Fake Paper Price vs. Actual Physical Price...

Morning everyone....

Ok, this is absolutely ridiculous now. How can they even display the precious metal prices with a clear conscience at this point.

I’m mean really....

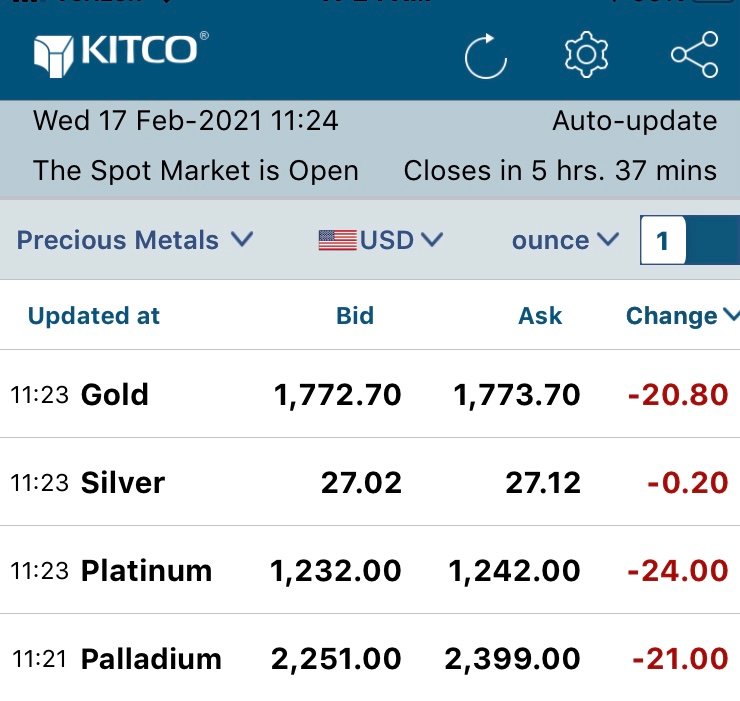

Here is the current snapshot from Kitco as of this post. Metals are getting crushed once again.

As you can see gold is down over $20, silver is down $.20, and platinum is down $24.

Yet you go to any dealer in the country and can’t come anywhere near those prices to buy any of these metals.

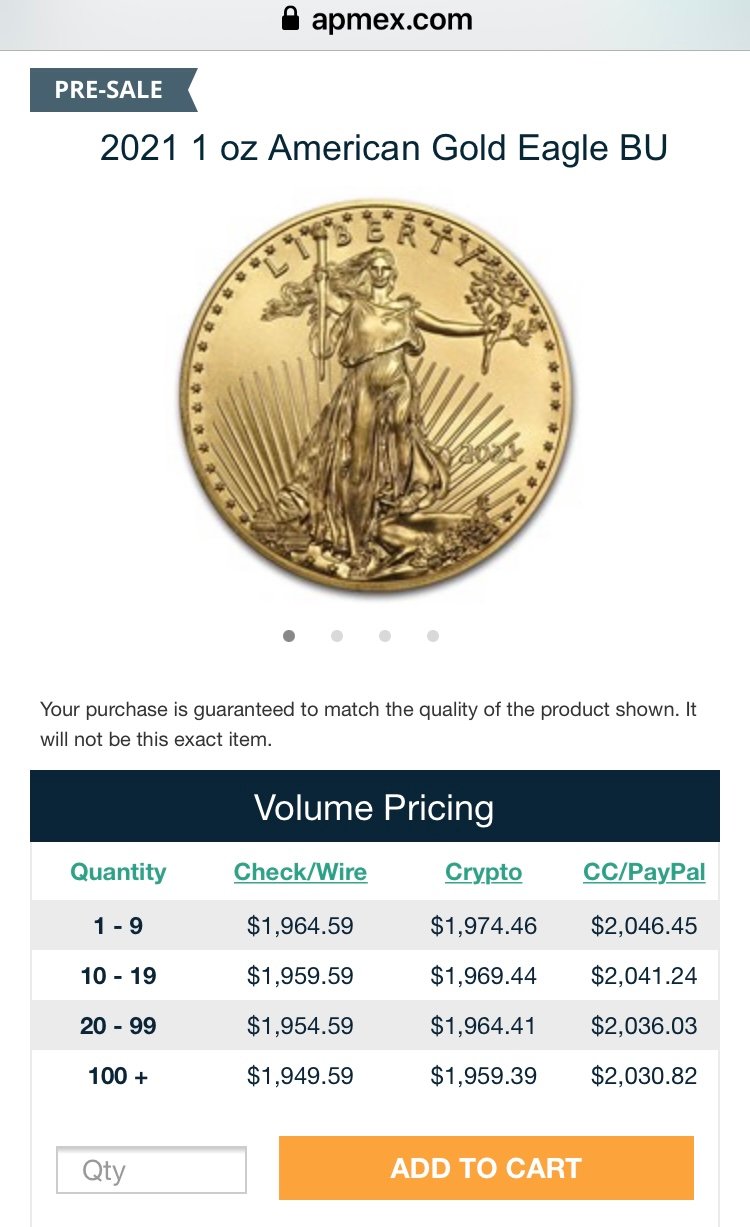

So gold is currently trading at $1773. Just to make it a round number. Here is a price for a one ounce American Gold Eagle from Apmex.

Never mind the price being over a 10% premium alone. These aren’t even on hand, they are a pre-sale only.

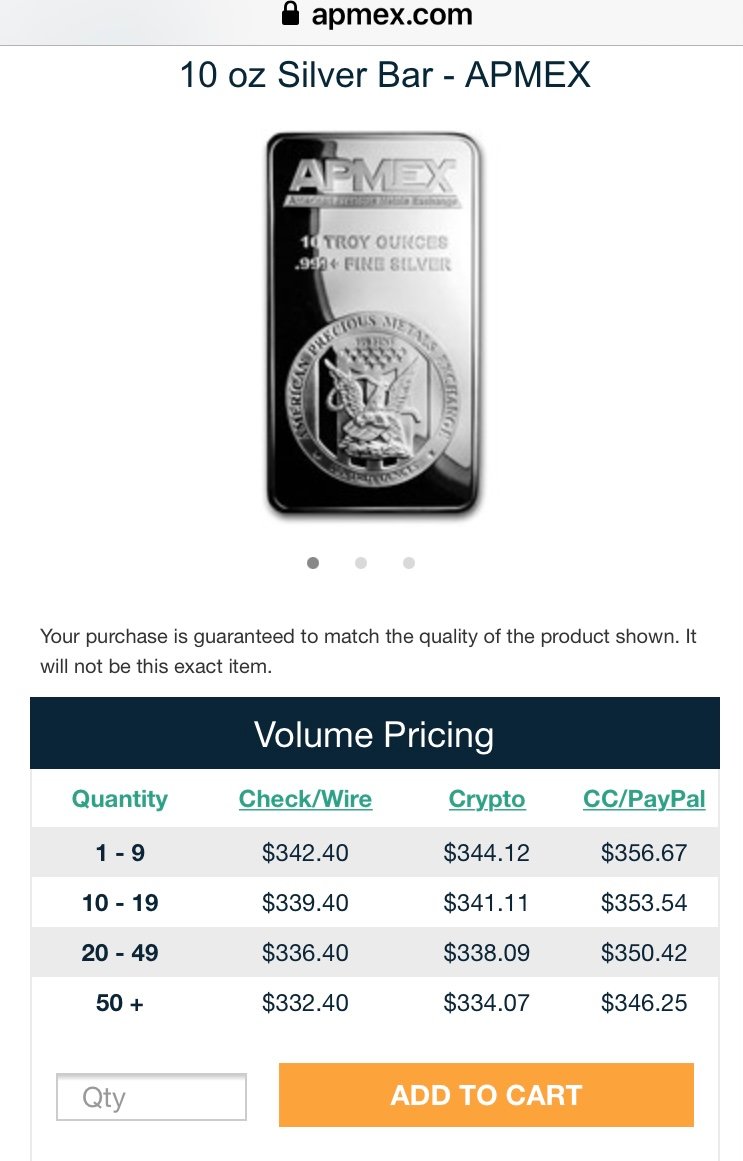

Now for silver. I went with what is typically the lowest premium silver normal people will buy, the ten ounce bar. Silver is currently trading at $27.02. Here is the price for a ten ounce generic silver bar.

That’s over a 21% premium on just a generic bar. Never mind the absolutely insane premiums on American Silver Eagles.

The typical premium on a ten ounce silver bar has always been between $.59-$.89 per ounce.

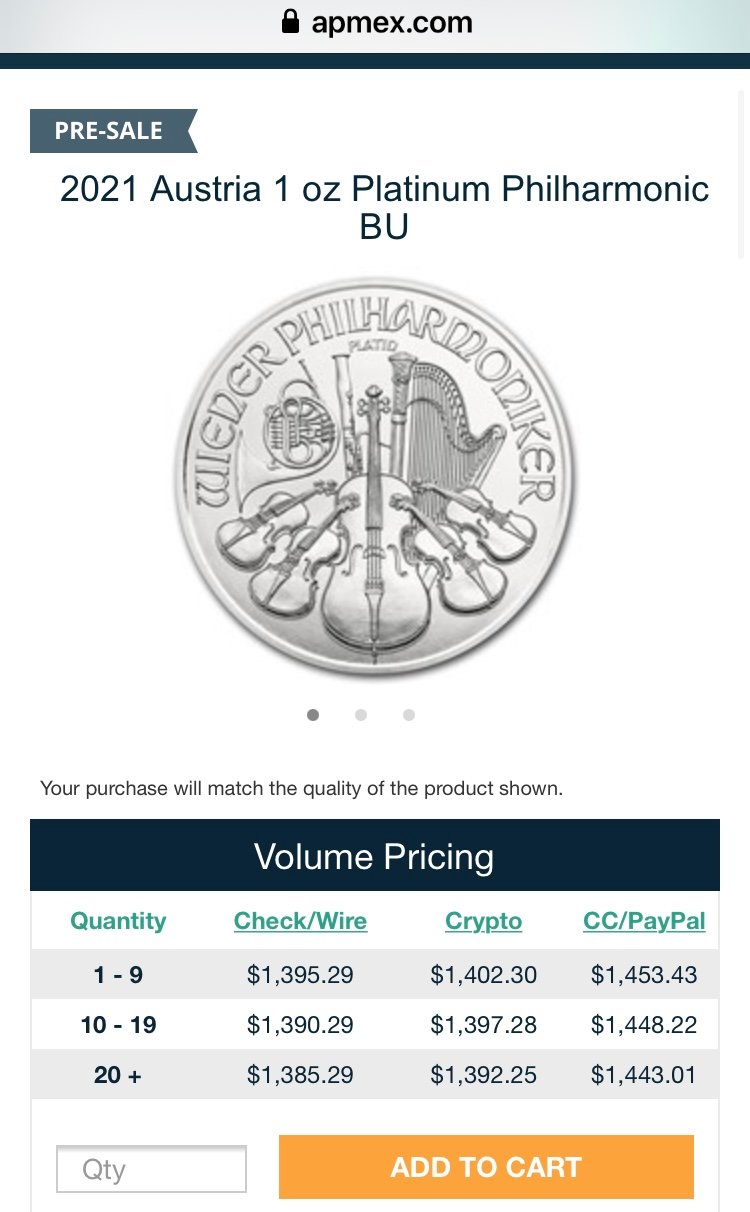

Now we move on to platinum, which has always carried the highest premium to purchase. Platinum is trading at $1232 currently. Here is a price for a platinum Philharmonic one ounce coin.

That’s a 22% premium over spot price. The normal premium range is around 5% over spot.

I don’t have an LCS (local coin shop) near me. But I made a trip to one at the end of last week to see what was going on with not only the price, but availability as well.

I chose a place that I have been to before and the owner knows me. Just to make sure the numbers are legit.

I walked in and after saying hello and some small talk asked what silver or gold he had for sale?

He said that he was all out of silver and gold. Unless I wanted to buy old Mexican or Canadian silver coins. He has plenty of graded coins in both silver and gold which some people have been buying since that’s all that’s available.

I then asked what he would pay for generic silver and American Silver Eagles. He said he’d pay spot for generic and spot plus $2 for any condition American Silver Eagles.

On gold bullion he also said spot, and for either American Gold Eagles or Gold Buffalos he would do spot plus $20 per coin.

If dealers are paying spot or higher for silver and gold. How is the spot price accurate?

Don’t tell me paper contracts....

Because they have to be backed by physical silver and gold each week.

There is something BIG brewing.....

I don’t know what, and I’m not SHTF apocalypse guy. But there is no way this can continue. Something has to give.

For those of you thinking the US dollar is going to collapse. Then why is it up .44 today currently sitting at 90.95?

What are your thoughts ???

I’d like to know...

Posted Using LeoFinance Beta

Precious metals going parabolic would call the current monetary system into question including the Federal Reserve Note. Naked short selling and other shenanigans are an on going affair if you trade on COMEX. I truly could see a day where the COMEX price goes to zero due to loss of confidence. Now the physical price (true price) will be what the free market values metals. :)

Posted Using LeoFinance Beta

Comex can’t go broke, JP Morgan is the backer and they have billions of ounces. This is the beginning of something though.

Posted Using LeoFinance Beta

Thanks again for the report, @silverd510. I'm off to the Local Coin Shop, to see what's happening. It is not easy to keep the faith and confidence in these:

.jpg)

Good luck. Do a post on what you find out. Don’t know where you are but it would be nice to know how it went down.

It definitely feels like something is brewing. The pressure seems to be rising on a lot of these assets/commodities. Not sure what the reasoning behind it is but...something is happening. I will definitely be interested in following along as you dig further. Followed.

Posted Using LeoFinance Beta

It’s like a pressure cooker ready to explode. Which way will it blow is what concerns me.👍

My thought is you had a dealer willing to pay spot plus instead of spot minus!

That tells you something is wrong with the spot price.

Posted Using LeoFinance Beta

Spot? Just Spot? With a physical shortage in progress admitted out of the same mouth.

I think the dollar strength comes from the recent sharp increase in the 10 year bonds, the Feds are playing with fire.

Physical is the place to be.

Posted Using LeoFinance Beta

This madness just started though. In all my years of collecting/stacking the spot price was the end all be all. Now it’s a complete joke. No one is using it as the sell number. That tells you it’s complete horseshit.

Posted Using LeoFinance Beta

I think you might be right @silverd510!! Just typical my friend hard to find any metal in price is going down ....on paper...🤣