On Average Spending on Necessities and Early Retirement...

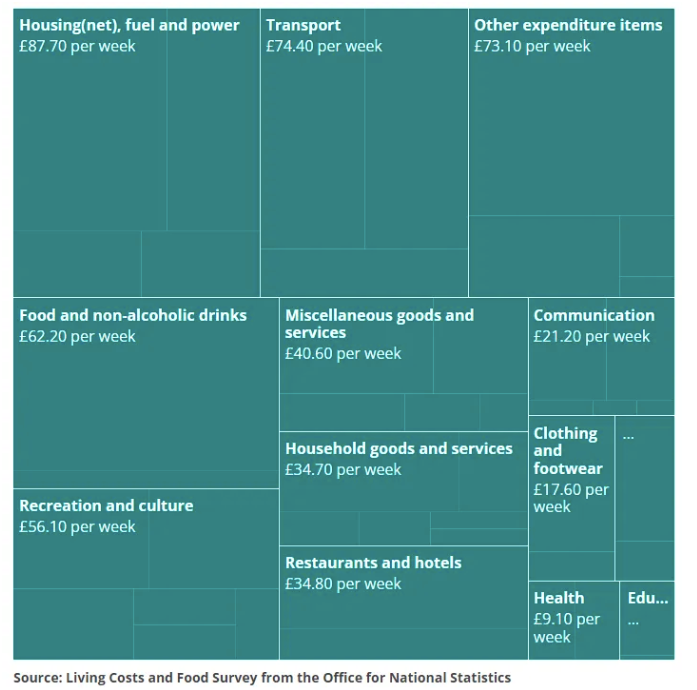

According to the ONS’ 2022 Family Spending Survey the average-consumer spends a total of £365.85 a month on necessities.

This breaks down as:

- £116.51 on food

- £66.67 on water, gas and electricity (I up this to £110 for a single person household)

- £32.50 on clothes.

- £89.83 on council tax (altered to reflect the 25% reduction!)

- £17.91 on repair of dwelling (probably more again if you’re living on your own, but I’m being generous here!)

This is based on a household survey, and I’ve divided the monthly expenditure by 2.3 to reflect the average household size.

Now the problem with these figures is that if you’re living on your own, the figure for water, gas and electricity is probably going to have to be doubled, because you’re likely to spend just as much heating and lighting your house on your own as you would do as a couple. Also with standing water charges making up a good chunk of the cost of your water supply, that’s going to be more expensive too. Also based on personal experience I’d say that nearer £110 a month is much more accurate, probably a little conservative!

Even food and clothes seem a little on the low side, but let’s go with it for now, and you don’t save that much on food or clothing by being a single householder!

Over the course of 10 years this amounts to £43, 902 based on an average annual expenditure of £4390.20.

Despite this amount being a larger amount than the average consumer spends on consumer frivolities (hotels and the like), reducing expenditure on necessities offers much less scope for taking years off one’s retirement age!

I don’t think it’s possible to reduce expenditure compared to the average-consumer, so these remain the same. If you are going to live in a regular flat (rather than squat or live in a caravan) then council tax is simply unavoidable. The same goes for ‘maintenance of dwelling’ — swapping out light bulbs, boiler servicing, paint, all crucial!

The amount of money for food above I think is sensible… I mean you can bring it lower but it’s food! It’s so basic and crucial to quality of life. Similarly, you can grow your own, but honestly, I do that for fun, and you don’t actually save money, you end up spending probably MORE than you would buying it from the local market: compost, fertilizer, slug control, seeds, plugs, tools etc. etc.

As to Water, gas and electricity, reducing expenditure on these three must be the most commonly touted piece of advice for saving money, but this only really applies to the very wasteful. Compared to the average-consumer, there is actually very little scope for reducing expenditure on bills further, given my scenario of one person living alone in a regular (i.e. not super eco-efficient) flat. At current electricity and gas prices I think around £110 a month is about as good as you can get.

There are radical alternatives that could reduce such bills further, which I will discuss later, but all of these require significant lifestyle change.

I was initially surprised that the average-consumer only spends £32.50 a month on clothes.

However, on reflection I probably only thought this because those people who spend a lot on fashion are likely to be the most visible (because what’s the point in adorning yourself otherwise?), thus the impression on the street is of a higher average expenditure on clothing. However, if you actually pause and count, there are many times more people just wearing plain old dull clothes, which, in line with the statistics, suggests that the average-consumer hasn’t been duped by the fashion industry.

The frugal-consumer basically just avoids high-fashion items and buys whatever quality basic clothing they can get for the money. I’m also factoring in a good amount of money for functional shoes, given all the walking the frugal-consumer is likely to be doing.

In Summary…

All of the items in this section are CRUCIAL for quality of life maintenance. Despite the fact that many money saving advice sites focus on reducing expenditure on energy, for example, it strikes me that the average household is doing pretty well here.

So I’m going to say that just being average in these domains is O.K. for an early retirement strategy.

Admittedly there are more time and capital intensive strategies which could help reduce your yearly and monthly outgoings, but these are expensive and really only applicable to the privileged: those with enough land for a decent allotment, and those with enough capital for a proper solar array, for example.

Sources

The ONS Family Spending Survey.

I bet I spend less than average on clothes. I may balance that out on food as we buy a fair bit of premium brands. You have to decide on what quality of life you want. You can make your home more efficient, but that may mean some up-front costs.

I would think the biggest savings come from moving to a cheaper part of the country. I've spent some time up in Northumberland and prices there can be less than half what they are in Bedfordshire and maybe a third of London. If you can do the same work remotely then it will be easier to pay the mortgage. You may just have less options for amenities and entertainment. I would think rising house prices have hit a lot of people, especially those just starting out.

I need to have a look at how many people have escaped out of more expensive parts of the country, since lockdown I imagine that's a popular strategy.

The downside of course is pricing local people out of the property market!

I think spendings on clothes and repair of dwelling might be lesser.

The above estimates chart does not likely work for us in Africa, our way of spending monthly is very different.

I can imagine!

I have never really broken it right down like that but I tried to simplify some numbers to try and get a guideline to where I might be at. I recon it costs me between 25-30k Aud just to survive were I live, rates, electricity, food, car, insurances but people recon you need 63-70k to comfortably retire out here in Australia nowadays. The figures I am talking are for a couple. I have the 25k covered already but am well short of a long term 63k regular passive income stream.

!LOL

!ALIVE

!PGM

lolztoken.com

My doctor told me to sleep on it.

Credit: reddit

@revisesociology, I sent you an $LOLZ on behalf of new.things

(5/10)

NEW: Join LOLZ's Daily Earn and Burn Contest and win $LOLZ

@revisesociology! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @ new.things. (5/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power (2x 50 HP) and Alive Power (2x 500 AP) delegations (4 weeks), and Ecency Points (4x 50 EP), in our chat every day.

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Cost of living is crazy if you have a relatively regular life, if you enjoy yr work it doesn't matter I guess aiming for early retirement, but it's nice to have the freedom option!

It's amazing what just cutting down habitual expenditures can do, but ironically saving hard is much easier when you've got a lot of money, it's far more motivating seeing 4 figures added to the savings every month rather than 3, which just makes you feel like you're going nowhere!

I would say I spend less on clothes, but more on food than this average. It's possible our food prices have gone crazier than yours, but also some of my food choices are more expensive due to my allergies. Prime example, most dairy products I have to buy grass fed rather then whatever is cheapest, because the feedlot stuff sets off my allergies (I assume this is because I am allergic to corn and soy, which is what feedlot cows would eat). Grass fed dairy is spendy.

I'm in a 1980s built, 567 sq ft apartment (50something sq m I think?). My electric bill has more fees than usage charges, but that probably wouldn't be the case if it included heat, which it doesn't (my building runs on central boilers so it's included in rent).

Yeah everyone's situation is going to be slightly different!

Proper meat is pricey, why I hardly eat any meat at all! Not sure if your heating is a good deal or not?!?

Yeah the rent is more than double what it was when I first moved into this building, but at least I know the dollar amount every month? lol

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

So Universal Crédit now is £368.74 a month for a single person over 25, for all but housing costs, I think? Comes in at just over £84 a week, compared to the recommended minimum of £120 (sorry, I can't remember the recommenders) with £37 of that for food. I was going to try an experiment with a £37 budget for a couple of weeks to see how healthily it was possible to eat. Of course, (societal) savings here translate into additional costs on things like health services later.

Yeah I can't remember what the govt calls the UC amount - there's some stipulation in there about it maybe being not enough! It's tight to say the least. Worth doing the experiment - probably a lot easier if you've got a comfortable middle class store cupboard to supplement with!

I didn't buy any clothes for myself this year. I spent 500 HIVE on clothes in 2022. Back then it was about $600. On average, my spending on clothes was 250 HIVE per year.

You work out spending in Hive...? Never seen that before! Better off powering up and repairing those clothes!

Yes, now my earnings are only in HIVE, about 2000-3000 HIVE per month. If there is a pump, there will be more earnings.

Here, if we tell you about the situation of our country, the people here are not giving early retirement because here now they are trying to end their pension and some money at once. It is being given but it is abuse of them now they are old age so how will they live their life in this way the government will have to think about it and there is no such concept here at all. People should retire early.