What’s driving gold to all-time highs….

Afternoon everyone…..

If you haven’t yet noticed, and live under a rock. Gold has been on an absolute tear. There is a lot of instability in the world with the market, world currencies and most of all record breaking debt.

Let’s break it down, shall we….

source:Gainesvillecoin

source:Gainesvillecoin

After more than three years of stagnation, gold has awakened with a vengeance since early-March and has promptly surged by nearly $300 an ounce or 14% to an all-time high $2,330 — a sharp move for a safe-haven asset that has a reputation for its slow and steady trends. Gold’s powerful rally came seemingly out of the blue and has confounded the majority of investors and commentators who have been much more focused on trendy speculative stocks and cryptocurrencies as of late. In this piece, I will explain several of the technical and fundamental factors that are driving gold to all-time highs, what is likely ahead for gold, and how investors can best take advantage of the yellow metal’s resurgence.

A Look at the Technicals:

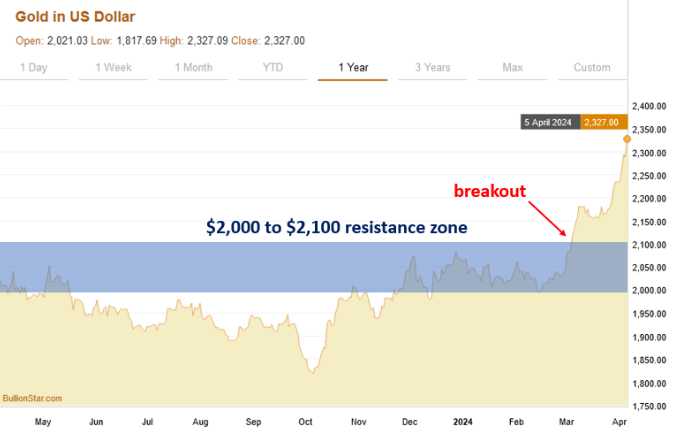

The chart of gold over the past year shows how it suddenly sprang to life over the past month. As I had explained in my last blog post on March 1st, there was an important technical resistance zone from $2,000 to $2,100 that had been acting as a price ceiling for gold since the middle of 2020. Gold’s successful close above that zone signified that a new rally had begun even though the fundamental drivers of it weren’t exactly apparent just yet.

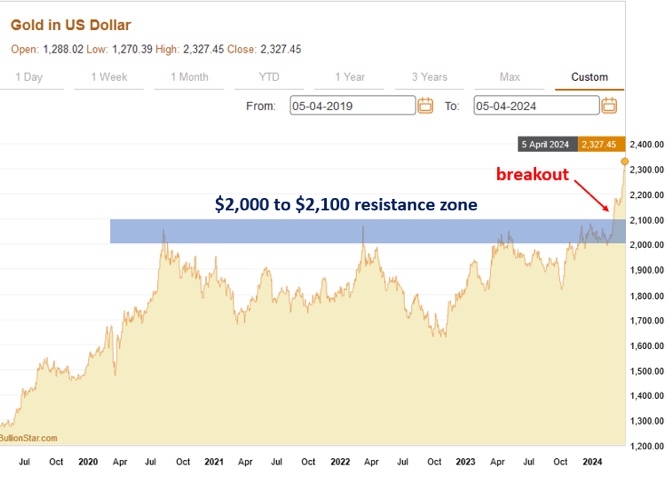

The multi-year gold chart shows the significance of the $2,000 to $2,100 resistance zone and how gold kept bumping its head at that level until it finally pushed through in the past month:

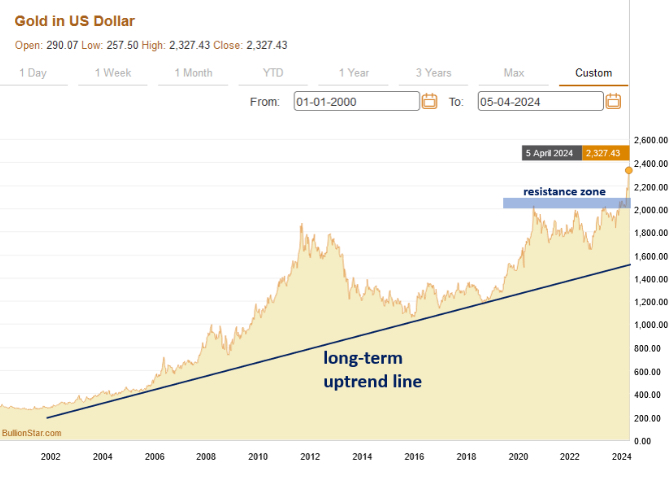

Gold’s multi-decade chart shows that it has been steadily climbing an uptrend line that began in the early-2000s as the U.S. and other countries kicked off an unprecedented debt binge that shows no signs of stopping whatsoever:

Gold is Rising Despite the Strong U.S. Dollar

What’s particularly interesting and notable about gold’s surge over the past month is how it has occurred independently of the action in the U.S. dollar. Gold and the U.S. dollar have a long-established inverse relationship, which means that strength in the dollar typically causes weakness in gold, while dollar weakness typically causes the price of gold to rise.

The charts show how action in the dollar often causes an opposite trend in gold. Gold’s recent surge took place while the dollar was trending slightly higher, which is a sign of gold’s strength due to its ability to buck the negative influence of the strengthening dollar.

What is also worth noting is how gold’s surprising recent rally has received very little mainstream attention by a press that is much more enamored with hot AI stocks as well as Bitcoin and other cryptocurrencies that have recently benefited from the U.S. government’s approval of a number of Bitcoin exchange-traded funds (ETFs), which has resulted in tremendous inflows from institutional investors and retail investors alike.

It's me!

!pimp

You must be killin' it out here!

@silverd510 just slapped you with 10.000 PIMP, @trumpman.

You earned 10.000 PIMP for the strong hand.

They're getting a workout and slapped 3/3 possible people today.

Read about some PIMP Shit or Look for the PIMP District

You received an upvote of 90% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

Gold is always a smart bet! The long term uptrend line says it all!

Imagine if the news was spreading pm fomo would be even crazier!BBH

@silverd510! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @bitcoinman. (7/50)

!PIMP

You must be killin' it out here!

@summertooth just slapped you with 20.000 PIMP, @silverd510.

You earned 20.000 PIMP for the strong hand.

They're getting a workout and slapped 4/4 possible people today.

Read about some PIMP Shit or Look for the PIMP District

Gold is literally a gold mine for foreign exchange folks.

Currently learning and I see people make thousands of dollars on a gold trade in matter of minutes.

I've seen someone lose thousands of dollars too😂

And with current events the economy will have a great movement, well that is what governments are looking for.

I wish you a happy day

Thanks