Not Financial Advice for cashing out crypto in a bull market....

So it would appear we are in a bull-market, maybe. I don't know. Possibly we are, possibly we are not.

But with BTC almost hitting an ALT and alts looking lively it's time to start thinking about taking some profits, hypothetically or in reality, or both, or neither.

TLDR My not financial advice for cashing out crypto in a bull-market...

My not financial advice to anyone with crypto that is worth more than they originally bought it for is to either cash some of it at some point or not.

If you do either of these options then one of them should result in you being IN profit. Unless you're transacting on ETH in which case doing anything will probably mean you end up losing most of your crypto to the transaction fees.

Entirely hypothetical more specific not financial advice

Focusing on the cash out route, rather than the hodl route, if you want to make MORE profit then you need to think about how much crypto to cash out into stables and at what prices...

For me personally dollar cost averaging out into stables, and in increasing amounts as prices increases might work as a strategy.

This might work for me as I'm maybe lucky enough to be pretty flush without the crypto and to have got in early enough that even cashing everything out now would mean I've more than 10* my original Vest anyway.

The downside of selling too early is of course the opportunity cost of what you'd lose by selling later, once it's sold, it's sold, after all.

I have no idea what's going to happen the the BTC/ Hive prices over the next couple of years, but cashing SOMETHING out would be nice, that's all I'm going to say as a target, I have a target which is something....

Entirely hypothetical cash-out points for Hive....

I'm a bit precious about my Hive, so I'd find it quite the psychological barrier to PD below 80K Hive, I like my 100K stack, and 80K isn't too far off being able to regain that.

Fortunately a cash-out schedule like the one below would net me $40K, which is a nice sum of money and may or not be related in some way to the cash-out target I've got....

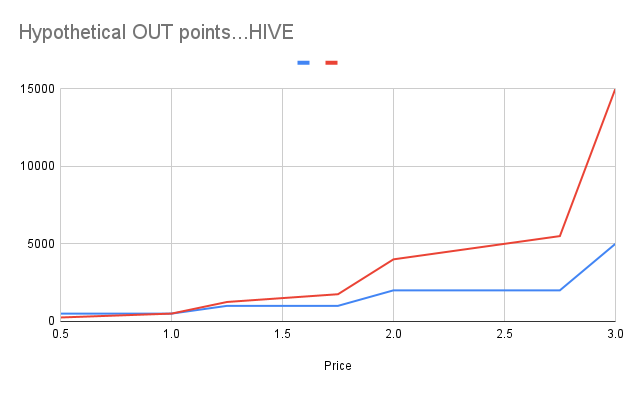

The blue line below is the price point and the red line the amount one might want to think about cashing out... you get the idea.... cash out small amounts early on and those amounts gradually increase as the price goes up, if it goes up!

So my general approach might be to cash out...

- 500 Hive once it hits $1.00 (it's getting there!)

- 2000 Hive once it hits $2.00

- 5000 Hive once it hits $3.00

Overall the above chart would mean a hypothetical PD of around 15K Hive.

That would save some more in case the price went up even higher!

And similar for BTC...?

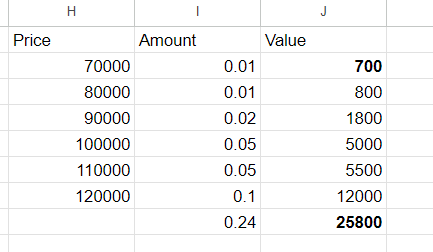

If I had BTC and were to cash out I might go for something like this...

It's a similar scale to Hive.. ramping up the cash outs as the value increases.

I'm not saying that I would sell at these prices, I might sell less, but I would sell something as BTC increases in price.

I mean I possibly may not have paid over $30K for any BTC, I may have bought some of it when it was down at the $3K mark (remember that, just after SF3 in Krakow!), so if these conditions were the case, then cashing out now would be either 20* or doubling, it's all still profit.

But obvs, one would rather be selling at $250K rather than $90K.

The point is to cash out SOMETHING early and then MORE SOMETHING later, then at least if MORE LATER never happens, one has something in stables to buy one's doughnuts with, which you can eat while you watch the prices go either up or down, or both.

Collateralising assets as part of the strategy...?

I am considering this. The general idea being that rather than selling BTC at a low-ish price, you use it as collateral, take out a stable coin loan, swap and save for HBDs and that 20% probably covers all the fees involved in setting that up plus the difference in repayment interest.

Then you can repay and sell the BTC if it goes proper mental, or not.

The risks are that the protocols or tech you use to collateralise/ swap etc. break down (it happened with Terra, remember), or if you get hacked. And then there's forced liquidation.

I mean I could do this now... I probably should but I dunno! Maybe just out-out is better...?

Making crypto profits conclusions....

Don't overthink it, once yer in profit, sell something at some point, or hodl, it depends whether you want dirty fiat or the crypto, which in turn depends on whether you need said dirty fiat to live off or not!

So there you go, NOW YOU KNOW WHAT TO DO TO MAKE PROFITS IN A CRYPTO-BULL MARKET!

Tips appreciated, not everyone is capable of giving such high level not financial advices after all!

Posted Using InLeo Alpha

Those are some great ideas for taking profits and I think DCA is probably a sensible strategy so that you always have something in case it moons. I'm still waiting to see how the markets react to a fed pivot and more money printing before I think to go into stables though.

I have picked this post on behalf of the @OurPick project! Check out our Reading Suggestions posts!

Please consider voting for our Liotes HIVE Witness. Thank you!

DCA all the way! I'm not selling just yet either - hold hold hold for now!

I bought more Hive on Binance yesterday at 0.417, then it got lower to 0.39. I wish I would have waited. Each time I have invested in Hive in the last 5 months I lost because I didn't waited and put a higher order. I think I lost more then 2k because I haven't waited. That has been a lesson to me. Anyway, I am not selling my Hives from Binance, maybe at some point I shall bring them in Hive or part of the entire sum and power up. Now I am powering down to buy more second layer tokens from Hive.

It's tough to time thingd right. You may as well power up what you have rather than have them sitting around doing nothing...?

I love it - its like Dollar Cost Averaging but in selling out at certain price points with certain allocations.

That's the plan!

In the past two bull markets, I followed the strategy of waiting for the end of the growth and selling some cryptocurrencies at the beginning of the bear market. Thus, my sales prices were 60-70% of peak values.

Fair play, selling just after those peaks can work too!

Thanks for the summary - I'm more or less going to do exactly this - DCA sell some (but nowhere near all) if/as prices go up.

Hope you are well!

I'm resistant to selling more than 25% of what I've got, probably because I'm a mug and too attached to my crypto! Probably should sell more like 50-80%!

Keeping holding on! (maybe sell 33%?!)

I'm probably more like sell 20% ! If it goes proper mental, like BTC at $250K and Hive at $5 I'd be tempted to sell more for sure!

I have also set the price at which I want to cash out some numbers of Hive. Unfortunately, I am on a power down because I have a project and I can only use little of my HP to run it because I don’t have enough money but I want to cash out 30% of my Hive when the price gets to $1

That's really good financial advice, man. You're right about having a plan. Like you said, if you sold it, you sold it. For example, I sold some Hive at .37 because I needed it, but now I see I was wrong, I should have waited a few days.

I'd better get ready to make my plan now.

You got to have a plan!