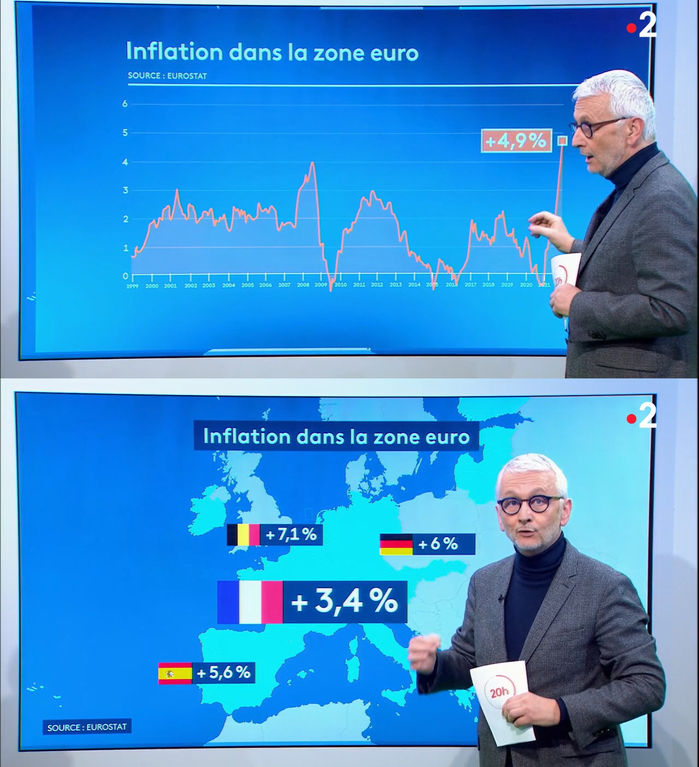

Inflation in the Eurozone is now highest since the birth of the euro in 1999

Take a look at these graphs:

Belgium at 7.1%, Germany at 6%. Poor Lithuania is struggling at 9.3%.

A lot of it is to do with the cost of oil and gas (many European countries use gas to produce electricity). France, which uses nuclear power to produce electricity, has inflation of "only" 3.4%.

What should happen is the European Central Bank raises interest rates, to induce belt-tightening, which in turn would force a reduction of energy use, which will cause prices to fall.

Some central backs have already acted. The Reserve Bank of New Zealand (RBNZ) has already raised interest rates twice, to 0.75%, because inflation hit 4.9%. The Bank of England looks like it will raise rates in January, and the US Fed will act in March.

But the European Central Bank is too scared to raise interest rates from their current -0.50 percent. That's right, ECB rates are negative, even as inflation rages. But eurozone governments (with the exception of Germany) are so indebted, that any rise in rates will cause financial problems which could lead to a bond market crisis. So their citizens have to just accept inflation. Proof again that the euro is a badly designed currency.

Posted Using LeoFinance Beta

Hi @rose98734,

Thank you for participating in the #teamuk curated tag. We have upvoted your quality content.

For more information visit our discord https://discord.gg/8CVx2Am

Eurozone economies are so disparate tat it is incredible that any think the euro works. Yet here they are!