Capital Gains Tax in the UK, much more generous than income tax!

The situation with how much capital gains tax you pay in the UK is dependent on the amount of income you earn, in the same year as you make your gains.

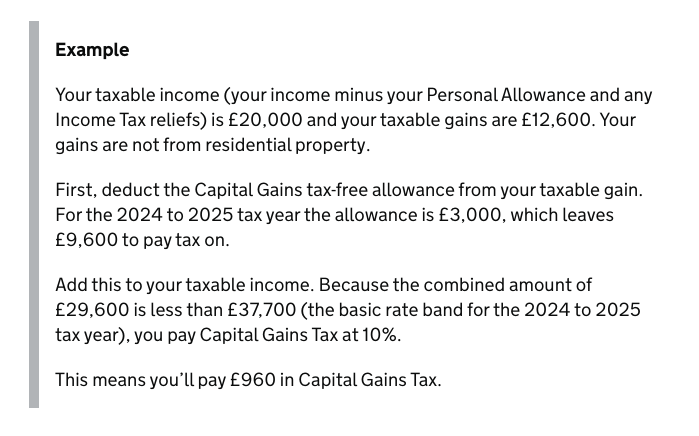

It's actually a remarkably simple system, assuming the gains aren't coming from property or a few other specialist areas which has different rules, and once you've realised most of the jargon on the HMRC Web Site is convoluted and learn that you have to rely on basically ONE example they provide to figure out what the situation is....

This example...

CGT income-dependent tax rates.....

For CGT you pay....

- 0% on the first £3000

- 10% on capital gains up to £37700 (income and capital gains combined)*

- 20% on any capital gains OVER the combined income and gains of £37 7000**

So if you earn £17.7K in a year you pay 0% on the first £3K of gains and then 10% on the first £20K of capital gains, and 20% on any gains above £20K.

If you earn £27.7K you'd pay 0% on the first £3K of gains, 10% on the next £10K of gains and then 20% on the rest.

The lower rate tax threshold disappears in this.

What's slightly confusing about the above calculation is that the threshold at which you start paying 20% income tax in the UK is £12 570 while the upper band, at which you start paying 40% tax is £50 270.

This kind of 'disappears' in the above calculation, as £52 270 - £37 700. gives you... the lower tax threshold of £12 570.

So for some reason these tax calculations are based entirely in the lower rate band.

That is, you only get pay 10% on that middle chunk of £37.7K if you're earning £0, you don't get to pay 10% on the entire £50 270. And neither do you get pay £0 on more of that 0 rate tax band for income.

And that 20% is the max you'll pay...

If you are living off investments (not property, the rates are slightly higher at 28% over that £37K combined threshold) then you only pay 20% on gains from £37K to £millions.

This makes it a MUCH better rate compare to your tax on higher rates of income, where you'll be paying 40% on everything you earn over that upper £50K threshold (and slightly more once you tip above 6 figures).

Examples...

So this means if you earned £27K in a year then you'd pay...

10% of £10K = £1000 on £10K of gains

20% on the next £10K = £3K on £20K of gains

And then £9K on £50K of gains....

That £9K on £50K sounds harsh, but £3K on £20K doesn't sound too pad.

And of course if one could LOWER one's income to say £17K then you'd only pay £2K on £20K!

If you're gonna be cashing out 6 figures then TBH a 20% tax bill is MUCH better than a 40% income tax bill, and given that you've probably done fuck all for yer capital gains, rather than probably not fuck all for working, that's sweet!

Posted Using InLeo Alpha

Does not sound bad at all if you compare that to SA who has a 40% rate on CGT.

For sure! I'll take that 10%

I reach %27 in the third month of the year.

The calculation of the gains themselves is a pain though. I can't see crypto going mainstream in the UK unless they get some form of tax simplification.

Well fair point! I'm just gonna report crypto-fiat and hope for the best. I don't trade much anyways!

Oh!, I didn't realise your tax free CGT allowance was so low, did it change recently, I'm sure it was higher in the past !

It was 12K two years ago!

Just as well I'm doing all my share trading inside my ISA these days, wouldn't consider holding shares outside of an ISA really

Sounds like a good strategy!