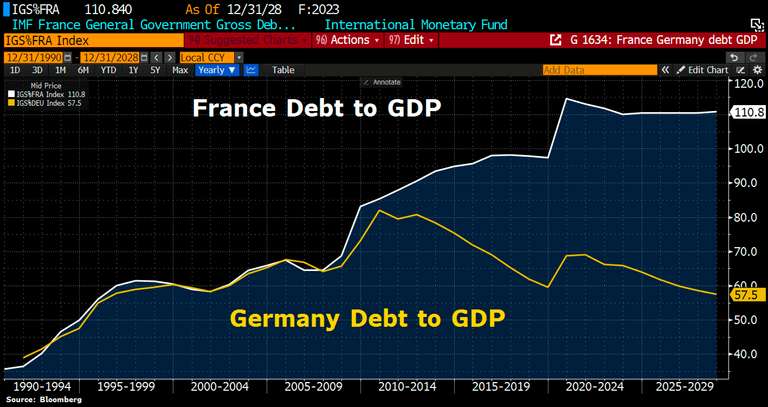

France's debt-to-GDP continues to diverge from Germany's

Here is the chart:

As you can see from the chart, Germany handled the eurozone crisis of 2011-2013 much better than France did. They knuckled down and produced balanced budgets while their economy grew.

The Germans also handled the pandemic better from a financial perspective - their debt-to-gdp ratio jumped 10% in 2020, while France's jumped by 17%.

Post pandemic, France has been shocking. While Olaf Scholz's Germany's debt-to-gdp has come down by 13% and Rishi Sunak's Britain's debt-to-gdp has come down by 15%, France has only managed a drop of 4%.

Yet both Scholz and Sunak experience severe criticism while Macron gets away with it.

However, the ratings agencies have noticed. Fitch has downgraded France from AA to AA-. Now Standard & Poor have placed France under review. If things don't improve this year, France might be the first EU country to have a debt crisis this decade.