What you need to know about "impermanent loss"

Introduction:

If you have done anything in Defi, then you certainly have heard of the latest and greatest versions of decentralized exchanges protocols or what are called DEXs. Yes, it would not be exaggerating to say that the likes of Uniswap, Pancakeswap, or the recently-launched Robiniaswap have changed our perception of trading and put a limit on centralized exchange's control of trading in the crypto space. And on top of that, they blew the doors wide for regular users like you and me to take part in the market-making process and benefit financially from it. This is all possible thanks to liquidity providing function that allows users to keep their tokens into decentralized trading pools and whenever someone needs to conduct a trade, they need to pay a fee that goes directly to liquidity providers. Moreover, those providers are not obligated to keep their tokens in the pools for a certain period of time, meaning they can redeem their funds plus any additional profits completely at their convenience!

Now, this all sounds well and good, but as is often the case, wherever lucrative opportunities exist, there are always hidden risks that lurk beneath. And when it comes to liquidity pools, the serious risk is no other than "impermanent loss"...

In this publication, I'm gonna explain what this infamous "impermanent loss" is all about and how you can manage and mitigate its risks. It might a bit of a tricky post but I hope you find it useful...

What is impermanent loss?

It is basically a case that occurs when you provide two crypto assets into a liquidity pool but the price of those two assets differs sharply from one another in a certain time frame. As known, to provide liquidity on decentralized exchanges, you're required to put the same dollar value worth of both assets into the pool. However, as we all know, there is nothing more prevalent in crypto than fluctuation. That means "the same dollar value" you've provided into the pool will not stay the same for long and at least one of the two assets you're locking could pump or dump in price at any time, which creates the ideal conditions for impermanent loss to arise.

Well, let's take an example to clarify the idea and defog any misconceptions

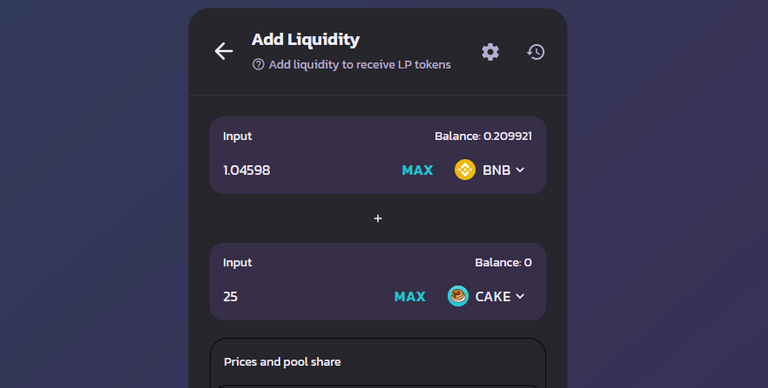

Suppose that John is providing liquidity to BNB-Cake on pancakeswap pool and let's adopt the approximate prices as following(to facilitate the calculation process)

- The price of BNB is $500

- The price of Cake is $20

John wants to lock up $500 worth of BNB and $500 worth of Cake (same dollar value) which makes up $1000 in total and splits up to:

1 BNB against 25 Cake (a total of $1000)

Still with me so far?

Well, let's keep away from huge numbers and suppose that the total value of the BNB-Cake pool is $10000, thus John's share is 10% of the pool, right?

Great!

Uniswape, pancakeswap and many other decentralized exchange adopt an automated marker maker model or (AMM) that requires the multiplied product of each coin's supply to remain constant.

In our example the constant of the total pools is: 10BNB * 250Cake = 2500

Traders are free to do their exchanges through the pool. they can buy BNB for Cake and vice versa, but if it happens that a large number of traders bought up BNB (for example) and a small number of them bought Cake, that would mean the amount of Cake in the pool will increase at the expense of BNB and that will also mean that the price of BNB will increase!

Now, if the price of BNB has pumped 4X and becomes $2000 (and Cake remained the same), the constant of the BNB-Cake pool remains constant but the ratio of involved assets changes.

Back to our small example, the new ingredients of the BNB-Cake pool will account for: 5BNB * 500Cake = 2500

Imagine that john withdraws his funds from the pool. He is of course still entitled to a portion of 10% of the total pool, this gives him: 0.5 BNB & 50 Cake (a total of $2000)

See?

John has lost some of his BNB and gained additional Cake in return, so it's not really a loss but the ratio of the funds have changed, and if John had waited until the price of BNB returned to its initial level ($500), he would have withdrawn his funds at the same initial ratio. That's the main reason why it's called "impermanent loss" . However, it might be a bit of a dodgy name because "impermanent" can easily become "permanent" if the price of one of the assets has changed and never returns to the initial level (BNB in our example)

Another fun fact worth mentioning is that John ended up with a total of $2000 in total, meaning he has doubled his initial investment of $1000, but if John had not provided liquidity in the first place and simply held his 1 BNB and his 25 Cake, he would have a total value of $2500 (considering the new BNB price), so yea, some potential profits have gone due to impermanent loss

Finally, I should point out that this example didn't take into account any gains earned from providing liquidity which might have compensated for any losses...

Final thoughts:

Well, I'm one of those who think the Defi space is going to completely change the economic world. Too bullish about it. That said, since Defi is still so new and hasn't been tested for a long time yet, we have to be open to possibilities about hidden risks involved in it. And while I'm sure those risks are going to be solved and avoided in the long term future, we should always make our personal strategy to keep safe. When it comes to impermanent loss, providing liquidity with stable coins might be the easiest way since those coins have little to zero volatility by design.(USDT, BUSD, DAI...etc). Also, keep always away from providing liquidity with sh!t coins that randomly pump out of nowhere. After all, those coins have the nastiest and craziest price actions which could add oil to any impermanent loss's fire...

what do you think guys? have you ever suffer this type of loss? I'd like to learn your thoughts in the comment...

PS, Unless otherwise stated, all images in this post are either my own design or from free photo-sharing sites (e.g. pixabay.com)

Posted Using LeoFinance Beta

This is so awesome and saved me the time of writing the article, lol. Reblogging for the Coin Logic front page rotating feed. I will also be featuring it in today’s video which will get you also listed as a beneficiary of that post!

Glad that you liked it and thank you so much for the support :))

Posted Using LeoFinance Beta

Congratulations @qsyal! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 9000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP