Will the dollar be replaced as a reserve currency?

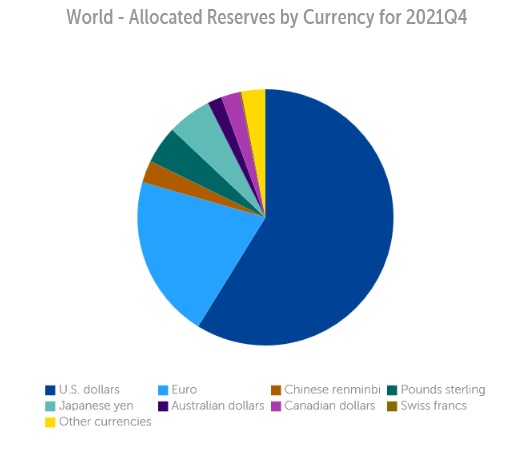

Here is the IMF's chart for the world's reserves by currency:

As you can see about 60% of the world's reserves are in dollars, followed by 20% in euros.

A lot of countries dream of the dollar no longer being the dominant reserve currency. There was a lot of excitement when the euro was launched in 1999 - the oil rich countries of the middle east like Saudi and UAE started allocating new reserves to the euro. That is, they didn't sell their existing dollar reserves, but when they acquired fresh funds they held it in euros, which meant that the dollar percentage of their total reserves started to drop.

This came to an abrupt halt during the eurozone crisis, and the euro's share of world reserves has not grown since then.

There are two requirements for a reserve currency:

- Is it useful?

- Is it safe?

Suppose you are Papua New Guinea and you are selling Nickel to South Korea for use in manufacturing. The South Koreans offer to pay you in either Korean won or Australian dollars which they have on hand. The Papuans choose Australian dollars, because they buy a lot of stuff from Australia and they can use the AUS$ they get from the Koreans to pay the Aussies.

In that little trading circle, the AUS$ is more useful than the won. If you do a lot of trade and have a network of countries dependant on you, your currency becomes more useful and thus important.

But then we come to the second criteria, safety.

The reason accumulation of euros abruptly halted after the eurozone crisis is because people weren't sure if the euro would break up. Even now they're worried about what interest rate rises will do to countries like Italy.

On the other hand 5% of the world's reserves are held in British pounds. Despite being a small country of only 67 million people, the UK ticks the safety box: this is a country that hasn't been invaded for nearly a thousand years and has had the same currency throughout.

What about China? Because of capital controls the yuan fails the usefulness criteria - if you can't get your money out you can't use it. And on the safety front, people don't trust the Chinese govt. It's worth noting that under the Ming and Qing dynasties, the bimetallic copper-silver coins issued by the Emperors were used throughout the Far East for centuries - they were both trusted and useful.

What about bitcoin? It's still too volatile to be useful. And the shenanigans of the last week have eroded trust. When that fool Do Kwon halted the TerraLuna blockchain, many lay people thought, "I didn't realise they could do that". It's sown doubt over the whole crypto space.

So the US dollar is here to stay as the world's premier reserve currency for the time being.