What's happening with the Bitcoin ETFs?

Hello!

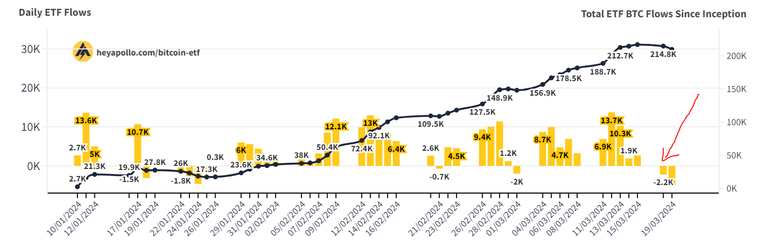

Last days we've seen the ETF inflows decrease to the point they became negative.

Sometimes an image is better than a thosand words:

The last month's price appreciation of Bitcoin looks correlated to the ETF inflows. The current correction too. So, I assume that the ETF inflows are one of the main drivers for price. I will be monitoring this metric daily.

The best part is that the outflows doesn't come from new buyers, they come from speculators that were holding Grayscale prior to the ETf approval.

Grayscale currently holds 360,000 Bitcoin. At this rate they will be out of Bitcoin in 5 months, but there would be a point before, were their outflows will start to become irrelevant. If I had to say when, I would say not later than 2 months.

I expect some turbulence in the coming weeks until Grayscale gets without Bitcoin to sell. This will bring us to the magic point were the supply on exchanges will dry faster than ever. In addition we will have half of the supply created each day. All of this makes a perfect cocktail for an explosive bull market.

I have been in this space since 2017 and I have never been that excited. I can't wait for all of this to happen, I will enjoy every fucking second of this wild ride.

Have a great day!

Posted Using InLeo Alpha

With such a strong drop in cryptocurrency prices, we have a good opportunity. I use liquid HBD to buy more ETH and HIVE when the price drops.

I am thinking about buying ETH now. I think the 10k mark is easy.

From what I read on twitter today it seems that Grayscale is lowering fees which means the incentives to hold BTC there would rise above zero once again for investors. 2024 and potentially the beginning of 2024 will be highly profitable for crypto, that's for sure.

I think that with the lowering of their fees some people will not sell.

Hopefully they stop selling BTC soon.

Yep, grayscale outflows won't matter at all.. supply shock is inevitable at some point after halving.

ETFs inflows went negative pre FOMC and since Q2 is coming which used to be boring in past.. I believe they're derisking or reevaluating it.. too excited for upcoming major upside in bull run.

I can't wait!

We'll be enjoying the crypto summer really soon!