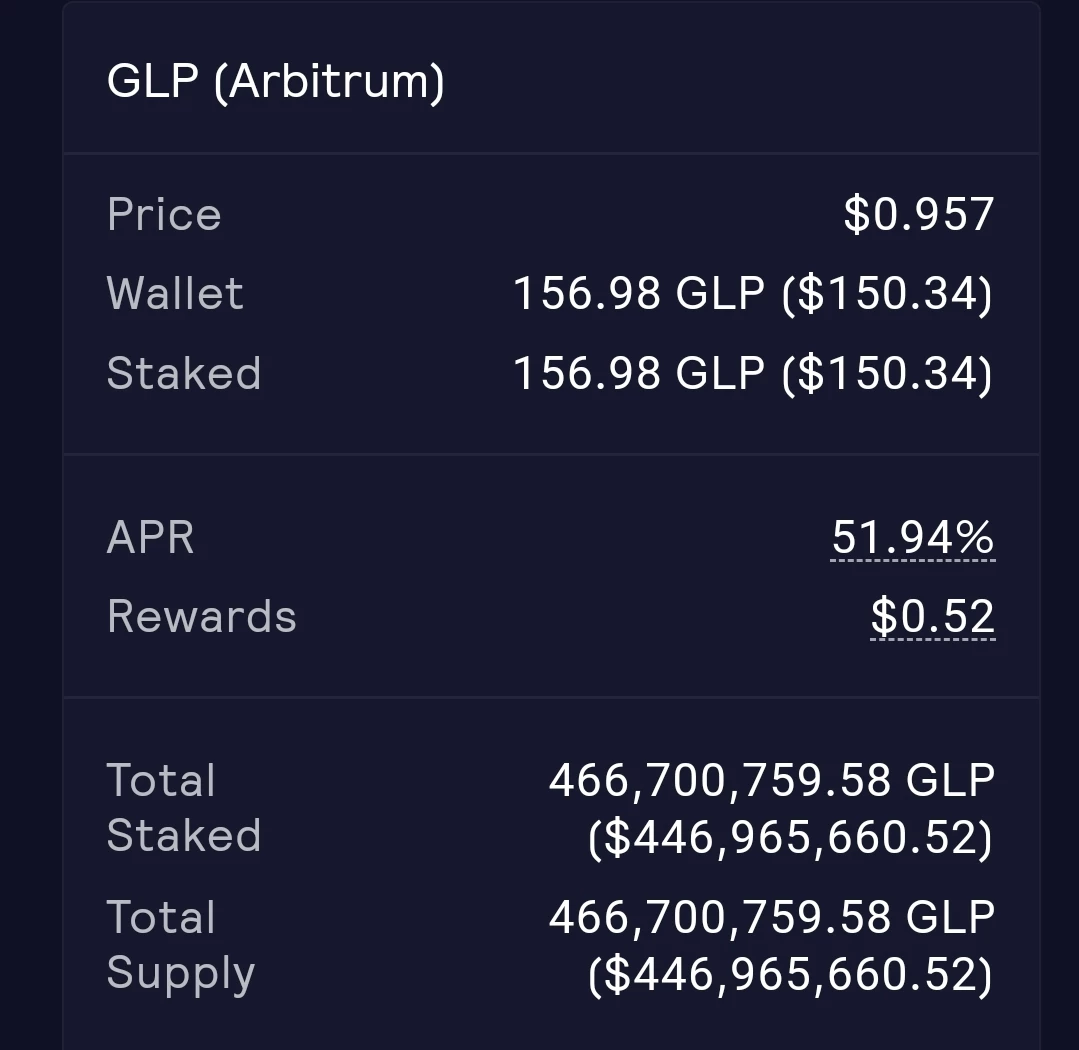

The Arbitrum hype made the APR surge, and at one point I was enjoying 51.94% yields on my GLP tokens. Farmed $0.52 worth of ETH in two days and this accelerated rate made me consider a GLP top-up.

Back to GMX for another share of GLP tokens, this time as a discounted price. Go big or go home they say... and I went big on GLP! Increased my stash by 200% and was looking forward to more ETH power farming.

Checked in a week and claimed $2.87 in ETH, as I wanted to explore and stake into GMD vaults. The GMD Protocol is a platform for maximizing yields and aggregating data built on top of already existing software and using GMD’s reserve token on Arbitrum. The best part is that the GMD's vaults are single-stake pools for ETH, BTC and USDC, taking impermanent losses out of the discussion.

Residual income:

Hive Blogging - LeoFinance, Peakd, etc

CakeDeFi $30 DFI for new users

The fountains: PipeFlare ZCash, GlobalHive ZCash & Get.ZEN

https://leofinance.io/threads/pvmihalache/re-leothreads-4w7vst9l

The rewards earned on this comment will go directly to the people ( pvmihalache ) sharing the post on LeoThreads,LikeTu,dBuzz.

looking to get few more too.

This already paid-out post was just upvoted by @susieisclever.

This post was created to allow this voter the oportunity to still upvote this content IF (s)he deems this content to be high quality.

Please don't use this post to self-upvote. You will get blacklisted if you do. And don't use it to upvote low quality content

This is a hive-archeology proxy comment meant as a proxy for upvoting good content that is past it's initial pay-out window.

Pay-out for this comment is configured as followed: