George Soros Is Buying Into Oil And Gas Too

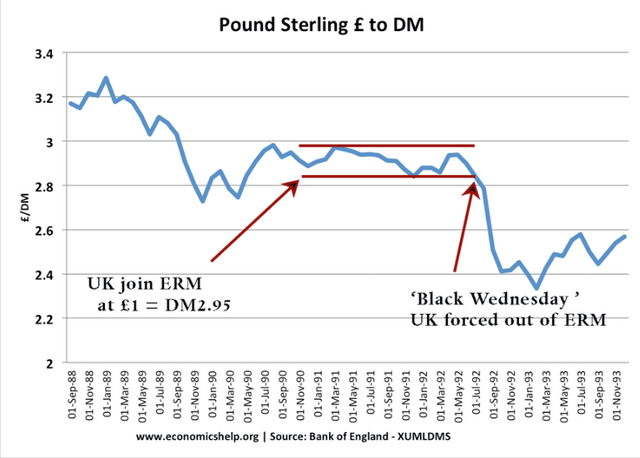

George Soros became one of the most famous currency traders in the world based on his bet against the Bank of England in 1992 on what became known as Black Wednesday, where he made over $1 billion on the trade.

In the months leading up to Black Wednesday, George Soros had been building a huge short position in pounds sterling. He recognized the United Kingdom was at a disadvantage when Britain joined the ERM, believing the rate at which the UK was brought into the Exchange Rate Mechanism was too high.

Black Wednesday occurred in the United Kingdom in September of 1992, when the British government was forced to withdraw the British pound from the European Exchange Rate Mechanism (ERM) after it was unable to keep the pound above its agreed lower limit.

In the past couple of weeks, I have been posting about how the Smart Money, in particular Sam Zell, Steven Cohen, Ken Griffin and Ray Dalio, all billionaires are buying distressed oil assets in the US.

Sam Zell is now buying distressed assets as the U.S. oil sector sees a slowdown. He’s bought assets in California, Colorado and Texas from companies that are raising cash to stablize their shrinking cash reserves.

Steve’s hedge fund is also buying into the oil sector. One such company is Pioneer Natural Resources. Pioneer Natural Resources Company operates as an independent oil and gas exploration and production company and operates in the Permian Basin of West Texas, one of the world’s largest oilfield

Ken Griffin is the founder and CEO of Citadel, made 9-digit purchases in three particularly interesting stocks, one of which was Baker Hughes Company. Baker Hughes Company provides integrated oilfield products, services, and digital solutions worldwide.

Ray’s hedge fund bought an additional 1,177,026 shares to the fund, increasing his stake to over 2.5 million shares of EQT Corporation, which operates as a natural gas production company in the United States.

Now George Soros is getting into the mix and recently bought shares of BP. BP engages in the energy business worldwide. It operates through three segments: Upstream, Downstream, and Rosneft. The Upstream segment is involved in the oil and natural gas exploration, field development, and production; midstream transportation, storage, and processing; and marketing and trading of liquefied natural gas (LNG), biogas, power and natural gas liquids (NGLs).

BP has had some trouble maintaining that sort of performance in 2019, however. In the Q3 earnings release, the company reported $2.3 billion in profits, a 17% decline sequentially and a 39% drop year-over-year.

The stock offers a solid industry position, a reliable dividend, and a clear path for future profits. Soros’ purchase of BP marked a new position, of 270,000 shares for his fund. At today’s prices, those shares are worth nearly $10 million.

Wall Street is upbeat about BP prospects. Setting that tone is BMO analyst Daniel Boyd, who writes, “We think BP is turning a corner after years flagging financial performance driven in part by oil-spill payments that are dropping off. We expect strong production and cashflow growth, enabled by high margin projects, to fuel dividend growth and improved returns.”

Boyd’s Buy rating is backed up by a $53 price target, suggesting a strong upside of 43%.

Thus, look for a possible bounce off the major support band at $35.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

This is typical of the big money players and how they rotate the markets they are in. Dalio, for one, is very vocal about his view on the state of the stock market (it isnt bullish) so it is no surprise he is looking into areas that will provide a better return over the next few year.

Oil and gas are being hammered by the move to renewables. While the shift is real, it is a bit overblown. EVs are not going to put a major debt in gasoline sales anytime soon. It will be at least 5 years before the impact is even begun to be felt.

Same with the shift in electricity production. It is happening but slower than the MSM admits.

If things were indeed collapsing for this market, people of this nature would not be buying like they are. They see a much higher side.

Great points, but with oil depressed, what happens when the markets turn for the worsts, credit will dry up and oil will get more depressed. I'm not seeing it, but that's why I'm not the Smart Money. These guys are making take a closer look at the sector in general.