I decided to quit Stock Picking - Time to go "All" Passive

I have neglected my portfolio for years.

It's time to finally give in admit that I don't have the time, or the interest anymore to try to pick individual stocks to grow my retirement accounts. This was something I enjoyed doing before on and off, but for the past two years I really neglected this portion of my portfolio and I think it's time I finally admit the time to move on.

Was actively trading - Until Covid Hit

I was really active with my trades, research, and following the stocks on a daily basis to ensure that I had my money where I thought it was good. I had clearly some risky stocks, some socks I thought were safer, then other ones I just thought were at a depressed level that was likely to recover from. When covid hit and everything took a big haircut, I was afraid to sell out for index funds then because I felt like I had taken a bigger hit than the overall market due to my individual holdings. I just kept waiting and waiting for things to get better, and it never really did from an individual holdings perspective. Sure I managed to pick some absolute winners, collected a lot of dividends along the way, but overall my performance suspect.

Afraid to sell at a big loss, so I did nothing.Time to take my losses and move forward

I admit defeat, I am not smarter than everyone else, and even if I was, I am too busy/lazy/apathic to pick stocks anymore.

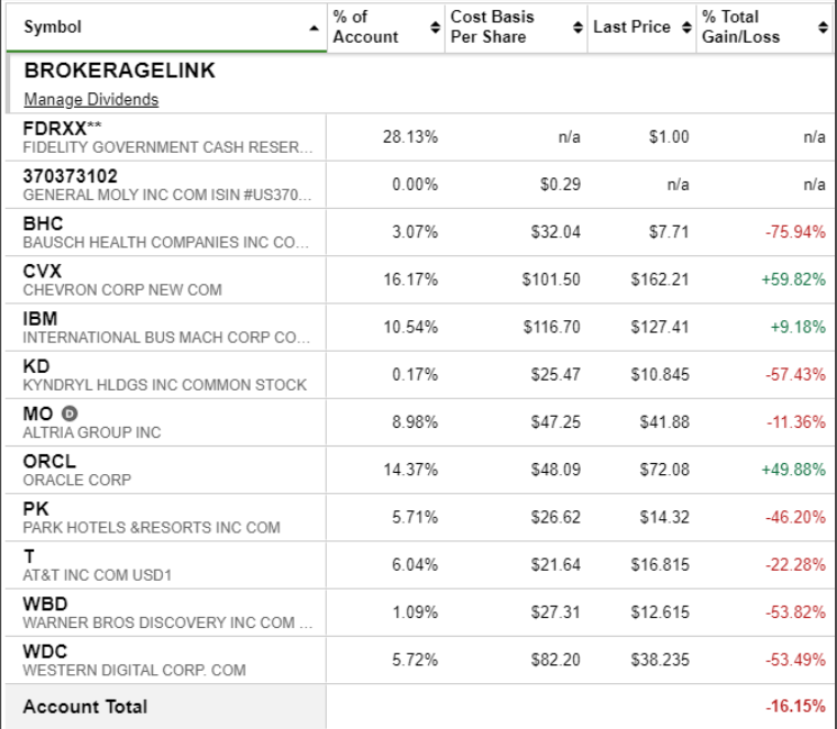

Current Holdings

As you can see with my current holdings, I had a hodgepodge. A quick high level review of what and why

- I bought Bosch and lamb, because I'd had a carry forward loss in my mind for them for a long time and was trying to trade it away until it was in that positive or neutral. This ended up being a catastrophe this year is the price plummeted from i-20s to where it is currently at 7. That's an absolute debacle, and would have been much better off of it sold out earlier this year.

- I bought Chevron and IBM as well as AT&t when I felt that dividend yields were above historical averages and the stock price was likely to return to a higher level to bring the dividend yields back down. Worked out really well for IBM and Chevron I've managed to collect dividends and share price increase.

- AT&t was a gainer and then it was a loser, and then it split off into Warner Brothers in AT&t and neither done well since then. L

- Philip Morris were highlight for me at one point, I was getting a fat dividend as well as a 30% share increase I believe, but at this point the share price is down and a dividend is still paying but it's not worth keeping.

- Western digital has been holding of mine so many years that I actually forgot when I bought it. I just kept holding out for it to return back to the Glory Days of 2017, but at this point I just have to admit it's not going to be better off it's going into the total market and Ride The Wave up.

New Investment Funds

It's time to take my losses admit that I no longer have been putting in the time and effort it takes to pick individual stocks, and my current risk appetite does not allow for individual stock trading on most occasions. I think I'm going to sell out and move everything into to vanguard funds,

- Total Market Fund

- SP500 Index

I think putting this portion of my portfolio into those funds will do nicely, as I'm basically just a low fee index fund guy at this point. Not sure if I will pick the ETF or Mutual fund yet. I need to see if I have any limitations on selection since this is within a 401k, but I know I have access to at least one of the two.

One Caveat - Precious Metals

The one caveat I think I'll allow for myself is the ability to invest a small portion of my portfolio into paper silver when I feel that the price is not aligned with personal evaluation of silver, RSI levels, gold silver ratio, etc. This play is not out of line for the rest of my investment portfolio and is really used to complement my physical silver holdings, with a paper silver pure Price play without the big premiums at the current silver market is forcing to pay for physical. Even if silver goes flat to negative, I'm okay holding that position as a long-term hedge and bringing down the overall performance of our portfolio from the total market. I just like precious metals and the same thing is open for gold if I choose to go with paper gold.

Time for stress free investing future

If I really feel like gambling, then I'll just go buy some more crypto!

Posted Using LeoFinance Beta